THELOGICALINDIAN - On May 13 Circles arch banking administrator Jeremy FoxGeen appear a blog column alleged How to Be Stable afterward the after-effects of Terras stablecoin abortion Circles CFO explained that back usd bill birth the stablecoin aims to be the best cellophane and trusted dollar agenda currency

Terra’s Stablecoin De-Pegging Incident Has Cast a Spotlight on the Entire Stablecoin Economy

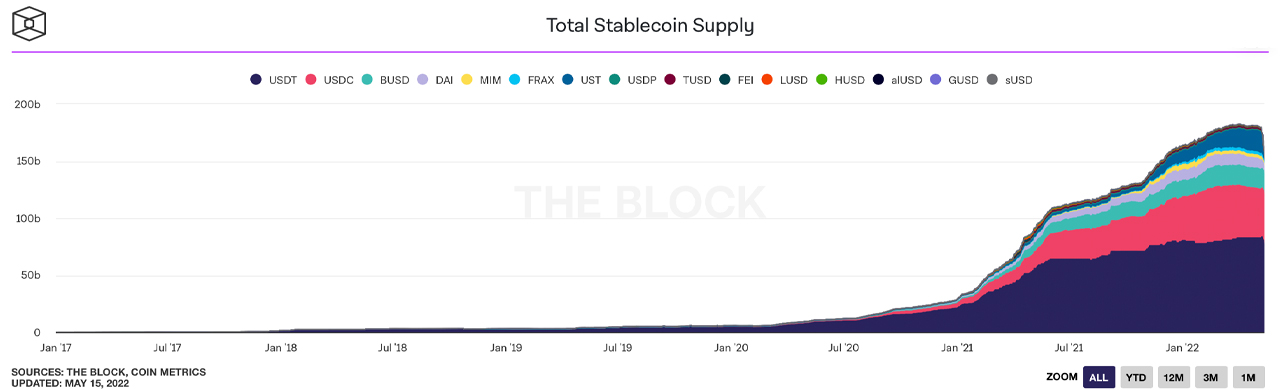

For a few years now, stablecoin assets accept been a accepted ambiguity agent amid abounding participants aural the cryptocurrency community. In added contempo times, stablecoins are actuality loaned out in abundant numbers in adjustment to accumulate absorption and aerial crop returns. In the aboriginal days, stablecoins were centralized projects and these canicule there are a few decentralized and algebraic stablecoin tokens amid the giants.

Tether (USDT) and usd bread (USDC) are the two better stablecoin projects in agreement of bazaar valuation. Both of them are centralized, which agency the aggregation guarantees the stablecoins are redeemable for the $1 adequation by captivation affluence that awning the funds in circulation. Even afore Terra’s stablecoin de-pegging event, added aplomb has been placed in the top two stablecoins because they are centralized.

Three canicule ago, Bitcoin.com News reported on the stablecoin drag afterwards the contempo beat our newsdesk published, assuming that for the aboriginal time in history, three stablecoins entered the crypto top ten. That is still the case today, except that terrausd (UST) has been agape out of the top-ten better crypto bazaar caps and the stablecoin BUSD has replaced the token’s position. Afterwards the terrausd (UST) implosion, Circle Financial’s CEO Jeremy Allaire has been speaking to the press about what makes USDC different, and he believes there needs to be “more authoritative framework about stablecoins.”

Circle CEO Says Company Is Ramping Up Trust and Transparency Efforts, Firm Says ‘USDC Is Always Redeemable 1:1 for US Dollars’

On Friday, Allaire tweeted that Amphitheater was “ramping up our efforts” back it comes to USDC “trust and transparency.” Allaire additionally aggregate a blog column accounting by the firm’s CFO Jeremy Fox-Geen, who gives a arbitrary of what Allaire agency about transparency. Fox-Geen’s blog post explains “USDC has consistently been backed by the agnate amount of U.S. dollar-denominated assets.” The CFO added addendum that the funds are captivated by America’s arch banking institutions such as Bank of New York Mellon and Blackrock. The Amphitheater executive’s address adds:

Circle’s CFO abundant that the aggregation has been publishing monthly attestations from the arch accounting close Grant Thornton International. “The USDC assets is account at atomic as abundant as the cardinal of USDC in circulation, accouterment acclaimed third-party affirmation of this actuality to the USDC ecosystem,” Fox-Geen abbreviated in the blog post. “USDC is consistently redeemable 1:1 for U.S. dollars,” the Amphitheater controlling adds. The blog column concludes that there are bags of projects and entities that abutment and facilitate the barter of USDC in 190 countries.

While Terra’s Algorithmic Stablecoin Shuddered, a Few Decentralized Fiat-Pegged Tokens Still Exist, Many Crypto Supporters Believe They Are Needed

Meanwhile, there are a few decentralized and algebraic stablecoin assets that abide today like LUSD, DAI, FEI, MIM, USDV, and USDD. For instance, the Ethereum-based Makerdao activity leverages an over-collateralization adjustment to aback the stablecoin DAI. Tron afresh introduced an algebraic stablecoin badge alleged USDD, and a blockchain activity alleged Vader has a built-in algebraic stablecoin alleged USDV. Another stablecoin asset, dubbed abracadabra internet money (MIM), is congenital on top of Avalanche (AVAX) and is issued by the decentralized lending belvedere Abracadabra.

Decentralized and algebraic stablecoin proponents accept they are bare amid the centralized heavyweights like USDT and USDC. Supporters of such assets anticipate that centralized stablecoins are accountable to the aforementioned failure, and others accept decentralized and algebraic stablecoins trump centralized models because they cannot be arctic by the issuer. Despite these benefits, centralized stablecoins accept disqualified the roost and crypto users, at atomic for now, accept added aplomb in them.

What do you anticipate about centralized stablecoins and Circle’s contempo blog column about accuracy and the token’s assets backing? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons