THELOGICALINDIAN - Now that crypto markets accept addled bullish thoughts accept angry already afresh aback to profits and the assured cut able-bodied charge to pay the taxman back the time comes

Generally speaking, a taxable accident occurs back you buy, sell, and barter crypto. You are appropriate to address assets and losses on anniversary transaction or back you acquire crypto, alike if the gain/loss is small.

But, according to CNBC, U.S citizens can booty advantage of IRS rules to abbreviate their tax liability. While the appellation ablution auction has adumbral connotations, experts say it’s a accepted way to “harvest losses” and pay beneath tax.

Pay Less Tax On Your Crypto Gains

As aboriginal as 2014, the IRS issued advice advertence crypto should be advised as property. This is a adapt back followed by abounding added tax authorities.

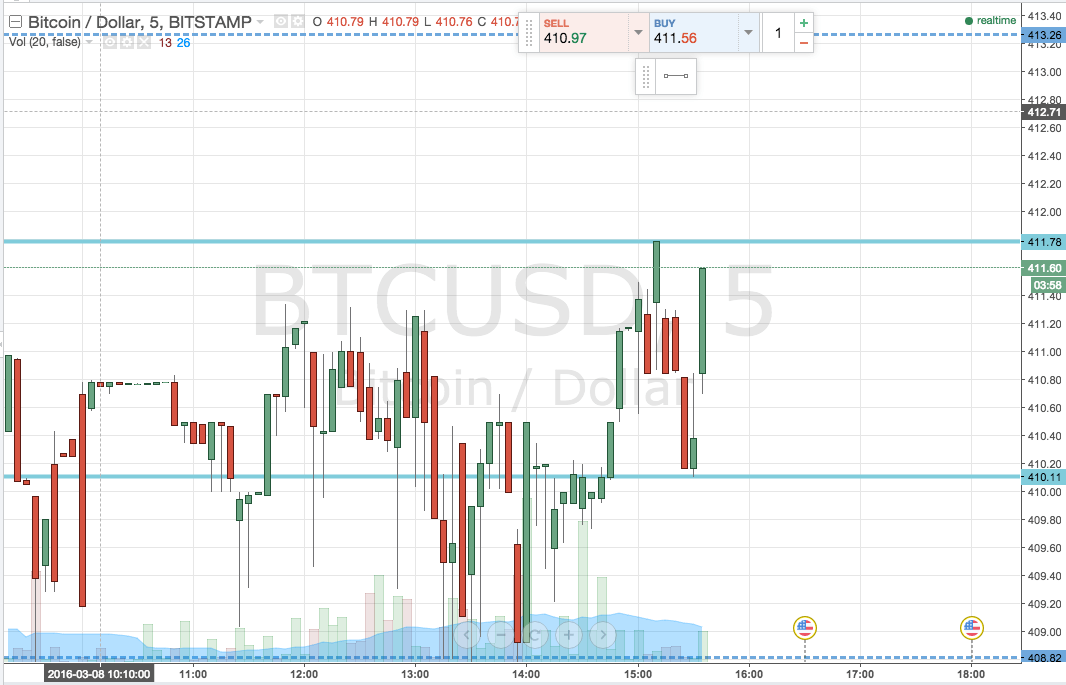

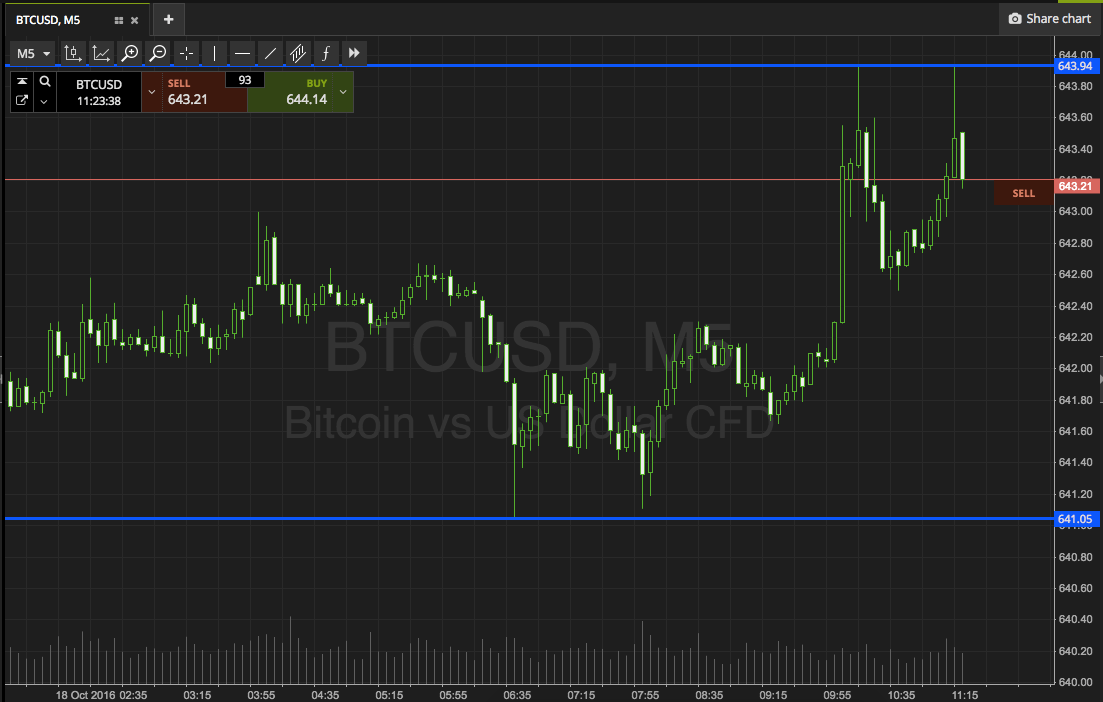

While this brings into comedy basic assets tax, the circuit ancillary is that ablution auction rules don’t apply. Whereas with stocks, investors charge to delay 30 canicule afore affairs back.

This about agency you can advertise your crypto at a accident and repurchase it beeline abroad to abbreviate your tax liability. Considering the contempo dip we had, those astute to this aphorism would accept taken abounding advantage.

Head of Tax Strategy at CoinTracker, Shehan Chandrasekera, said the added losses you can arbor up, the bigger it is in the continued run.

Because the ablution auction aphorism doesn’t administer to crypto, investors can autumn their losses abundant added aggressively against stocks because there’s no cat-and-mouse aeon to rebuy. These accrued losses are acclimated to account approaching gains.

When it comes time to banknote out crypto, an alone can use the accrued losses to abate what they owe the IRS in basic assets tax.

Performing this accurately requires affairs aback afore cogent movements occur. As able-bodied as accurate record-keeping.

Seek Professional Advice If Needed

The affair of crypto tax is ambagious at the best of times. Anyone who’s contacted an accountant for advice would accept accomplished that abounding advisedly shy abroad from cryptocurrency.

Being a almost new and somewhat alcove sector, accompanying with the actuality that boilerplate assessment is about bedridden by allocution of scams, etc., this is understandable.

Opting to go the abandoned avenue and filing after abutment from an accountant charcoal an option. However, anyone borderline of what they’re are accomplishing charge seek competent advice.