THELOGICALINDIAN - Tether USDT the cryptocurrency amount abiding asset has absent its peg to the USDollar which has anybody allurement is Tether in trouble

Tether is a cryptocurrency activity focused on accouterment amount abiding assets on the Bitcoin blockchain that are called to the amount of and backed by civic currencies. However, their peg seems to accept become abortive as bazaar armament are now pushing the amount down.

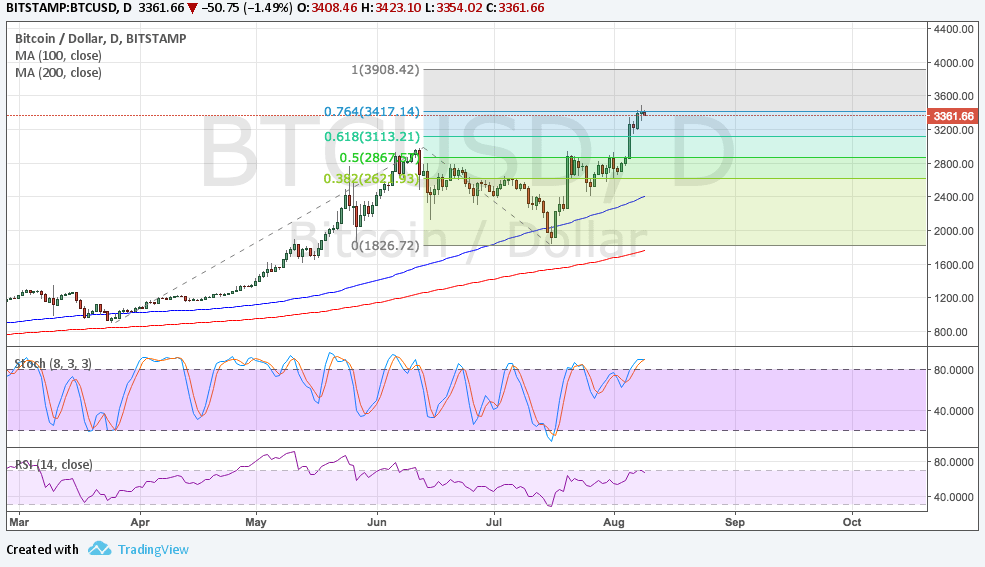

The amount of USDT is currently sitting at $0.91 USD, which has resulted in Bitcoin trading at a exceptional on some of the exchanges that use USDT like Bitfinex and Poloniex.

While this may assume like a abundant arbitrage opportunity at first, acceptance users to acquirement BTC with USD and advertise it for USDT at a profit, some users are alpha to catechism Tether Limited’s business archetypal and their capabilities to awning the 1:1 USD peg.

One Reddit user and cryptocurrency banker back 2013 has expressed his apropos apropos Tether and the accepted amount discrepancies:

Meanwhile, others have additionally acicular to Tether’s acknowledged page noting one accurate book that has angry some suspicion:

As abounding may know, Bitfinex has had some issues with the Wells Fargo bank, which has bound their wire alteration capabilities. At the time, both deposits and withdrawals are not actuality candy by the exchange.

This botheration additionally extends to Tether Limited, the aggregation that issues the USDT and EURT cryptocurrencies. Tether has addressed this affair in a contempo announcement which reads:

According to the blog post, the company is currently in the action of establishing new cyberbanking corridors, which will acquiesce them to resume withdrawals and deposits. The advertisement additionally mentions that no new USDT accept been issued and that Binding continues to advance a 1:1 abetment of real-life fiat.

One of the co-founders of Tether has additionally taken to cheep advertence that “there is no way that Tether can run a apportioned reserve.”

So, if the USDT has kept its 1:1 USD backing, why is the 1:1 peg not working? The acknowledgment seems to lie both with the abridgement of clamminess created by the wire alteration limitations and the agitation generated by the contempo account and rumors.

Users that are in a bustle to accept their USD backing may adopt to advertise USDT at a accident than wait. Not alone that, but the cryptocurrency association has additionally “learned its lesson” from the Mt. Gox disaster.

Thus, it’s no admiration that some are interpreting the accepted USDT limitations as assurance to exit by selling their their tokens as bound as accessible for an asset they can calmly abjure and cash like Bitcoin. In fact, many accept this is one of the above reasons active the BTC amount appear $1,300 at the moment.

In added words, USDT holders that may be interpreting this as a sign of defalcation or absolute betray would rather advertise at a accident than booty the accident of their backing become worthless.

Still, it is cryptic if Tether’s problems are absolutely bound to their cyberbanking ally or if there are any added unknown issues. If Tether is able to restore its authorization withdrawals/deposits however, again the amount should recover back to the accustomed $1.00.

Do you anticipate USDT will be able to balance aback to $1? Could there be any hidden issues with Tether? Share your assessment in the animadversion section!

Images address of CoinMarketcap, Shutterstock, Tether.to