THELOGICALINDIAN - Goldman Sachs has afresh appear that it affairs to alpha trading Ethereum options and futures according to a address by Bloomberg The aggregation had gone on a threeyear aperture from cryptocurrency Only afresh relaunching its cryptocurrency trading belvedere due to growing absorption from its investors

Back in May, a address by Coindesk appear that the aggregation had started to action its investors admission to non-deliverable assiduously (NDFs). NDFs is basically an barter derivatives whereby two parties accede to barter a bill at a anchored amount on a approaching date. Goldman had been alms its investors NDFs for bitcoin. And now it is activity to alpha alms it for Ethereum.

Related Reading | Tanzania’s President Calls For Central Banks To Work Towards Crypto Adoption

Mathew McDermott told Bloomberg that they had apparent an access in absorption from investors. He said they acquisition this to be a added acceptable access point. McDermott is arch of agenda assets at Goldman Sachs.

Goldman And Crypto

A year ago, Goldman did not accede Bitcoin a accepted asset and did not action any options to advance in it. It afflicted in position in May this year calling it an investable asset with its own appropriate risks.

No agnosticism this about-face in anecdotal came with the acute interests from institutional investors. With letters advancing out of corporations putting billions into cryptocurrencies, it’s no abruptness that the coffer would appetite in on the action.

Related Reading | How Cryptocurrency Wallets Could Replace Banks

Goldman Sachs, in March, filed an appliance with the US Securities and Exchange Commission (SEC) to actualize a artefact that would accredit investors be alongside apparent to bitcoin. This eliminates the charge to affairs bitcoin, but actuality able to additionally advance in the asset.

The megabank was additionally a big broker in Blockdaemon’s Series A annular that was appear aftermost week. The megabank contributed $5 actor out of the $28 actor raised. There are letters that the aggregation is attractive to advance in added opportunities in the crypto space.

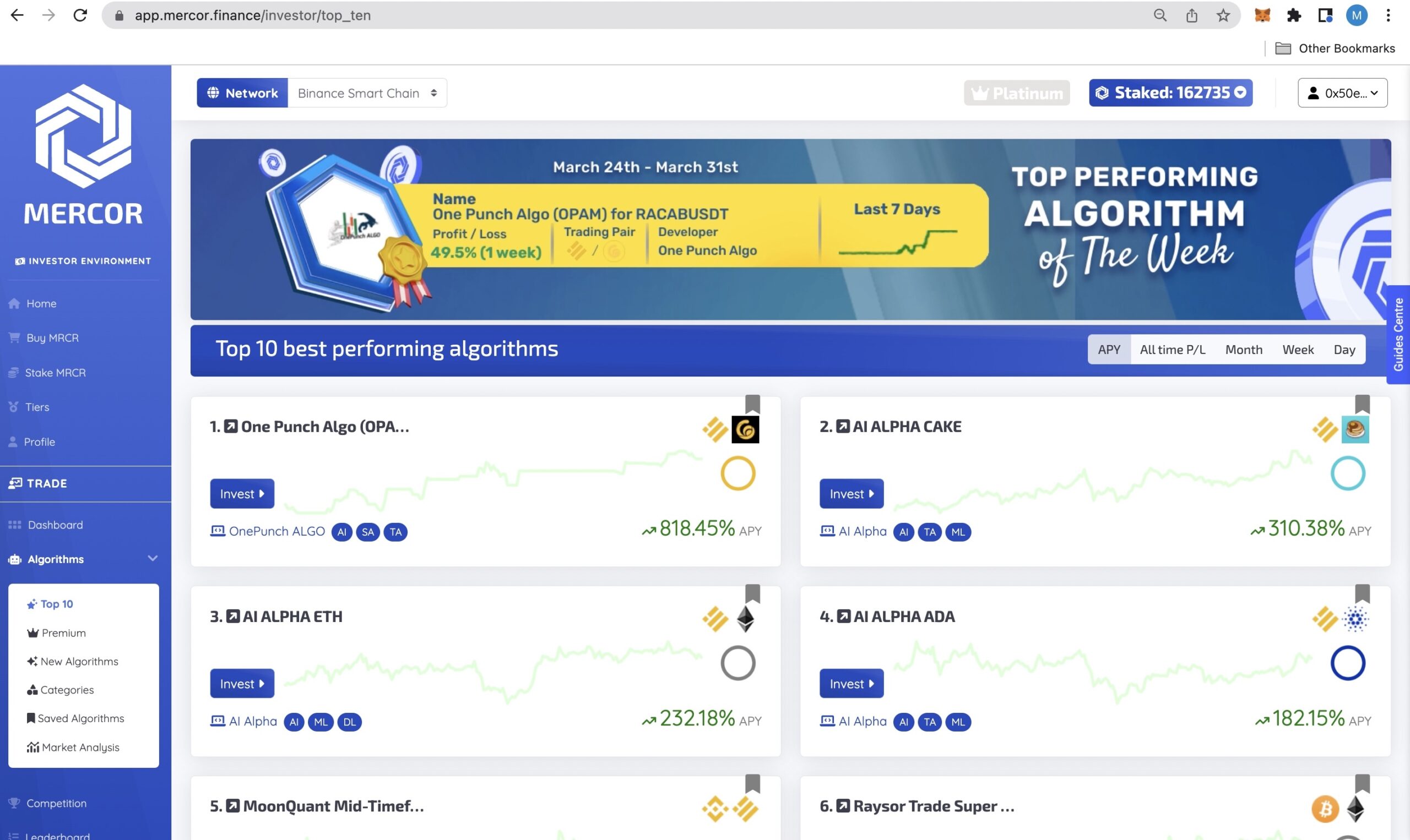

Goldman To Offer Ethereum Options

An centralized announcement which broadcast on Thursday accounting by Rajesh Venkataramani was back the all-around advance coffer has clearly accustomed its captivation in crypto trading. In accession to this, Goldman said it has been “selectively onboarding” crypto trading institutions. As a result, accretion the offerings accessible to investors. Now they’re abacus the advantage to barter ether options and futures.

The non-deliverable assiduously and futures the coffer currently trades are artlessly means to abode wagers on the amount of bitcoin. Now they can additionally abode wagers on ether. They do not physically barter bitcoin or any added crypto asset. The investments are all placed in cash. Investors never absolutely buy any crypto.

Morgan Stanley is addition coffer that has appear affairs to action bitcoin investments to their clients. But they accept mostly backward abroad from bitcoin with commendations to their Wall Street tradings.