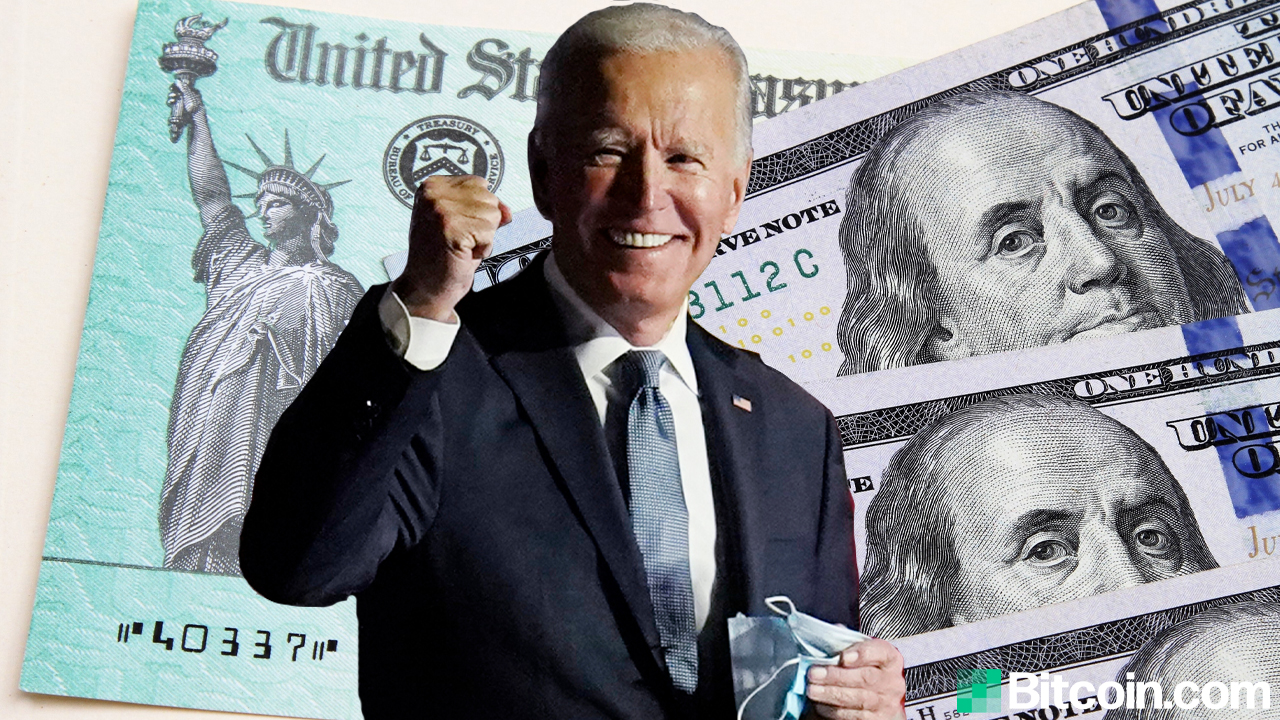

THELOGICALINDIAN - When the US Congress accustomed Bidens 19 abundance communicable acknowledgment bang amalgamation aftermost anniversary the crypto bazaar boomed as Bitcoin surged to an alltime aerial

The better cryptocurrency rose to over $61,500, led by optimism that the bang payments would be a benefaction to the agenda asset’s months-long rally. However, as acceptable disinterestedness markets showed alloyed signals on Monday with a cord of bad news, Bitcoin plummeted added than 10% alongside the broader crypto market.

Analyzing the Impact of Stimulus Checks on the Crypto Market

Since then, the agenda badge recovered best of its losses and retested antecedent highs. But can the $300 billion in bang checks advance Bitcoin and added altcoins to beginning highs? The acknowledgment is unlikely. As the aboriginal bang checks accustomed in the accomplished few days, there has been an arrival in the cardinal of crypto barter deposits, as apparent below.

However, a added authentic representation of basic arrival into the crypto bazaar would be the absolute aggregate of barter deposits. Upon a afterpiece attending at absolute inflows in USDT (Tether), we can see that absolute aggregate rose to $1.5 billion on the aboriginal day of bang checks arriving, with a bit-by-bit abatement to about $700 actor in circadian barter inflows. From this on-chain data, it’s bright that the bang checks had a negligible appulse at best.

A recent survey done by Mizuho Securities adumbrated that about $40 billion in bang checks may be spent on equities and cryptos in the afterward weeks; it could be accessible that not all bang checks had been claimed to leave a apparent appulse on cryptos. However, the Internal Revenue Service (IRS) appear 2 canicule ago that added than 90 actor bang checks account $242 billion had been delivered. This meant that about 80% of checks had already been claimed beyond the country.

So what does this all mean? A accessible account is that analysts abundantly abstract the accent of bang checks, and overoptimism from traders led to the accomplished weekend’s surge. Addition achievability is that the abeyant basic arrival from bang checks was negated by bearish account of the Indian government proposing a absolute crypto ban and a whale allegedly auctioning positions on belvedere Gemini. If the latter, addition above agitator may be bare for cryptos to abide their rally.