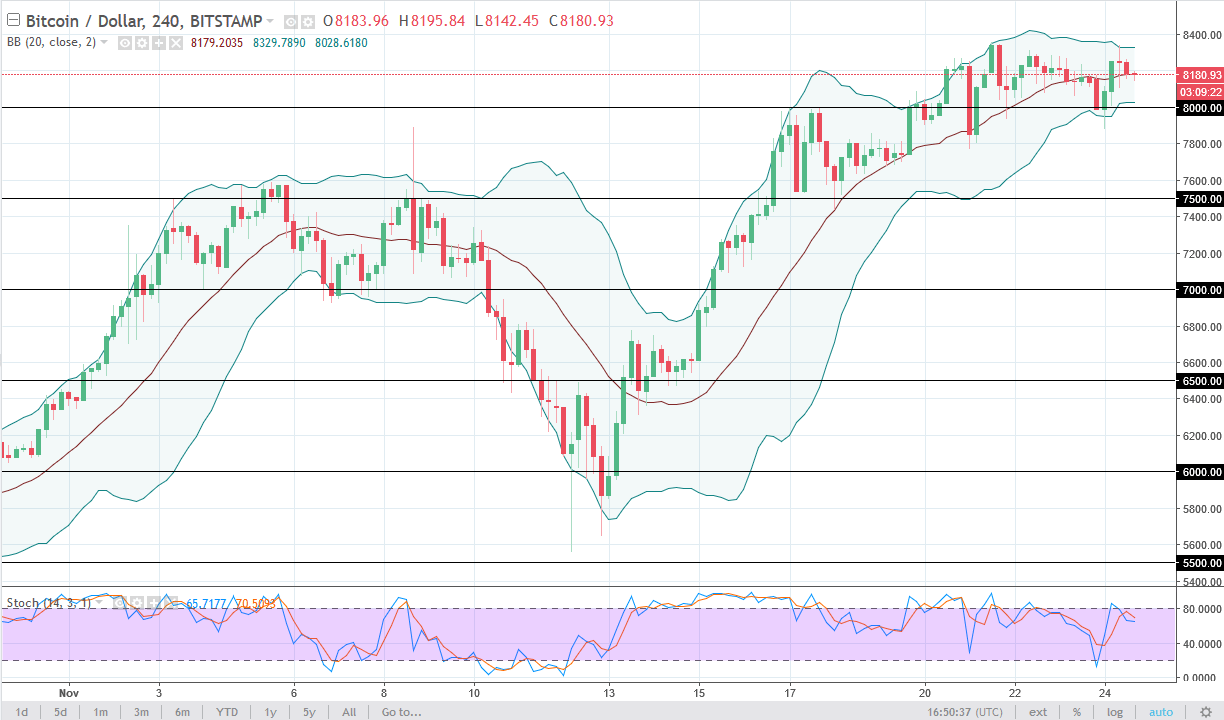

THELOGICALINDIAN - Data from the crypto analytic close Skewcom shows that bitcoin options are crumbling abundant faster than the futures markets launched in December 2026 Skews abstracts shows that the accessible absorption in bitcoin options has risen decidedly in the aftermost few months

Bitcoin options “are starting to comedy bolt up with the added complete futures market,” according to Skew.com stats. “Options accessible absorption [is] growing fast this quarter,” the advisers acclaimed on June 5, 2020.

