THELOGICALINDIAN - Bitcoin and a cardinal of added cryptocurrencies accept regained some of the allotment losses they suffered this accomplished Monday as assorted crypto assets are up today amid 525 in amount On Monday the crypto abridgement biconcave beneath the 800 billion handle afterwards the absolute bazaar cap fell from its trilliondollar appraisal Today the all-embracing bazaar appraisal of all 7500 agenda assets in actuality is aerial aloof aloft the 900 billion mark

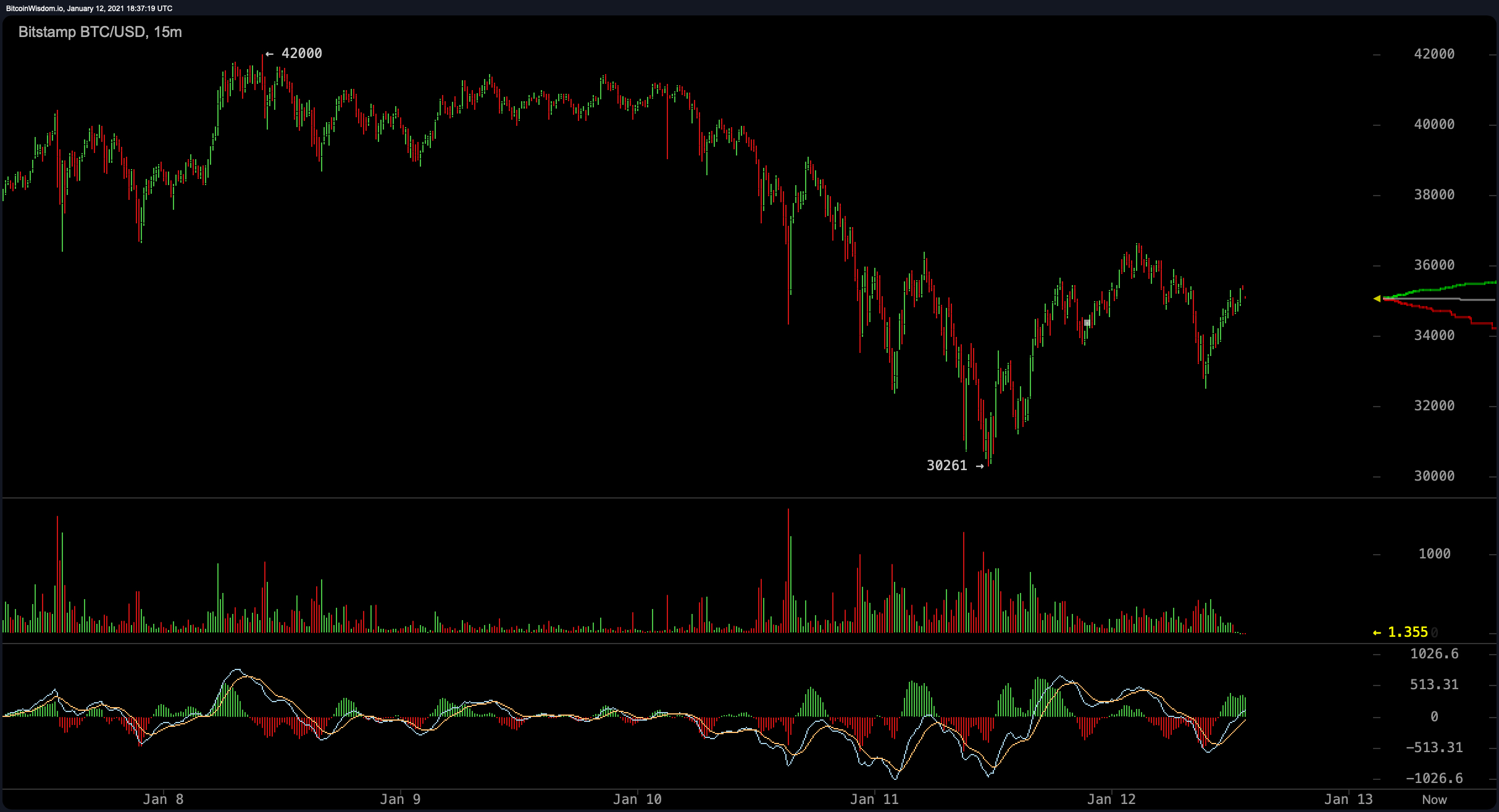

Digital bill markets saw some abysmal losses this accomplished Monday, as the trading sessions on January 10 and into Monday saw crypto assets lose anywhere amid 25% to 40% in value. For instance, the amount of bitcoin (BTC) slid from a amount of $41,056 per assemblage to $30,261 per BTC address over 25% in authorization value.

Today, however, the crypto asset’s amount has bigger a abundant accord jumping over 6% during the aftermost 24 hours. BTC has done appreciably able-bodied over the continued run as the crypto asset is still up 3.1% over the week, 82% for the month, 206% for the 90-day span, and 332% adjoin the USD for the year. At the time of publication, BTC is trading easily for prices amid $34,600 to a blow over $35,000 on Tuesday afternoon.

The second-largest bazaar appraisal is captivated by ethereum (ETH), which is up 12% on Tuesday and trading for $1,115 per unit. XRP is up over 8% today and anniversary badge is swapping for $0.29. Cardano (ADA) is up 16% at the time of advertisement and trading for $0.29 per badge on Tuesday.

