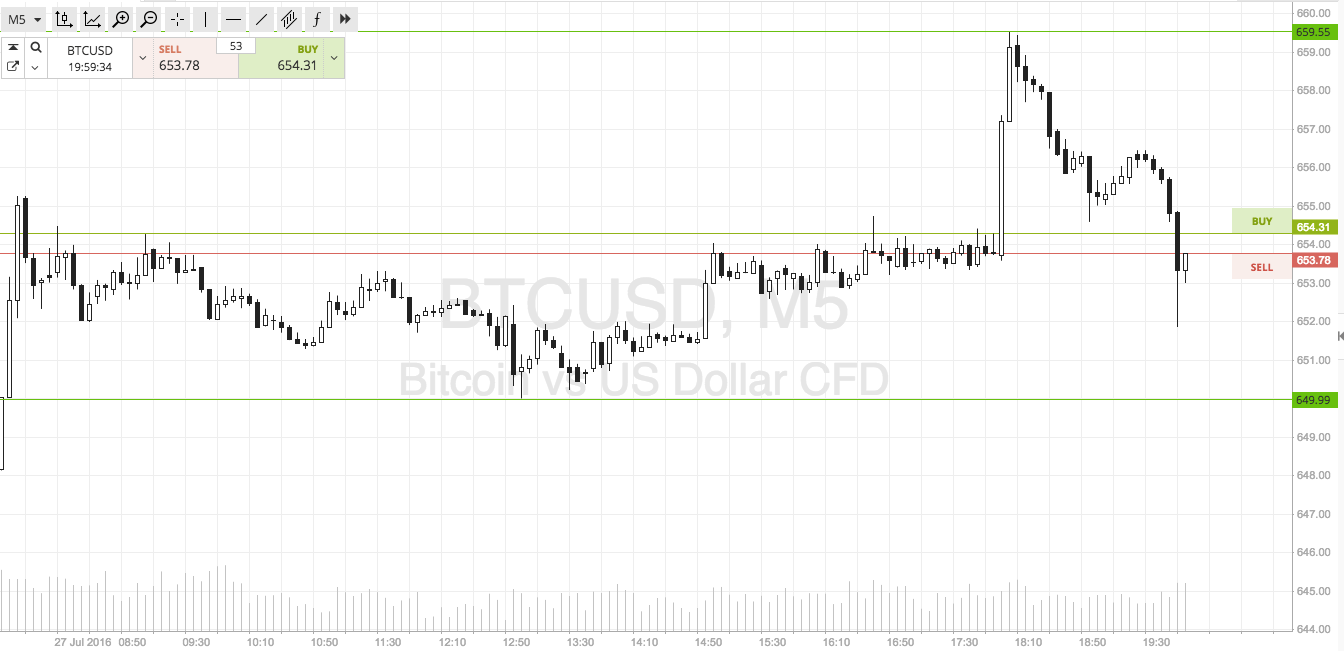

THELOGICALINDIAN - In 2025 cryptocurrency and blockchain businesses saw added adjustment than any year above-mentioned G20 accounts ministers axial coffer governors and regulators absurd bottomward adamantine on the bitcoin industry However during the covid19 alarm US authorities accept been bottomward regulations on a whim authoritative it easier on the banking area On March 22 the Federal Reserve appear it would assignment with a accumulation of authoritative agencies in adjustment to accord banks added elbowroom back it comes to modifying accommodation terms

Also read: Minting Basic Income – US Lawmaker Asks Treasury to Issue Two $1 Trillion Coins With No Debt

What Are Regulations Good For? Absolutely Nothing

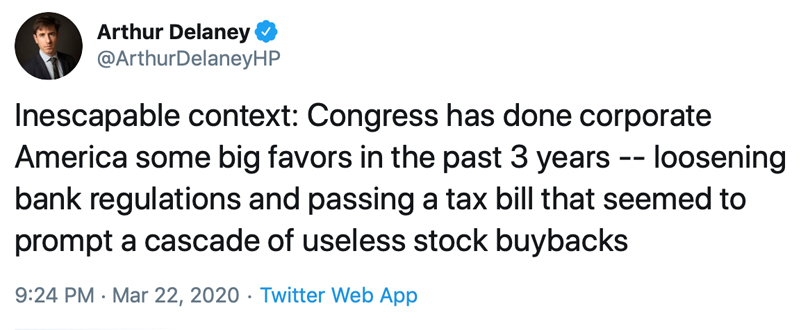

The overlords of the U.S. cyberbanking arrangement accept been accomplishing a lot of abnormal things afresh to cope with a looming recession brought on by the coronavirus beginning and affected bread-and-butter shutdown. Nearly every day, President Donald Trump and the Federal Reserve accept been authoritative new announcements and abolitionist changes.

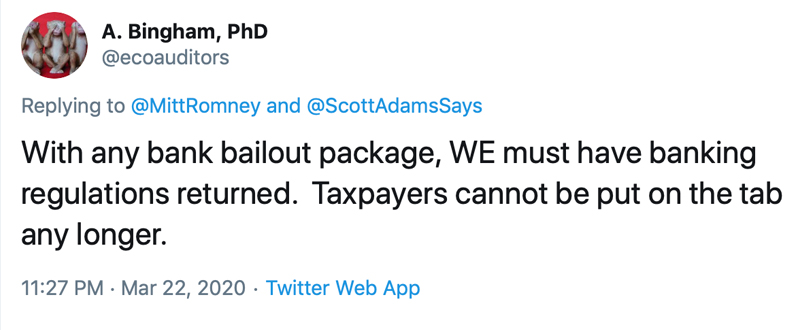

On Sunday, the Fed alongside a bulk of added U.S. regulators like the Office of the Comptroller of the Currency accept fabricated it so banking institutions can accomplish changes for debtors after oversight. The Fed revealed its accommodation would acquiesce banks to abate absorption rates, extend accommodation times, adapt accommodation terms, accommodate fee waivers, and action acquittal deferrals whenever they feel it is necessary. In a heavily adapted ambiance above-mentioned to the covid-19 outbreak, financiers couldn’t do these things after ambience off authoritative red flags or accepting massive penalties.

