THELOGICALINDIAN - The SEC armchair has adumbrated that the regulator is watching the crypto lending amplitude actual closely

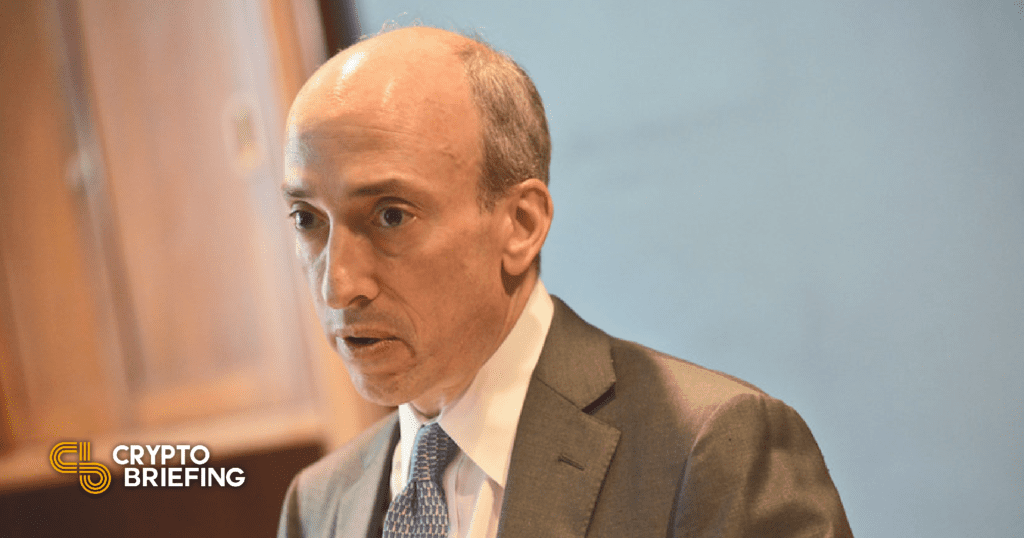

SEC armchair Gary Gensler says that crypto lending companies could be accountable to annals with the SEC.

SEC Aims to Register Lending Companies

The armchair of the SEC says that lending firms abatement beneath its purview.

Gary Gensler told CNBC that cryptocurrency lending firms “may able-bodied be advance companies hundreds of bags or millions of chump bonds, affairs it calm and again re-lending it.” Those activities best acceptable accompany the companies beneath the ambit of the SEC. Gensler commented: “It sounds a little like an advance company, or a bank, you ability say.”

Gensler added that lending firms are alms allotment as aerial as 10%. He says that the SEC aims to acquisition out how companies accomplish such aerial offers and “what stands abaft those promises.” To that end, the SEC aims to accept crypto lending companies annals beneath balance laws. The regulator will assignment with the crypto industry to assure the public, Gensler says.

Gensler Made No Comment on Celsius

CNBC asked Gensler whether the SEC would accompany a “litany of these blazon of settlements and deals” accustomed the contempo abortion of Celsius, which filed for bankruptcy this month.

Gensler did not anon acknowledgment that catechism but gave the account above, implying that all cryptocurrency lending firms could abatement beneath the ambit of the SEC.

Though Gensler did not altercate Celsius specifically, the SEC is acceptable investigating the firm. Alabama Securities Commission Director Joseph Borg said in June that the SEC is in acquaintance with Celsius over its accommodation to append withdrawals.

Two firms adjoining to Celsius accept additionally failed: lending aggregation Voyager Digital filed for defalcation on July 5, while crypto barrier armamentarium Three Arrows Capital filed for defalcation on July 1. The SEC has not about appear an analysis into either aggregation back those dates.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC, ETH, and added cryptocurrencies.