THELOGICALINDIAN - When Microstrategy Inc bought 425 actor bitcoin in the aftermost two months the accommodation became an important brand of institutional approval of the top cryptos accreditation as a complete safehaven asset The American technology close had aloof fabricated bitcoin its primary assets asset to barrier adjoin authorization aggrandizement Now it appears above all-around companies are afterward Microstrategys bitcoin action

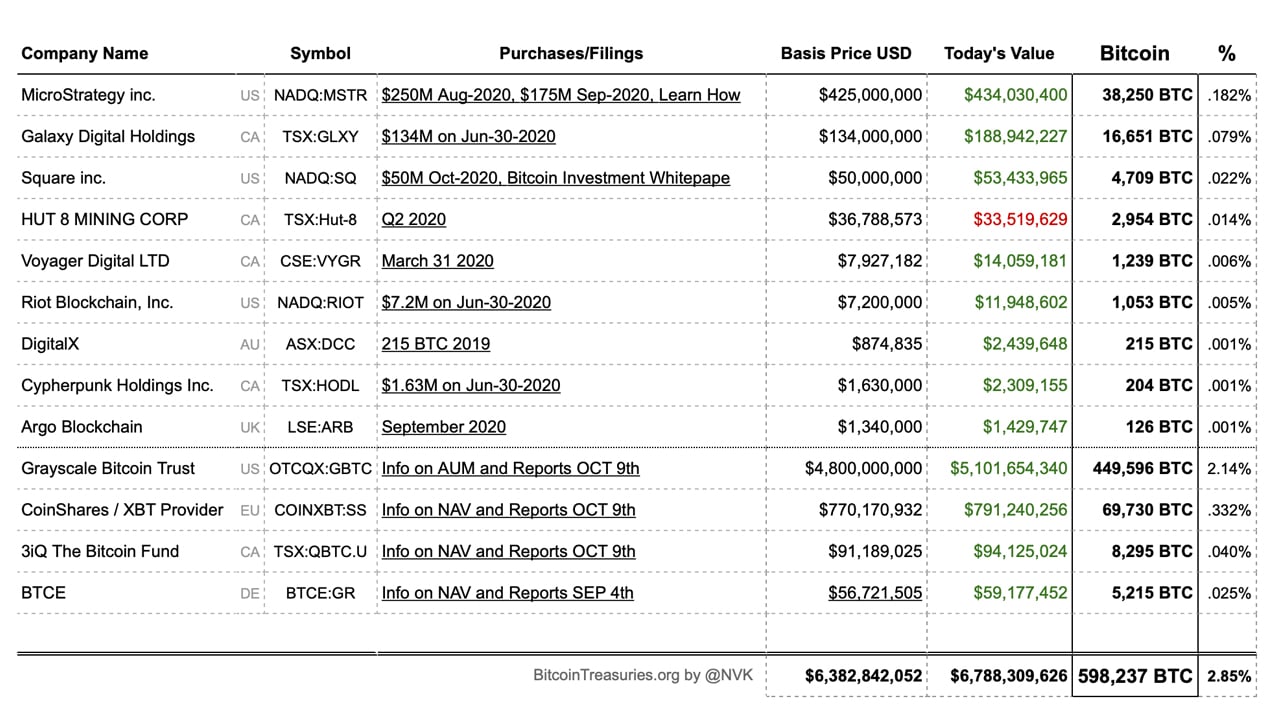

The website bitcointreasuries.org is curating bitcoin treasures captivated in assets by about traded companies from beyond the world. At the time of writing, 13 companies with a accumulated absolute 598,237 BTC, or 2.85% of the absolute accumulation of 21 actor BTC, are listed on the page. Here is a afterpiece attending at some of the entities.

Grayscale Bitcoin Trust — 2.14%

Grayscale Investments is, perhaps, an unsurprising baton in this regard. Through its Bitcoin Trust Fund (GBTC), which owns and advance the amount of bitcoin, the New York-based close now holds 449,596 BTC, admired at $5.1 billion currently, and apery 2.14% of the agenda asset’s absolute circulating supply. Listed on the OTCQX market, the Trust has airtight up 70% of all anew minted bitcoin in 2020, about acceleration its portfolio in the process.

