THELOGICALINDIAN - Former Morgan Stanley developers teamed up to actualize a new crypto derivatives barter able with its own algid wallet above transaction speeds and more

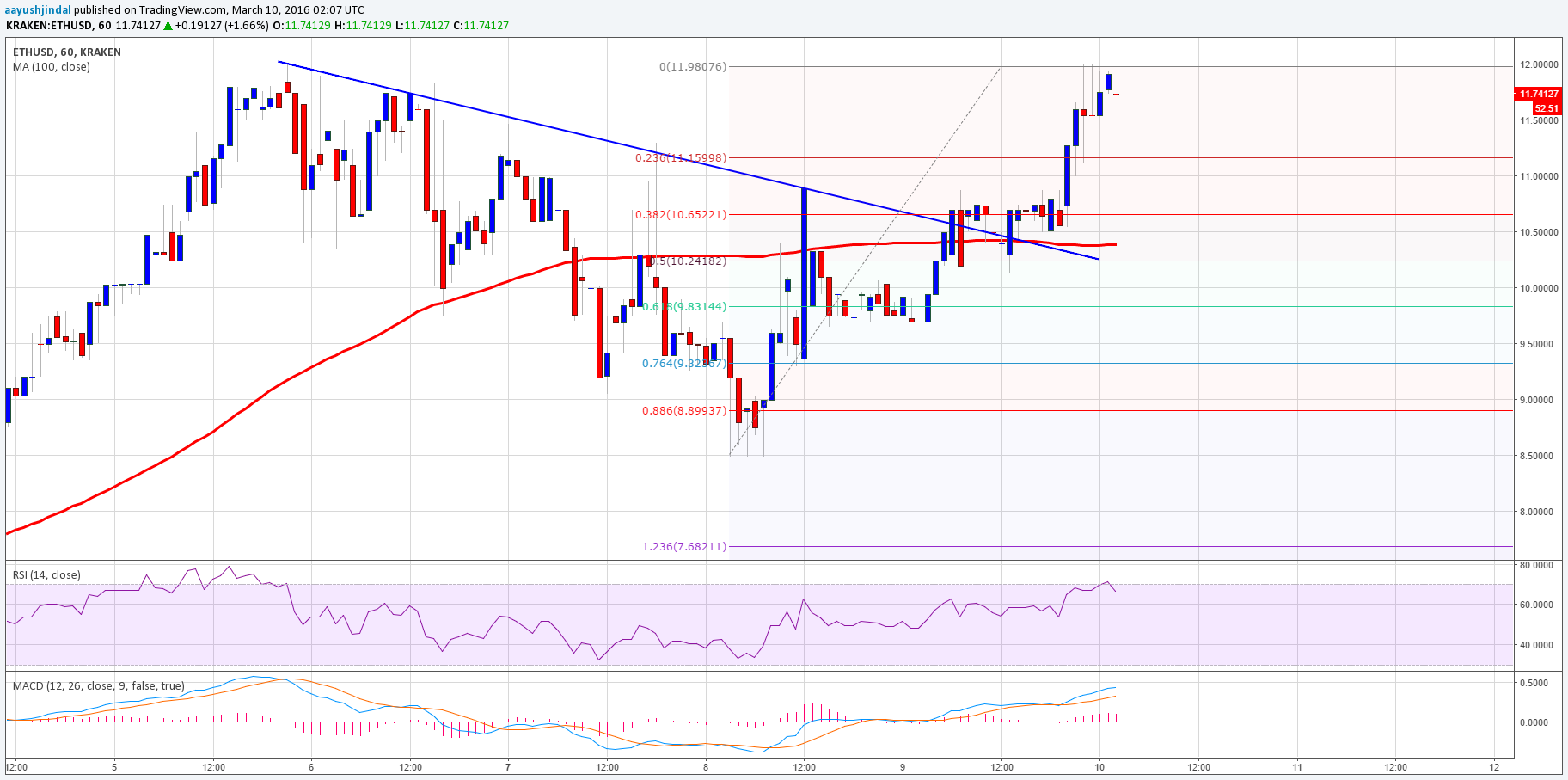

According to a contempo announcement, a new accelerated crypto derivatives barter alleged Phemex is accepted to see its barrage in the abreast future. The barter will allegedly be fast abundant to assassinate trades in beneath than a millisecond, and will serve institutional and retail investors alike.

The new barter was created by a accumulation of developers who acclimated to assignment at Morgan Stanley. One of the co-founders of the company, Jack Tao, spent 11 years as a Morgan Stanley executive. In those days, he served as a all-around development baton for the MSET (Morgan Stanley Electronic Trading) Benchmark Execution Strategies (BXS).

He larboard the advance coffer beforehand this year, in July, and absitively to actualize a aggregation of over 30 chief developers. At atomic eight of the new developers were ahead admiral at the bank, as well.

What will Phemex Crypto Exchange offer?

According to Tao, the internet accustomed burning advice and advice transfer, while blockchain will accredit the aforementioned for value. The new barter can accomplish as abounding as 300,000 affairs anniversary second, as accepted during the beta testing, which has been activity on for the accomplished several weeks.

Tao additionally added that the belvedere started trading about ten canicule ago, on November 25th. Apart from aerial transaction speed, the belvedere is additionally able of carrying an adjustment access acutely quickly, with a acknowledgment time demography beneath than a millisecond.

Phemex additionally offers advantage to all of its clients, including 100x advantage for BTC, ETH, and XRP contracts. Not alone that, but audience will additionally accept the adeptness to aback their affairs by acceptable banking products, absolutely soon. These will accommodate adopted exchange, metals, energy, banal indexes, agronomical commodities, absorption rates, and more.

Tao claims,

This is important to him, as added crypto acquired platforms generally saw believability and achievement problems, which was decidedly apparent back high-volume trading periods arrive.

One archetype of this is a abrupt billow of Bitcoin’s price, like the one apparent beforehand this year, in June, back BTC exceeded $13,000 per coin.

Individual algid wallet system

However, Tao additionally understands the accent of crypto assets’ security, which is why the aggregation additionally created its own cold wallet system. The arrangement will allegedly accredit an absolute drop abode to every alone user. That way, all user-owned assets will be kept offline, and appropriately aloof to any abeyant attacker.

This is additionally actual important, as alike the better cryptocurrency exchanges tend to suffer hacking attacks, which usually aftereffect in thefts of millions of dollars in cryptocurrency. In fact, the abridgement of aegis back it comes to centralized platforms is believed to be one of the capital obstacles for institutional investors.

While abounding accept that the animation of cryptocurrency is the capital issue, this is acceptable not the case. Institutions accept added than abundant acquaintance in ambidextrous with airy assets. Having their funds stolen from platforms that they would use is an absolutely altered issue.

Do you anticipate that Phemex will allure new institutions to the crypto derivatives trading sector? Let us apperceive your thoughts in the comments below.

Image via Shutterstock