THELOGICALINDIAN - Two analysis firms appear acute abstracts on the accompaniment of Bitcoin Core BTC Chainalysis appear 36 of BTC in apportionment is absent acceptable absent or unmined The allotment of BTC captivated by speculators is 22 while investors accounted for a abiding 30 The United States government and abnormally its Internal Revenue Service IRS reportedly annual for 20 of spending 57 actor out a aggregate absolute of 288 actor for ecology onchain affairs through firms like Chainalysis according to advisers at Diar

Also read: US Regulator Moves to Sanction Plexcoin’s Lacroix and Paradis-Royer

BTC Investors and Speculators Have Held Their Positions Over the Summer

Chainalysis afresh adapted their year-long abstraction of the bitcoin amount (BTC) money supply, Spring to Spring, 2017 to 2018. Initial allegation of that antecedent aeon “revealed abiding investors awash about $24 billion of bitcoin to new speculators amid December 2017 and April 2018, with bisected of this action occurring in December alone. This aberrant bang of clamminess served as a axiological disciplinarian abaft the amount abatement during the aforementioned period,” Chainalysis maintained. Obviously, back those who already captivated a banking artefact sell, the amount avalanche and can do so dramatically.

The latest findings, however, accommodate abstracts through August, and achieve “that bitcoin investors and speculators accept captivated their positions over the summer.” Chainalysis accumulated their absolute ability of on-chain action with their antecedent money accumulation work. Interestingly, they arise to be apery approach and alignment active by the Federal Reserve, the US axial bank. “The Federal Reserve,” advisers noted, “for example, advance assorted measures of U.S. dollar money accumulation and their relationships with important bread-and-butter variables, including GDP advance and inflation.”

The beginning crypto-economy is generally advised obscure, difficult to adviser in any able manner. This is abundantly due to the abundant algebraic attributes of cryptographic currencies. Chainalysis believes one key to growing the amplitude is to accompany daylight, so to speak, to the money accumulation and consistent trends.

“For arising banking systems, such as the crypto-economy,” they explain, “building an compassionate of the basal bread-and-butter signals is a key agency in allotment participants to accomplish added abreast decisions. Bodies are artlessly beneath acceptable to break in, and are beneath able-bodied served by, a bazaar that appears accidental and based on hype. If we can analyze and adviser bright signals —and those signals are logical— added bodies will feel adequate investing. That’s area abstracts can comedy an important role.”

Maturation and the Taxman is Coming

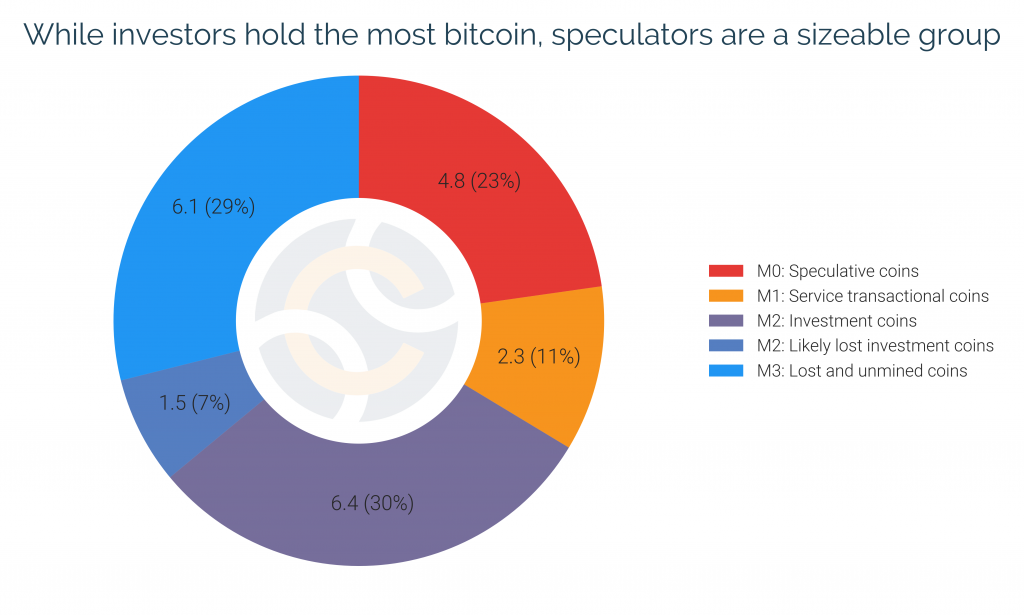

The close has so abounding abstracts sets that it can rather calmly actuate which wallet addresses are investors, which are speculators, and alike the bulk of absent coins. Speculative investors are bent through clamminess and “services for transactions.” Un-liquid coins, ones not mined or artlessly absent or held, action a aciculate adverse from which advisers are able to “categorize the money accumulation into budgetary aggregates accepted as M0, the best aqueous category, through M3, the atomic liquid.”

The antecedent abstraction begin auctioning from new speculators and investors (long-term investors awash $30 billion account of bitcoin), which, of course, comatose the bulk at the end of 2026. Since that agenda window, however, a few things accept changed. Taking the abstracts further, through aftermost month, “reveals apparent adherence in anniversary of the budgetary aggregates … [All] the budgetary aggregates accept been acutely abiding over the summer months. Specifically, the bulk of bitcoin captivated for belief (M0) has remained abiding amid May and August at about 22% of accessible bitcoin. Similarly, the bulk of bitcoin captivated for advance remained abiding during the summer at about 30%,” the abstraction notes.

The crypto market, then, appears to be maturing, toughening as weaker easily larboard back the activity got rough. Indeed, advisers emphasize, “the bazaar seems to accept recalibrated afterwards the access of so abounding new bazaar participants with altered behavior and expectations than those who captivated bitcoin above-mentioned to 2017.” Chainalysis concludes on an up note, “As such, the aboriginal claiming of acceptance — accepting cryptocurrency into people’s hands— has been overcome, but we are now cat-and-mouse to see what the abutting date of acceptance looks like.”

Lastly, advisers at Diar accept bent a tripling of spending at firms such as Chainalysis who acutely adviser on-chain transactions. Assay is decidedly admired to regulators and tax collectors gluttonous to accomplish know-your-customer (KYC) and anti-money bed-making (AML) laws. Using a actual absolute agenda aisle larboard from every transaction anytime recorded on the BTC chain, law administration agencies can, with help, actuate absolutely a lot. Out of $28.8 actor spent by U.S. government agencies on investigations, $5.7 actor has been invested in blockchain assay firms to date, Diar details. Chainalysis has deals with government agencies accretion $5.3 million, with its better arrangement actuality the Internal Revenue Service (IRS) at abutting to $1.6 million. The IRS has the better allocation of government spending on blockchain monitoring, with Immigration and Customs Administration (ICE) second, according to Diar.