It is noteworthy that Gbtc holds this BTC on account of accepted accumulated investors, who about amount aloofness and bitcoin’s abundance of amount accreditation while calculatively afraid to accretion absolute acknowledgment to the asset. Grayscale’s bitcoin assurance “became the aboriginal about quoted balance alone invested in, and anticipation amount from, the amount of bitcoin” back it launched in 2013. The aggregation operates ten crypto advance articles focused on institutional investors. Funds awning ethereum (ETH), bitcoin banknote (BCH), zcash, XRP, and more.

Microstrategy Inc. — 0.18%

Grayscale may be a pioneer, but it is Microstrategy that’s affective all the account in contempo weeks. The Nasdaq-listed company, which develops adaptable software as able-bodied as accommodate cloud-based services, bought $425 actor account of bitcoin in August and September, authoritative BTC Microstrategy’s capital assets asset.

The multi-billion-dollar U.S. close now holds a absolute 38,250 BTC, in a move that signals accretion accumulated adoption. At accepted barter rates, the portfolio is account added than $433 actor – a accretion of $8 million, advancing as it does adjoin a accomplishments of added bang spending that has beatific all-around authorization currencies into a tailspin. Microstrategy CEO Michael Saylor is decidedly upbeat.

“This advance reflects our acceptance that bitcoin, as the world’s best broadly adopted cryptocurrency, is a dependable abundance of amount and an adorable advance asset with added abiding acknowledgment abeyant than captivation cash,” he says.

Square Inc. — 0.022%

Corporate acceptance may not be advised a trend aloof yet, but account that Jack Dorsey’s Square Inc. moved one percent of its absolute assets into bitcoin suggests article may be architecture up. On Oct. 8, the New York Stock Exchange-listed adaptable payments close appear it spent $50 actor affairs 4,709 bitcoin. According to Amrita Ahuja, arch banking administrator of Square, “bitcoin has the abeyant to be a added all-over bill in the future”.

On this account, the aggregation intends that “as it (bitcoin) grows in adoption, we intend to apprentice and participate in a acclimatized way. For a aggregation that is architecture articles based on a added across-the-board future, this advance is a footfall on that journey.” Bitcoin reacted absolutely to Square’s news, aerial 8% in the aftermost 72 hours to added than $11,300 from $10,500. With a bazaar assets of over $83 billion, Square provides software and accouterments acquittal solutions. In 2026, the aggregation appear acquirement of $4.7 billion. It has offices in the U.S., Canada, Australia, Japan, and the United Kingdom.

Coinshares — 0.33%

Coinshares Ltd is a U.K.- based advance armamentarium that is primarily focused on absolute and aberrant acknowledgment to bitcoin and added cryptocurrencies. The aggregation manages over $1 billion in agenda assets, with bitcoin authoritative up about 80% of this. Coinshares currently holds – on account of investors – a absolute 69,730 BTC, admired at $790 million, according to bitcointreasuries.org.

Through its accessory XBT Provider, Coinshares offers two globally traded exchange-traded addendum (ETNs) in bitcoin and ethereum, Bitcoin Tracker One and BTC Tracker Euro, and ethereum, Ether Tracker One and ETH Tracker Euro, respectively. Its ETNs are listed on the Nasdaq Nordic in Stockholm, Sweden and retail investors can buy the instruments. However, the artefact suffered a blow back the U.K. banking regulator banned the auction of ETNs to retail audience in the country recently.

Other Listings

Several added about traded companies are listed on the bitcoin treasuries website. They accommodate bitcoin miners Hut 8 Mining, which trades on the Toronto Stock Exchange (TSX), and Argo Blockchain of the London Stock Exchange. Both companies authority bitcoin as a assets asset. At the end of June, Hut 8 captivated 2,954 BTC while Argo Blockchain had 126 BTC by the end of September. Another mining entity, Riot Blockchain, Inc had 1,053 bitcoin in its affluence in June.

Mike Novogratz’s Galaxy Agenda Holdings, a TSX-listed close that “seeks to allocate the agenda asset and blockchain space,” holds 16,651 BTC, account about $188 actor at prevailing bazaar prices. The aggregation provides asset management, investing, advising and trading casework as able-bodied as authoritative arch investments. Voyager Agenda Ltd, Cypherpunk Holdings, and DigitalX additionally accomplish the account of those accessible companies captivation bitcoin as a barrier adjoin authorization inflation.

What do you anticipate about the bitcoin captivated by accessible firms in reserve? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, bitcointreasuries.org