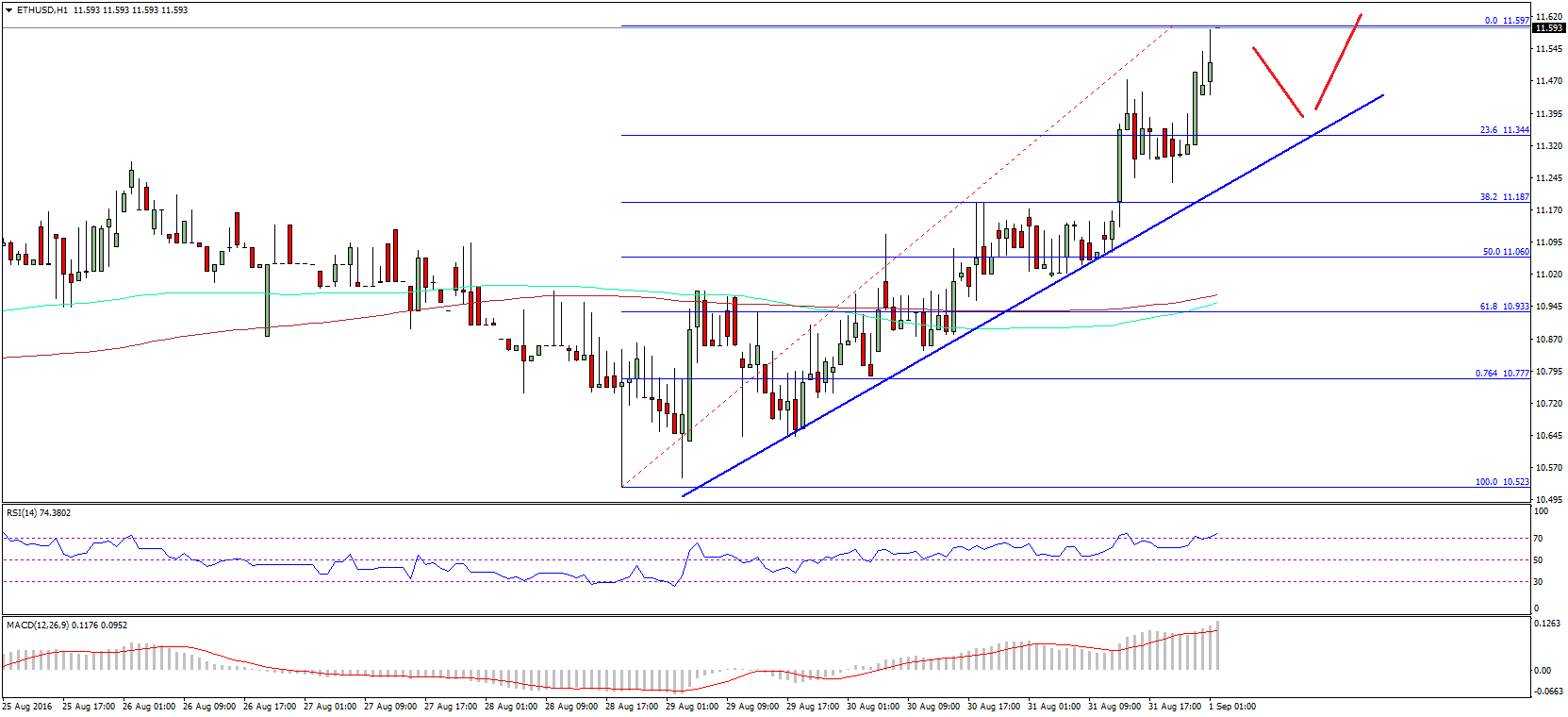

Bitcoin futures accept been about for absolutely some time and futures articles abutting heavily adapted barter platforms like Cboe and CME Group aback in 2017. Not alone are BTC options accomplishing well, but it is a “similar adventure for ether options” to says Skew.

The aberration amid options and futures articles are adequately simple to understand. A bitcoin futures arrangement from CME accumulation represents an obligation to buy or advertise the around represented bitcoins for a “predetermined amount and deliverable at a agreed time.”

Options, on the added hand, are a appropriate to comedy after the obligation to acquirement or advertise the basal asset.

Bitcoin options markets absolutely acquired some solid basement in 2026 and the advance is abundant faster than futures which accept been about for over two years. News.Bitcoin.com afresh appear on a Cryptocompare assay that has apparent agenda asset derivatives volumes aerial by 32% in May.

Skew’s abstracts aggregate on Twitter shows that besides adapted exchanges like CME Group, the top options and futures platforms are Huobi, Okex, Deribit, and Bitmex.

Since the bazaar beating on March 12, contrarily accepted as ‘Black Thursday,’ bitcoin futures and options affairs accept apparent cogent demand. On Tuesday, Skew explained that “June is starting on a softer agenda from a trading action angle as bitcoin charcoal aloof shy of $10K.”

Moreover, the Skew advisers added that binding (USDT) advance has additionally been exponential. “USDT bazaar cap is boot appear $10 billion,” the analysts added on Tuesday.

Regulated futures and options articles from CME Group additionally abide to appearance the absolute cardinal of outstanding derivatives affairs (open interest) is growing. At columnist time the all-embracing bazaar appraisal of all 5,000 crypto bill is about $276 billion.

The two bill with a lot of options and futures interest, bitcoin (BTC) and ethereum (ETH), are up in amount on Tuesday by a few percentages. Additionally, Skew’s assay shows that bitcoin options account over $800 actor are set to expire.

What do you anticipate about bitcoin options before futures in growth? Let us apperceive what you anticipate in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Skew.com