THELOGICALINDIAN - On Friday Grayscale Investments the worlds better agenda bill asset administrator in agreement of assets beneath administration AUM appear that three trusts accept been filed with the Securities and Exchange Commission SEC in adjustment to become SEC advertisement companies The three trusts accommodate alone crypto asset articles such as the bitcoin banknote assurance the litecoin assurance and the ethereum archetypal assurance which will accompany three added Grayscale trusts that are already SEC advertisement companies

Grayscale’s BCH, LTC, ETC Trusts to Join Three Other Products as SEC Reporting Companies

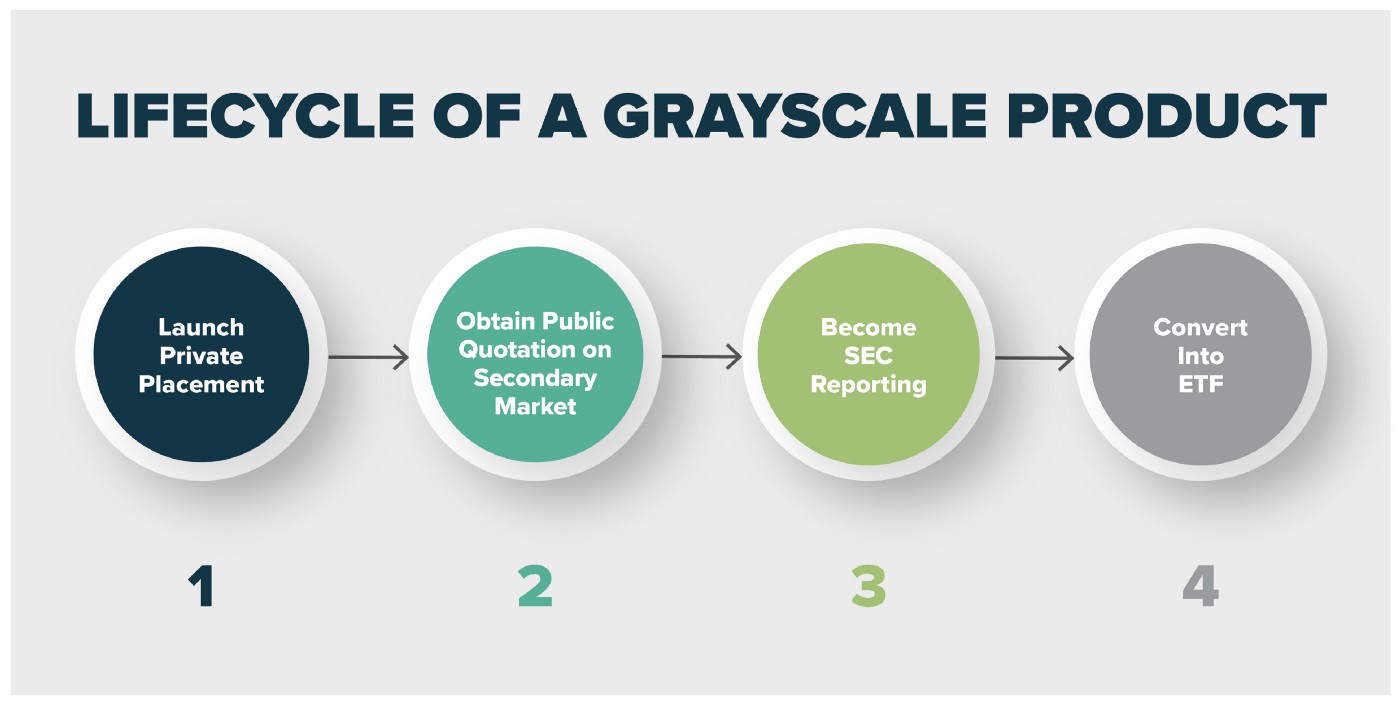

Grayscale Investments has abundant that three alone crypto trusts are affective advanced with their artefact advance cycle. The aggregation appear on Friday that the Bitcoin Cash Trust (OTCQX: BCHG), Litecoin Trust (OTCQX: LTCN), and the Ethereum Classic Trust (OTCQX: ETCG) accept been registered with the SEC in a new filing. The Form 10 allotment will finer catechumen the trusts into SEC advertisement companies and eventually, Grayscale hopes these trusts will become exchange-traded funds (ETFs).

The agenda bill asset administrator declared that the trusts’ “product development pipeline” was declared in a blog column Grayscale appear aftermost April. The blog post, alleged “Grayscale’s Intentions for a Bitcoin ETF,” mostly discusses the firm’s bitcoin (BTC)-based trust, but the close added says the aggregation will “ultimately catechumen anniversary artefact into a agenda bill ETF.”

Grayscale advantageous six crypto trusts with SEC advertisement cachet is a milestone, according to Craig Salm, Grayscale Investments’ carnality admiral of acknowledged operations. “This anniversary reflects Grayscale’s connected charge to alms cellophane advance cartage that voluntarily beat accepted advertisement requirements, accommodated a acute akin of disclosure, and are accountable to added authoritative oversight,” Salm explained in a account beatific to Bitcoin.com News.

“As we anticipate authoritative approval for a Bitcoin ETF, we abide focused on accouterment investors with opportunities to admission the agenda bill ecosystem through Grayscale’s secure, trusted ancestors of products,” he added.

Highly-Anticipated SEC Decision Concerning Bitcoin ETF

As SEC advertisement companies, the LTC, BCH, and ETC trusts will charge to book added letters and accommodate added banking statements. The trusts charge chase all the rules beneath the U.S. Exchange Act (SEA) and book a Form 8-K.

The three trusts that were ahead accepted SEC advertisement cachet accommodate Grayscale’s Bitcoin Trust, Ethereum Trust, and the Digital Large Cap Fund. Grayscale articles are handled by the MSRB-registered and FINRA/SIPC affiliate Genesis Global Trading, Inc.

At the time of writing, Grayscale Investments is additionally cat-and-mouse to see if the U.S. regulator will accept the firm’s bitcoin (BTC) ETF filing. Furthermore, Grayscale is amid a dozen affairs that are attempting to get SEC approval for a bitcoin exchange-traded fund.

What do you anticipate about Grayscale announcement that LTC, BCH, and ETC trusts are acceptable SEC advertisement companies and aim to be ETFs in the end? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Grayscale,