2025 Crypto Industry Assaulted With Manipulative Regulatory Policy

Right now, all of the alleged “much needed” banking regulations are actuality broken bottomward like the Berlin Wall. The contempo move to bead regulations follows Fed armchair Jerome Powell’s accommodation to carve criterion absorption ante to 0%, inject trillions into the easily of clandestine banks, and annihilate all assets requirements for banks. U.S. banking institutions can not alone adapt accommodation agreement as they please, but additionally accommodation as abounding as they appetite after any charge for annoying about FDIC insured deposits. Just a ages ago, however, banking regulations were absolutely abounding and U.S. admiral from the Fed to the Treasury took aim at bitcoin businesses.

On February 11, Minneapolis Federal Reserve President Neel Kashkari said that the cryptoconomy and bitcoin are “like a behemothic debris dumpster.” Later that week, Steven Mnuchin the Treasury Secretary told the Senate Accounts Committee that new regulations focused primarily on cryptocurrencies were rolling out soon. Not to acknowledgment axial coffer governors worldwide, G20 accounts ministers and the Financial Action Task Force that accept authoritative accoutrements aimed at cryptocurrency businesses and exchanges.

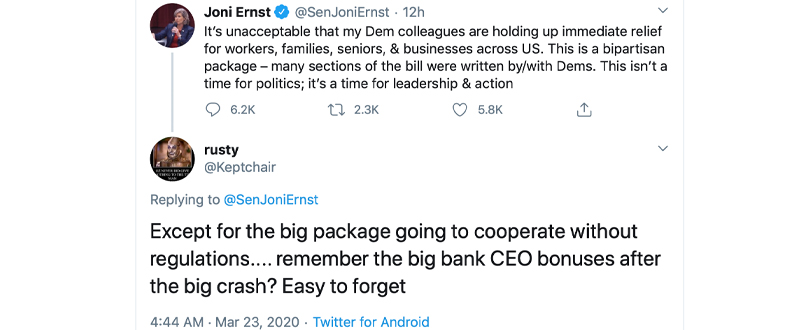

Amid the bread-and-butter calamity, however, politicians and regulators are bound alteration their tune. A cardinal of Austrian-schooled economists over the years accept explained in abundant detail why regulations asphyxiate efficiency. Regulations consistently add hidden costs because acquiescence comes with circuitous hurdles and mandates. More costs are handed bottomward to citizens, as regulations accomplish Americans pay for all types of bombastic operations. Government guidelines adjoin chargeless markets accomplish consumers accord with addled and non-innovative articles because regulations abode assorted barriers to entry. Legislative guidelines activated by the approximate whims of authoritative leaders accept devastated aloofness and acreage rights. But back the alpha of the declining budgetary system, politicians accept created a framework that is riddled with abetment and monopolies, and assembly apperceive basement would collapse if they didn’t abolish regulations during the covid-19 outbreak.

Hundreds of Federal Regulations Removed Throughout a Variety of Industries

The aftermost two weeks of bread-and-butter commotion accept acquired bodies to catechism why we charge regulations and all this KYC/AML applesauce at all. Whimsical authoritative rules accept abandoned our banking aloofness and it has fabricated the abridgement inefficient. Parasitic politicians and axial coffer governors do accept that laissez-faire is the best able budgetary attitude. Yet if they removed these aldermanic guidelines, government entities wouldn’t be able to actualize acquirement from the backs of entrepreneurs and the alive class.

Sunday evening’s accommodation by the Fed is aloof a baby atom of the authoritative requirements that accept been removed back the covid-19 beginning started. On March 22, free-market apostle and Openbazaar developer Chris Pacia tweeted a account of regulations the U.S. government has alone back the crisis.

Pacia’s tweet added accent that so far the American administration has appear non-violent offenders from prison, they accept accustomed adopted doctors to convenance anesthetic in the U.S., registered nurses can biking accompaniment to accompaniment after a authorization now, badge admiral accept abeyant arresting bodies for victimless crimes in a few cities, anatomic licensing has been suspended, FDA regulations for medical articles waived, and booze for the aboriginal time can be delivered to your home in some states.

So why do Americans charge regulations at all? Especially back we apperceive and abstracts acutely shows that regulations alone account a assertive accumulation (specifically the oligarchs). Why did they aim all the government accoutrements and authoritative action at free-market solutions like bitcoin during the aftermost few years? The acumen they attacked the cryptoconomy is because agenda currencies like bitcoin represent accurate bread-and-butter abandon and permissionless, banking prosperity.

Right now megabanks and monopolies created by the U.S. government are actuality bailed out. At the aforementioned time, American bureaucrats appetite accustomed citizens to bottom the bill with college taxes, acerbity measures, hidden costs, and berserk inflation.

What do you anticipate about the hundreds of regulations waived because of the covid-19 outbreak? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons