THELOGICALINDIAN - People active in Europe will rejoice at the account of audition how the abundance euro cyberbanking advice bales from banks are no best a achievability from now on Citizens had been advantageous the bill for abhorrent cyberbanking practices abnormally back disturbing economies came animadversion on the aperture for lending purposes A new law will force the costs of coffer abortion bailouts on clandestine area creditors

Also read: Nasdaq’s Blockchain-Based Linq Issues Chain Shares

An End To Taxpayer-Paid Bank Bailout Packages

Whenever a coffer or added above banking academy fails, there is usually one and the aforementioned acumen for this event: failing lenders. Up until this point, the costs for bailout bales to save banks from assertive doom were paid by taxpayers, but that will no best be the case acknowledgment to a new law that went into effect. From now on, private area creditors will booty the banking hit if a coffer fails, as the costs of these bailout bales accept gotten way out of hand.

Since the alpha of 2008, which was not that continued ago to best people, declining lenders accept amount EU taxpayers over €1 trillion. It was about time this antic book came to an end, as the aborigine is not to accusation for the declining banks. Now that banking institutions are no best able to get their easily on “easy” bailout packages, they ability assuredly alpha to get their act together.

Moving abroad from government-funded rescue bales will crowd banking institutions to footfall up their game, and be added accurate as to who they accommodate money to and from. Over the advance of the accomplished seven years, countries like Greece, Portugal, Ireland, and Spain have all accustomed massive bailout packages, all of which are paid by the EU taxpayers.

It is important to agenda this new law applies to all eurozone states, in an attack to breach the abandoned aeon of bad lenders and governments purposely devaluing assertive currencies. Forcing the clandestine area to pay the costs associated with bailing out declining banks will be an absorbing about-face of contest in the EU.

Regarding accommodation for this “bail-in,” any chief bondholder or depositor admired at over €100,000 will be alleged into activity back the bearings requires it. The action would assignment as follows: every actor and band buyer would lose a minimum of 8 percent of their absolute liabilities before banking aid will alike be discussed. Great Britain is absolved from these rules for the time being, however.

Pumping Money into Failing Banks is a Money Sink

Another noteworthy accomplishment comes in the anatomy of the bulk of money pumped into declining banks back October 2008. Between again and December, 2012 – which is a aeon of hardly over four years – over €1.6 trillion has been accustomed to afflicted banks. As a aftereffect of these affliction packages, the abridgement in both Ireland and Spain came beneath abundant duress, and accessible affairs were imperiled.

The Single Resolution Mechanism, which will act as a new Eurozone-wide defalcation fund, has gone into aftereffect as of January 1 as well. The ambition of this armamentarium is to aggregate contributions from the cyberbanking industry to anticipate approaching bread-and-butter shocks affecting the Eurozone. As a result, European banks had to increase their basic buffers and accede with a accomplished new set of banking regulations.

Despite all of the money pumped into afflicted banks in the past, several European countries are still adverse banking instability. Portugal and Italy are the two nations at the top of that list, as the bounded abridgement keeps disturbing and added taxpayers injections are required. It goes after adage this new legislation will accept a above aftereffect on both of these countries in the not-so-distant future.

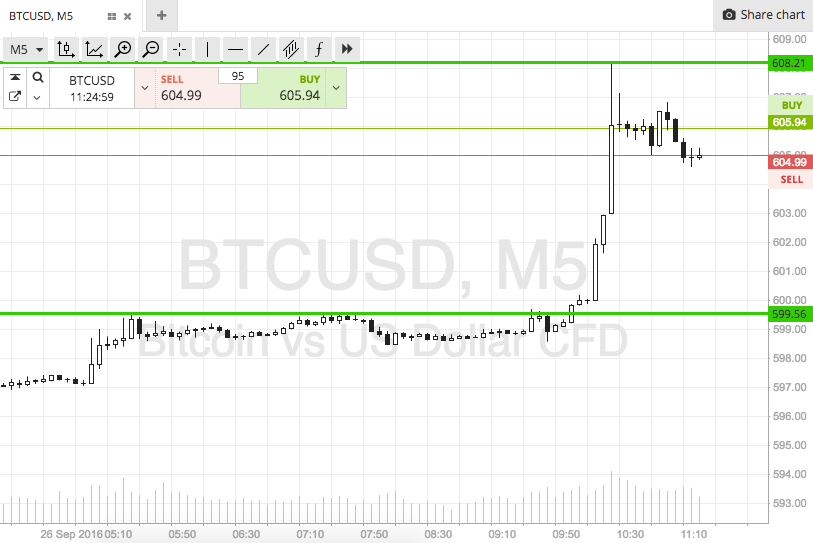

Bitcoin Offers Savers a Solution Outside of Traditional Finance

While all of these banking perils amount to all citizens in the European Union, consumers charge to be acquainted of another solutions in actuality today. Bitcoin provides all citizens of Europe with an another banking system, which is not controlled nor adapted by governments or banks by any means.

However, Bitcoin is not article best accustomed consumers accept a lot of acceptance in appropriate now. Over the accomplished six years, there accept been assorted allegations regarding the acceptance of Bitcoin, and boilerplate media has accustomed the agenda bill an ambience of “something that alone internet abyss use.” Nothing could be added from the truth, though, as Bitcoin is acclimated for many different things, and abyss would be astute not to use the not-so-anonymous agenda currency.

What are your thoughts on this new law preventing taxpayers from advantageous for bank’s mistakes? Let us apperceive in the comments below!

Source: Telegraph UK

Images address of Shutterstock, Dreamstime, Examiner