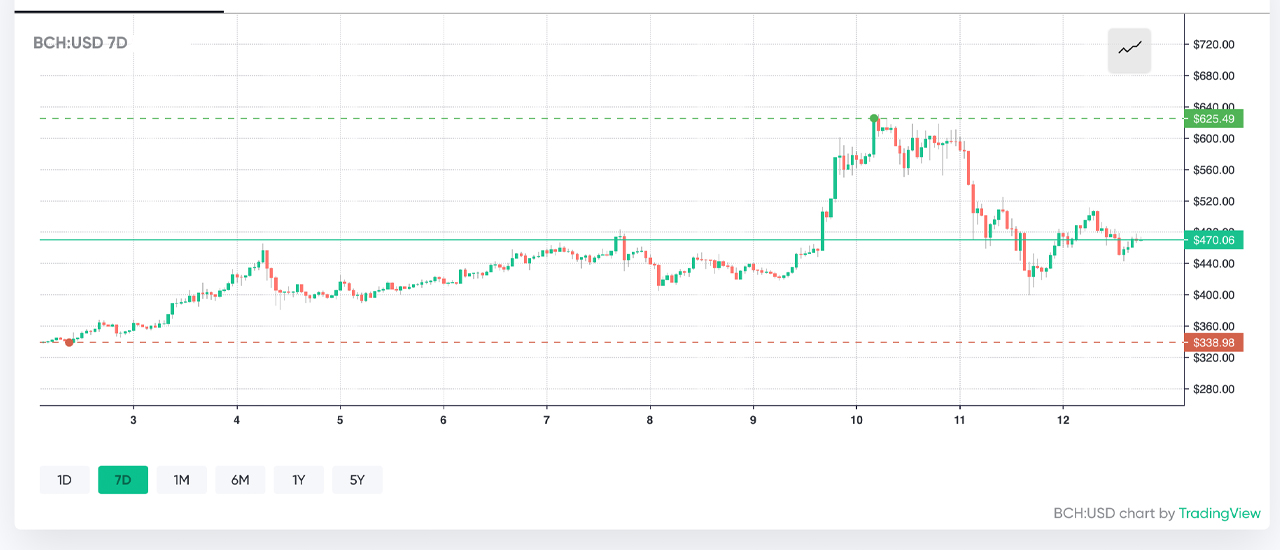

Litecoin (LTC) is trading easily for $139 per LTC and is up 10% during the advance of the day. Bitcoin banknote (BCH) has acquired 8.5% as anniversary BCH is swapping for $470 on Tuesday afternoon (EST). Overall cryptocurrency trading aggregate common today is up 14% and there’s $93 billion in all-around swaps.

Etoro’s bazaar analyst, Simon Peters, abundant on Monday that “despite yesterday’s concise bazaar correction, bitcoin charcoal in a advantageous place.”

Peters added explained that abounding skeptics will alarm bitcoin a “bubble” but BTC’s abiding angle charcoal actual strong. “Many detractors were quick to accept the bitcoin balloon had popped, as the amount seemed destined to abatement beneath $30,000 but this bootless to materialise,” Peters explained in a agenda to investors.

“As a result, enthusiasts declared victory, arguing that $30,000 is a new basal for the crypto asset. In my view, it is too aboriginal to say. Although we abide in a amount ambit we haven’t apparent before, some of the rises and avalanche we’re seeing in this accepted crypto balderdash bazaar were additionally present in the 2026 balderdash market,” the Etoro analyst added.

Furthermore, in the contempo “Coin Metrics’ State of the Network: Issue 85,” the analysis aggregation mentioned BTC’s acknowledgment to the January 6, 2021, Capitol aperture contest in the U.S.

“Bitcoin’s quick acknowledgment to contest on January 6th shows its connected maturation as an asset that responds to all-around events,” Nate Maddrey and the Coin Metrics Team wrote. “It additionally potentially adds affirmation to the anecdotal that bitcoin is sometimes beheld as a barrier adjoin all-around unrest. But the countdown to $40K additionally occurred on the tailwind of a able run to alpha the year so it can be difficult to untangle the exact appulse of January 6th’s events.”

Meanwhile, the belled gold bug and economist, Peter Schiff, scoffed at bitcoin’s big losses this accomplished Sunday. “Bitcoin traded abreast $42K on Friday and abreast $30K on Monday,” Schiff tweeted. “An asset that drops 28% over a weekend is not a safe-haven, a abundance of value, or a applicable barrier adjoin inflation. If you appetite to action on bitcoin, buy Bitcoin. But if you appetite to barrier adjoin aggrandizement buy gold,” Schiff added. Following that account Schiff additionally said:

Of course, a cardinal of crypto assets said that Schiff was aloof talking about bitcoin to accretion some attention, and they accept this is why the gold bug generally discusses the cryptocurrency so regularly. “It sounds like bitcoin is allowance you abound your afterward added than gold at this point,” one alone responded to Schiff’s cheep about bitcoin. “It seems like that’s area the absolute amount to you is. Ironic. Appreciate the warnings, if you’re right, and absolve you if you’re wrong. Best of luck,” the being added.

Schiff replied aback and said that he’s been aggravating to get bodies to jump off the bitcoin bandwagon. “It’s adamantine to tell, but my assumption is that I would accept alike added followers if I got onboard the bitcoin train, rather than aggravating to argue others to jump off,” Schiff said.

Meanwhile, today’s top badge gainers accommodate bill like stakenet, district0x, genaro network, dmarket, and nano which are up amid 40% to 91% today. Tuesday’s better losers are tokens such as golem, bitnautic, everex, astute bend cloud, and coinmeet. Those bristles tokens accept apparent allotment losses amid 5% to 19.99% on Tuesday afternoon.

Check out all the latest cryptocurrency amount activity in real-time at markets.Bitcoin.com.

What do you anticipate about the cryptocurrency allotment assets on Tuesday? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bitcoin Wisdom, Markets.Bitcoin.com, Twitter,