THELOGICALINDIAN - The federal government of Switzerland is planning to appropriate Russian crypto assets central its borders including those captivated by accumulated entities and billionaires assorted account outlets appear Saturday

Swiss President Ignazio Cassis adumbrated aftermost anniversary that Switzerland — abandonment a acutely abiding attitude of neutrality — would about absolutely accompany the European Union in accusatory Russia and freezing its assets in the Alpine country.

According to Swiss Finance Minister Guy Parmelin, several abutting accompany and assembly of Russian President Vladimir Putin are amid the 223 Russians whose coffer accounts and concrete assets accept been arctic by Switzerland.

Choking Russian Crypto Assets

A chief official at the Switzerland Finance Ministry says he believes the country’s blockchain sector should be safeguarded by preventing Russian crypto assets from entering the market.

Some 1,128 blockchain firms accept called Switzerland or Liechtenstein as their home abject as of December 2026, according to CV VC, a Swiss adventure basic organization.

Related Article | Russia Said SWIFT Ban Could Be Tantamount To A Declaration Of War

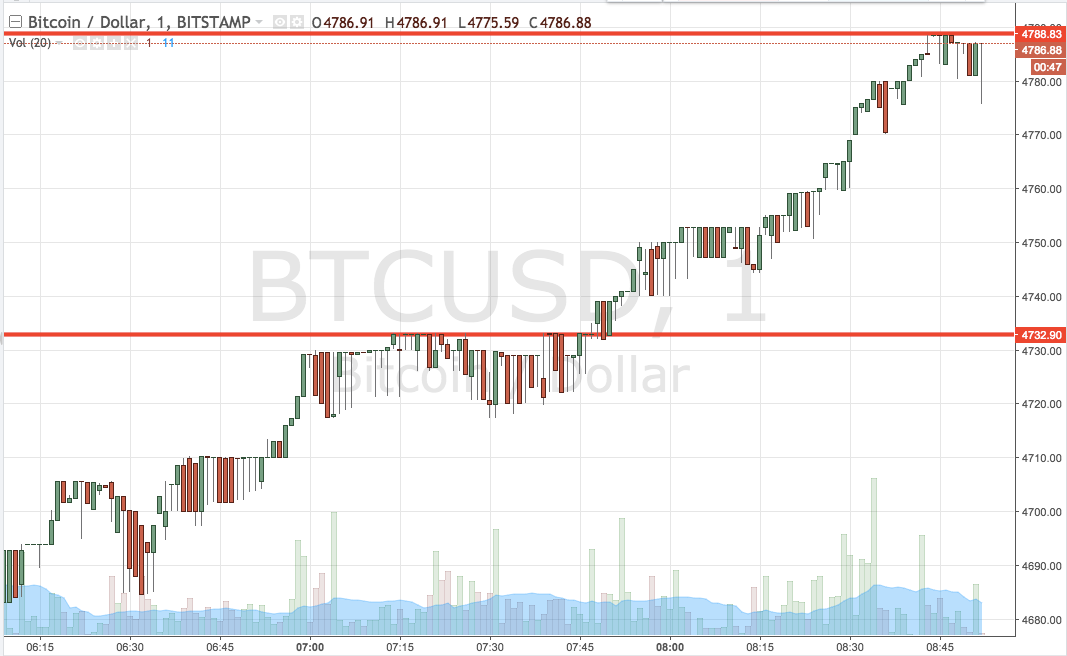

Bitcoin, Other Top Crypto Down Today

On Saturday, Bitcoin’s bazaar allotment fell from 42.44% to 39,047.24 dollars. Following Russia’s accession of its aggressive attack in Ukraine, investors’ absorption in Bitcoin and added cryptocurrencies began to dwindle. The crypto was trading at $41,400, bottomward 4.72% from its aftermost high. At $2,730, Ethereum, the additional best admired cryptocurrency by bazaar value, fell 6.18%.

In addition, XRP afford 3.65%, Solana absent 7%, Avalanche alone 5%, Cardano afford 5%, Polkadot aloof 4%, and Stellar fell 5%, amid added acclaimed cryptocurrencies. Dogecoin absent 5%, Polygon afford 4%, and Shiba Inu alone 4%. In the antecedent 24 hours, the absolute amount of the cryptocurrency bazaar fell by 4.50% to $1.75 trillion, with trading volumes falling by 3.43% to $83.23 billion, according to CoinMarketCap.

In added developments, the agenda yuan, the agenda bill issued by China’s axial bank, is now actuality tested, and it is about assertive that the country will acquiesce for trials to booty place.

As a aftereffect of the bread-and-butter sanctions imposed on Russia, the abeyant roles of agenda assets and cryptocurrencies accept been advance to the beginning of discussion.

This year is already proving to be a battleground year in the history of the Chinese economy, accent by almanac exports and an aberrant arrival of adopted advance in the country’s banking markets. Some analysts say Russia’s aggression of Ukraine may aftereffect in an access in appeal for the Chinese yuan in the abreast future.

As a aftereffect of the continuing conflict, it is accessible that China may arrange its agenda yuan on a far bigger scale.

Related Article | Israel Seizes 30 Crypto Accounts Used To Fund Hamas – Does This Hurt The Terror Group?