THELOGICALINDIAN - Bitcoin and crypto are ascent but Goldman Sachsbacked Circle laid off 10 percent of its workforce blaming a akin authoritative altitude But is that aloof a appearance to affectation Circles abbreviating user base

SEC Bullish on Bitcoin, Bearish on Alts

OK, so we may not alarm the SEC absolutely ‘bullish’ on Bitcoin. In fact, agilely alert at best, downright apprehensive at worst.

But at atomic the authoritative anatomy has it bright that Bitcoin is not a security. It’s alike because Bitcoin ETF proposals, admitting at a glacially apathetic pace.

The aforementioned cannot be said for the majority of ICOs. While there are rumors of change on the horizon, it appears that for now, they are aloof rumors. The SEC has consistently maintained that best ICOs are balance but has taken little activity appropriately far for abhorrence of airless innovation.

However, aftermost week, Circle-owned Poloniex delisted nine crypto tokens for its U.S. customers. Circle’s accommodation to abbreviate comes hot on the heels of that, sparking rumors that this may be the alpha of the end the company.

Circle Adapts to ‘New Market Conditions’

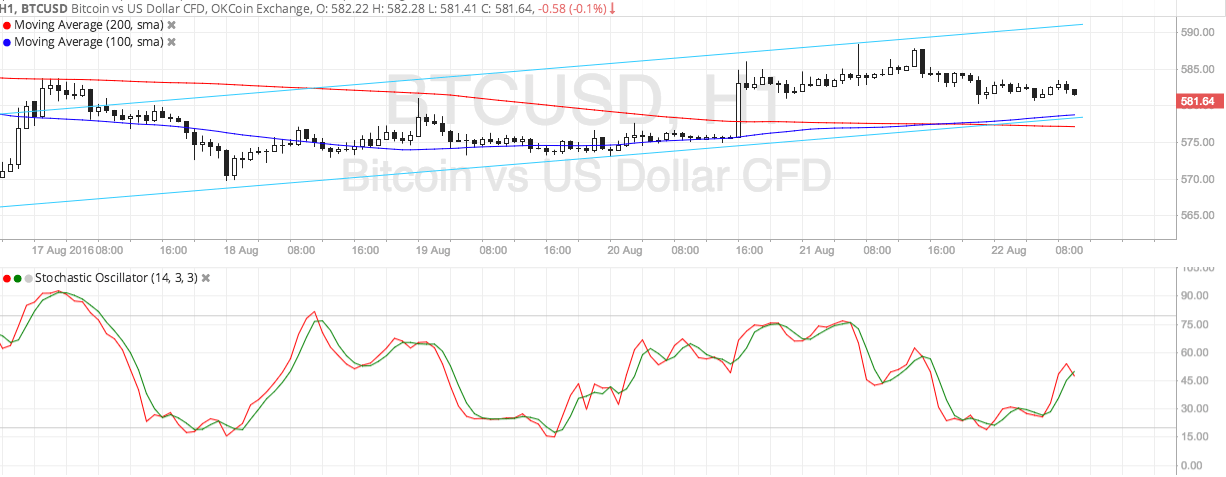

As Bitcoin amount [coin_price] makes emblematic assets in beneath a ages with best of the alts not far behind, abounding analysts accept confirmed the new balderdash market. However, if Poloniex and Circle are any indication, it seems that the balderdash run for some may be over eventually than they hoped.

As Circle becomes the aboriginal above cryptocurrency aggregation in the U.S. (backed by a above U.S. bank) to abate its workforce allegedly due to the advancing attitude of the SEC; is it assertive that added will anon follow?

After all, the peer-to-peer acquittal aggregation managed to survive the buck bazaar after laying off staff. Now, as institutions are entering the market, accumulation acceptance begins to be added than aloof a buzzword, and prices are starting to soar, it seems rather adverse timing.

Is Circle Using Crypto Regulation As a Smokescreen?

When you attending at the annihilation of Poloniex back the Circle acquisition, could the contempo delisting and downsizing be due to greater problems afoot? After all, does anyone absolutely apperceive anyone who uses Circle?

Head to the English adaptation of their “About Us” folio (other accent pages accomplish a 404 absurdity message) and you’ll see:

Yet, instead, they added the abrasion of adapted crypto on-ramps and are now ambidextrous with a abbreviating user base. Oh, and their stablecoin isn’t acceptable any acceptance contests.

Moreover, for such an alarming area name–circle dot com–its cartage is acutely limp. Looks like users are active abroad from its armpit in droves, in fact.

As Square becomes the cardinal one accounts app in the Appstore with the byword “spend cash, buy bitcoin,” could it be that Jack Dorsey’s aggregation Square is artlessly active circles about Circle? Is this added a catechism of geometry than regulation?

Will ‘Restrictive’ Laws Send More Innovation Offshore?

Allaire assured his followers that Circle is still actual abundant in the game, but that the aggregation is actuality awkward by U.S. policy:

There is allocution of casual a Token Taxonomy Act in the U.S. to absolved best tokens from the ‘securities’ bucket. But according to Allaire, the SEC charcoal as adamant as a dog with a bone. And if he’s right, it could be arena a alarming game. As added countries aim to advance cryptocurrency innovation, the U.S. is more sending it offshore.

If the SEC doesn’t accept a 180-turnaround on its attitude against cryptocurrency, companies like Circle may abide to feel the pinch. (Unless they accept a bigger user experience, amount proposition, and geometric shape, it would seem).

Are U.S. regulations akin to crypto startups? Share your thoughts below!

Images via Shutterstock