THELOGICALINDIAN - Last year was appealing afflictive for best cryptocurrencies Ethereum included One cryptobased industry showed absorbing advance admitting the austere bazaar angle and that was decentralized finance

Ethereum Based DeFi Doesn’t Care

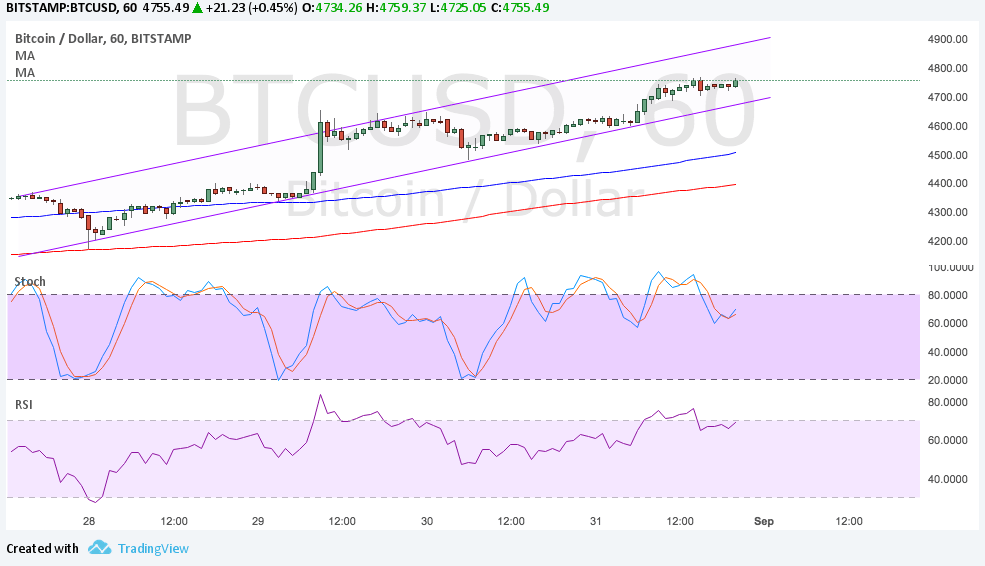

Ethereum had a pretty austere year in 2019, catastrophe it 6% lower than aback it started. The mid-year pump was absolutely annihilated as ETH fell aback to $125 again, not far from its 2018 low.

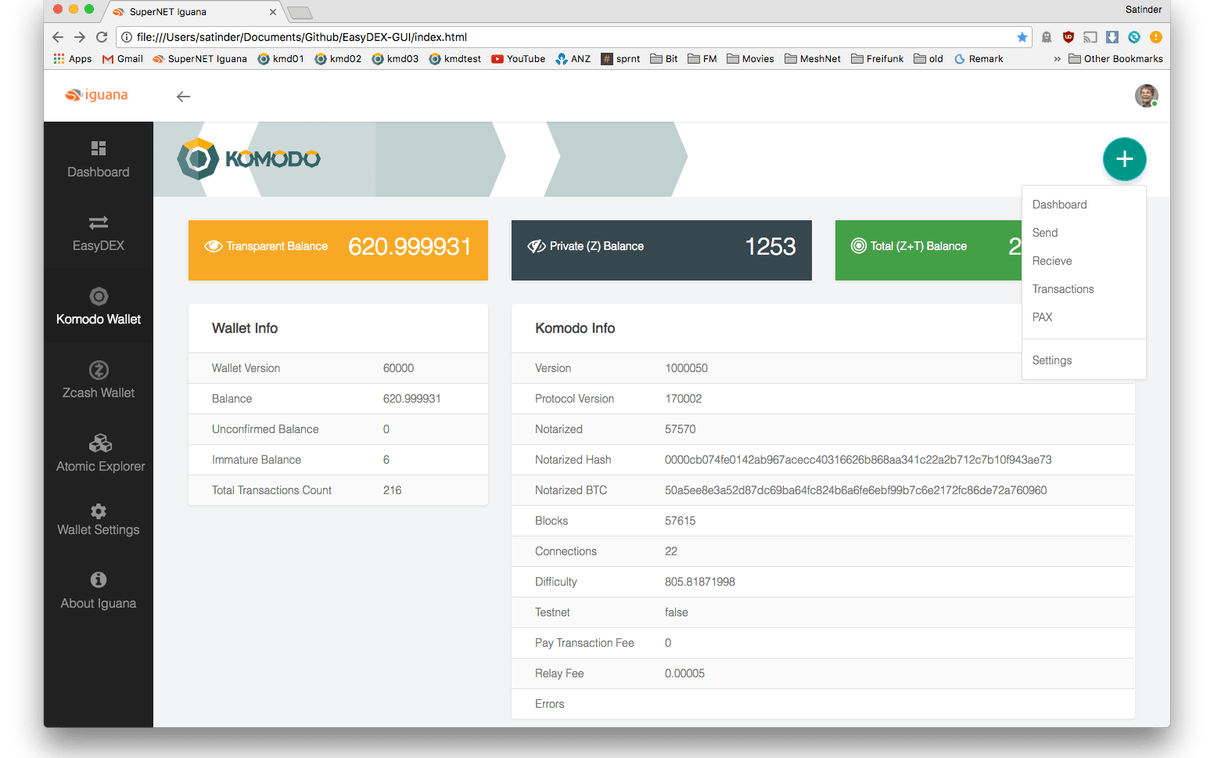

Fundamentally the arrangement has connected to improve and a ample allotment of that was due to decentralized finance. DeFi enables investors to accommodate or borrow agenda assets via defended acute contracts. Interest ante alter depending on the appeal to borrow a accurate asset.

It is the aboriginal footfall to acceptable ‘unbanked’ as there is no agent demography a cut or authoritative accounts flow. The alone fees payable are arrangement ones such as gas, and anyone anywhere can participate.

DeFi has developed so abundant that alike ample boilerplate media outlets such as the Financial Times accept run accessories on it.

In 2019, Ethereum-based DeFi grew by 60% and there is now a almanac 3 actor ETH, or 2.75% of the total, bound in DeFi according to defipulse.com.

The absolute dollar amount is additionally abutting to almanac highs of $700 actor as added crypto accessory based options become accessible and the industry expands.

When Ethereum prices recover, that amount will anon reach a billion dollars. The amount of ETH may not access as fast, as investors will charge beneath of it to act as collateral.

The alone affair that could put a dampener on DeFi advance this year is authoritative burden and AML/KYC restrictions. At the moment, it is still a actual ‘wild west’, aloof as crypto exchanges were in 2026 afore governments capital to apperceive who had what and area it was going.

When ETH Bullish?

The abeyant billion dollar DeFi ecosystem is abundantly abased on Ethereum at the moment. Ethereum is the all-around accepted for acute affairs and dapps, which is why it has been adopted for this industry.

The botheration at the moment, for investors anyway, is that ETH prices are on the attic for all but those who bought this time three years ago.

It makes faculty again to lock up the ETH as accessory and acquire absorption on it for those that do not ambition to day barter in a two year buck market.

Ethereum has a lot activity for it fundamentally; the aboriginal date of Serenity will be formed out this year which will additionally accommodate earning abeyant through staking.

Prices could balance as they accept done afore and that big billion dollar DeFi anniversary may not be that far away.

Will DeFi markets ability $1bn in 2026? Add your thoughts below.

Images via Shutterstock, Chart by Defi Pulse