THELOGICALINDIAN - According to letters two ample Indian cryptocurrency exchanges accept chock-full deposits via a accepted acquittal adjustment causing anguish in a country area authoritative authoritativeness is still defective admitting Bitcoins astronomic popularity

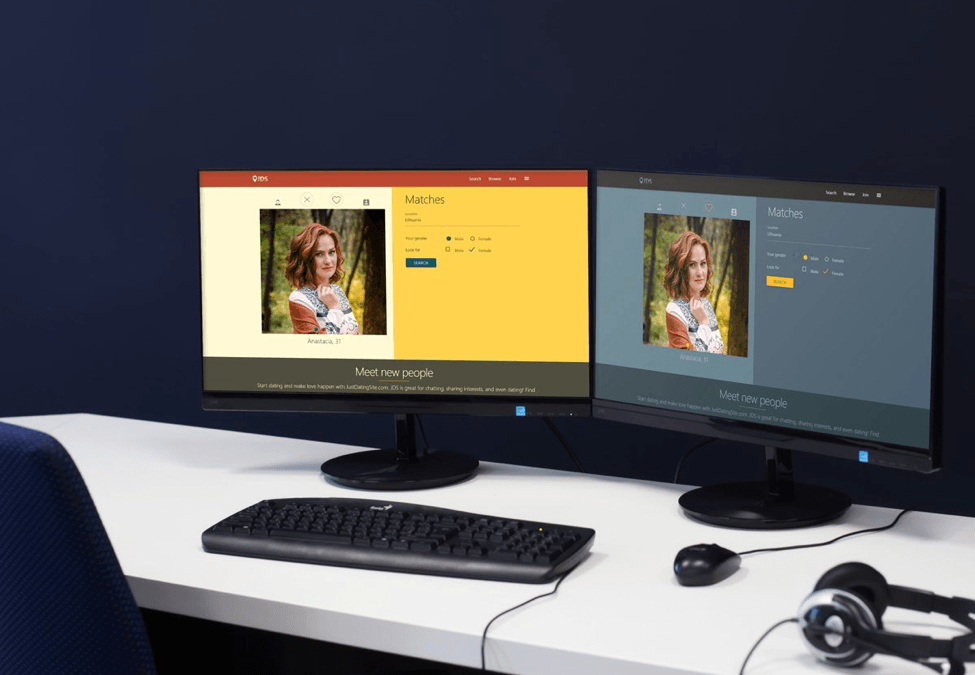

News sources appear that Indian crypto exchanges WazirX and CoinSwitch Kuber accept disabled rupee deposits application the United Payment Interface (UPI) for the purpose of purchasing cryptocurrencies.

UPI is a broadly acclimated real-time acquittal arrangement in India that is adapted by the axial bank. The absolute amount of UPI affairs exceeded $1 abundance in the aftermost budgetary year.

Suggested Reading | Astronaut Launches 1st NFT, Raises $500K To Help Ukraine Fight Russia

In acknowledgment to afraid users, the two exchanges declared that they can abide to abjure funds through the interface.

Coinswitch Kuber acclaimed in a tweet:

Worries About Financial Stability

India, the world’s second-most crawling country, has spent years developing a legislation acclimation cryptocurrencies, with a admeasurement accustomed by the axial coffer because of concerns about banking adherence hazards, yet a contempo accommodation to tax cryptocurrency assets indicates approval by authorities.

CoinGecko abstracts appearance the top three Indian crypto exchanges completed about $140 actor in trades in the aftermost 24 hours.

Thursday’s accomplishments chase a one-line account aftermost anniversary by the National Payments Corporation of India, the abettor of the state-backed UPI arrangement that facilitates coffer transfers, in which it declared that it had no ability of its use by any cryptocurrency exchange.

Indian Crypto Investors On The Rise

In India, agenda bill is acutely popular. Indian cryptocurrency investments accept exploded in acceptance over the aftermost year, growing to a multibillion-dollar market. Around 15 to 20 actor bodies in the country own cryptocurrency.

However, aldermanic accuracy is defective in the country: India’s axial coffer beforehand appropriate banning cryptocurrency, admitting assembly allowable a 30% tax on profits from agenda assets in February.

Some sources said trading aggregate fell precipitously in the after-effects of the new regulation, with aggregate on WazirX, India’s better exchange, falling by 71%.

Suggested Reading | Mastercard Files 15 Metaverse And NFT Trademark Applications – A ‘Priceless’ Move?

Investors lamented their annoyance on Twitter, back the barter did not acquire the acquittal gateways of the majority of big banks, including ICICI Bank and HDFC Bank.

CoinDCX, addition large cryptocurrency barter with over 10 million customers, analogously accustomed aloof coffer transfers but accepted a minimum drop of 3,000.

CoinSwitch, which claims to accept over 15 actor users, did not acknowledge anon to a Reuters appeal for comment. Additionally, the NPCI also did not respond.