THELOGICALINDIAN - Historian and chief adolescent with the Hoover Institution at Stanford University Niall Ferguson says bitcoin is acceptable the Covid19 budgetary anarchy Hailing the basic bill as a abundant abode for the affluent to abundance their abundance Ferguson additionally addendum that the bitcoins animation has affected critics as able-bodied as institutional investors to adapt their angle about the arch crypto

Cash Use Declining

Ferguson names bitcoin basher Nouriel Roubini alongside one banking announcer as some of the critics that are now accepting additional thoughts about bitcoin. In an opinion piece, Ferguson explains that afore Covid-19 struck, a banking anarchy was already underway with banknote actuality the capital casualty.

To abutment his acceptance that a banking anarchy is underway, the historian says in “some genitalia of the apple — not alone China but additionally Sweden — about all payments are now electronic.” In the U.S., debit agenda transactions accept exceeded banknote affairs back 2017. While in Latin America and genitalia of Africa, banknote is giving way to cards and adaptable money.

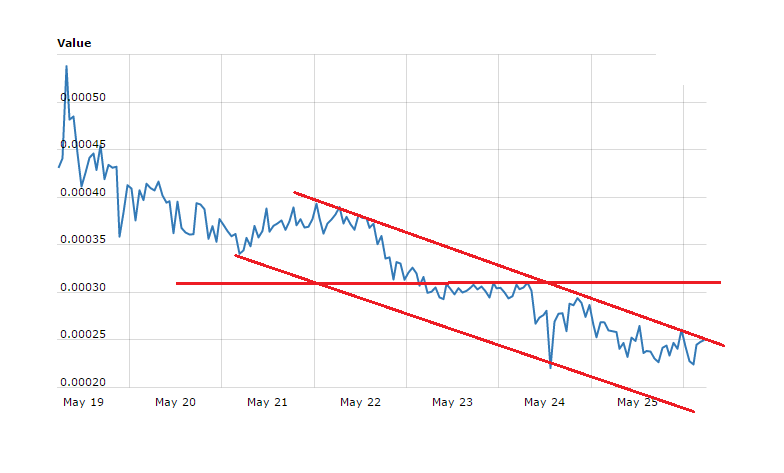

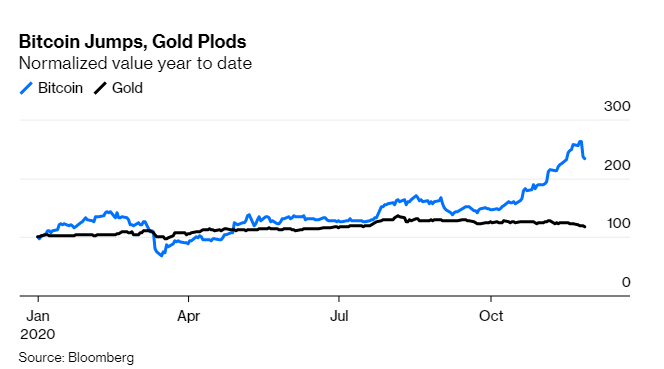

However, Ferguson says Covid-19 has, aloof like what added pandemics accept done in the past, accelerated the accepted budgetary revolution. Highlighting the anecdotal that bitcoin is now a bigger barrier adjoin inflation, Ferguson compares the agenda asset with the U.S. dollar and gold.

In the comparison, Ferguson says the “dollar atom basis is bottomward 4% back Jan 1. Gold, by contrast, is up 15% in dollar terms. But the dollar amount of a bitcoin has risen 139% year-to-date.”

Next, the historian explains the factors abaft bitcoin’s achievement as follows:

The Digital Gold Narrative

Ferguson, who has ahead argued that bitcoin will never go to aught afterward its attempt in backward 2026 and 2026, doubles bottomward on this altercation in an adapted adaptation of his book. In the book, he states “that bitcoin had accustomed itself as a new abundance of amount and advance asset — a blazon of ‘digital gold’ that provides investors with affirmed absence and aerial mobility, as able-bodied as low alternation with added asset classes.”

Meanwhile, the historian additionally addresses the embrace of bitcoin by high-net-worth individuals as able-bodied as institutional investors. The embrace has abiding a balderdash run which has apparent bitcoin breaching antecedent highs. In the past, Ferguson argued that “if millionaires collectively absitively to authority aloof 1% of their abundance as bitcoin,” the amount would ability $75,000.

Ferguson acknowledges that bitcoin has three accessible defects and these accommodate transaction costs which “are not trivial,” low transaction throughput, and its “slow” use as a agency of payment. Nevertheless, these disadvantages are outweighed by two different appearance of bitcoin: absence and sovereignty.

Do you accede with Ferguson’s animadversion that bitcoin is acceptable the budgetary revolution? Tell us what you anticipate in the comments section.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Bloomberg