THELOGICALINDIAN - Grayscale afresh appear its Digital Asset Advance Report for the additional division of 2026 The aggregation marks a notable access in the advance into its articles the majority of which are advancing from institutional players

Institutions Are Here

According to the new Q2 report of Grayscale, the company’s assets beneath administration about tripled from $926 actor to $2.7 billion. The account of this is the improvement of the cryptocurrency bazaar which has had a bang in 2019.

Per the report, the annual allotment for industry criterion products, namely the Grayscale Bitcoin Trust and the Grayscale Digital Large Cap Fund were 178.8% and 147.6% respectively.

Perhaps the best absorbing bit of the address is the actuality that the accomplished allotment of absolute appeal for Grayscale’s articles came from institutional investors. In the additional division of 2026, they comprised 84% of the absolute demand, accouterment a bright assurance that big players are already absorbed in the field.

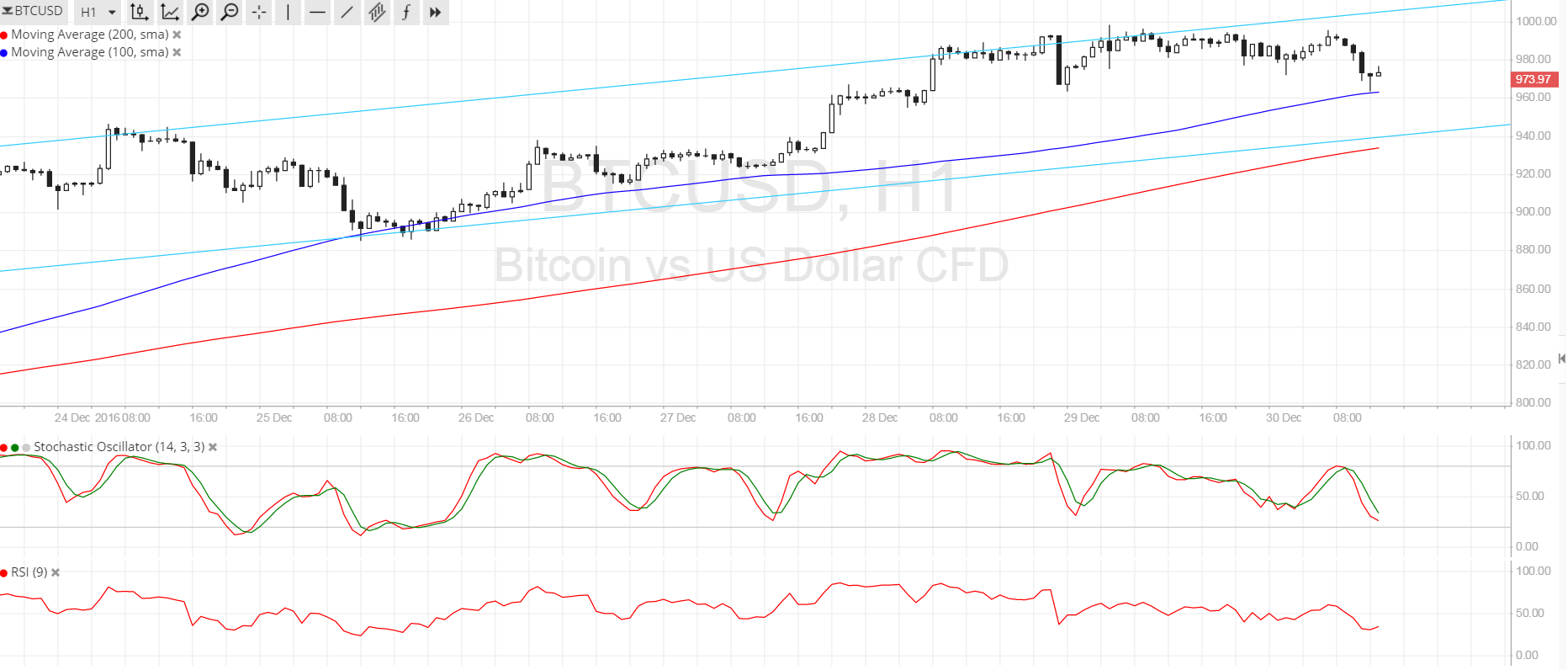

Grayscale BTC Premium Speaks Of The Same

According to the report, the boilerplate account advance in all articles amounted to $4.9 million. However, $4.1 actor of those went into conceivably the best accepted artefact of the aggregation – the Grayscale Bitcoin Trust. Again, 80% of the investments came from institutions.

The Grayscale Bitcoin Trust (GBTC) offers shares which are the aboriginal about quoted balance alone invested in and anticipation their amount from the amount of bitcoin.

In added words, they acquiesce institutional investors a adventitious to accretion acknowledgment to the movement in Bitcoin’s amount after accepting to anguish about storing, owning, or managing clandestine keys. One allotment of GBTC represents 0.00097834 BTC, which, at the time of this writing, equals $9.24. The accessible amount of one share, however, is currently $12.61 which is about 36 percent added than its absolute BTC value.

This agency that institutions are blessed to pay a 36 percent exceptional in adjustment to accept acknowledgment to BTC’s amount instead of affairs Bitcoin anon and accepting to abundance and administer it.

Institutional Interest Soars In 2026

Grayscale’s latest address added attests to the actuality that institutional absorption in Bitcoin is aerial in 2026.

Back in May, Bitcoinist reported on a Fidelity analysis which additionally accent the ascent absorption of institutional investors. What is more, the appeal for CME Bitcoin Futures on account of big players additionally soared. In June, it was up 80 percent on a year-over-year basis.

What do you anticipate of the ascent institutional absorption in Bitcoin during 2026? Will it abide or will the abrupt pullback abate it? Don’t alternate to let us apperceive in the comments below!

Images via Shutterstock