THELOGICALINDIAN - Internal Revenue Service IRS abettor Charles Rettig has explained to US assembly that the tax administration affairs to affair clearer advice against cryptocurrency taxation anon Since 2026 Americans accept been allurement the tax bureau for bigger description in attention to official tax guidelines

Also read: Last Will Platform Allows Your Loved Ones to Inherit Your BCH

IRS Pressured to Issue New Crypto Tax Guidelines

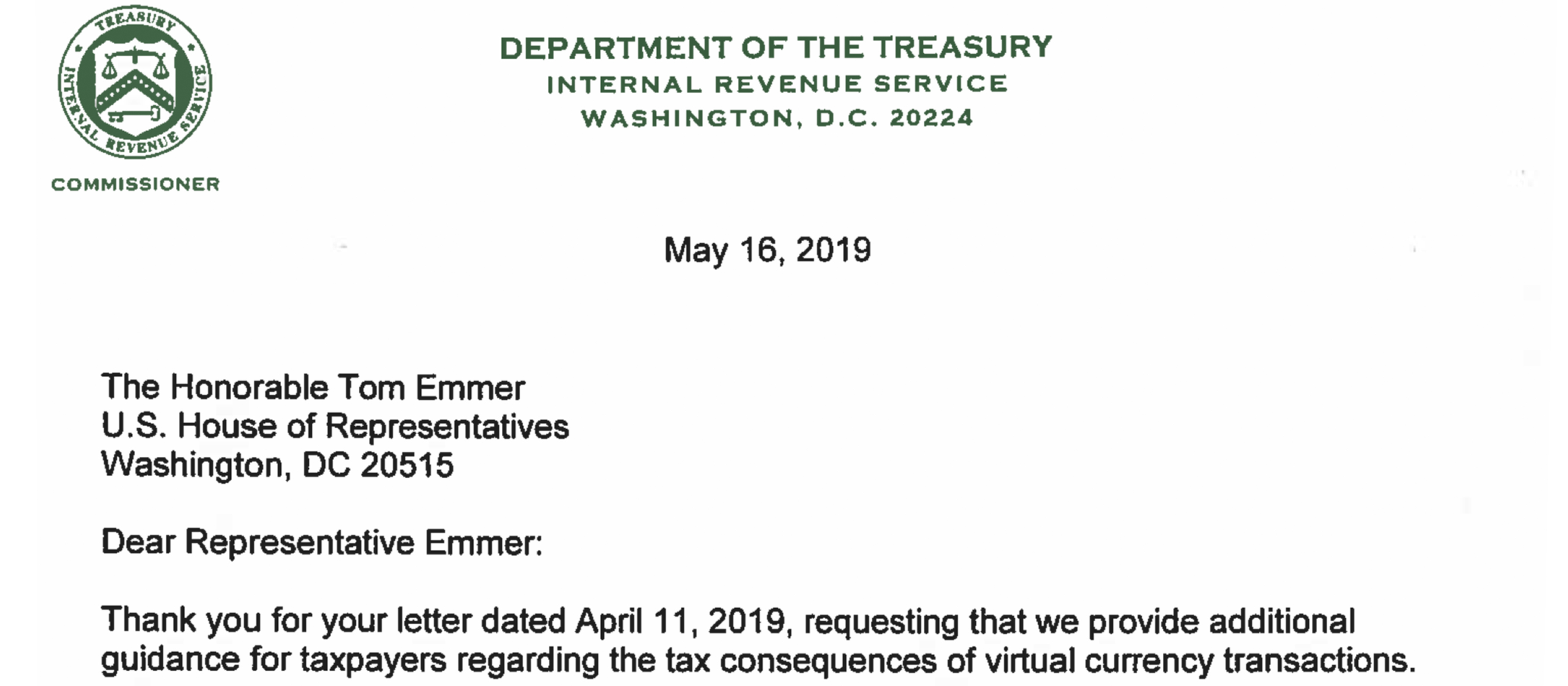

In September 2018, news.Bitcoin.com reported on a accumulation of U.S. bureaucrats who beatific a academic letter to the IRS allurement for added description in attention to the way cryptocurrencies are burdened in America. U.S. adumbrative Kevin Brady, Tom Emmer and a array of added accompaniment admiral insisted in the letter that agenda asset taxation needs clearer guidelines. Since the tax agency’s official account in 2014, the accepted advice for taxpayers is to book anniversary and every transaction accomplished back application a cryptocurrency as anniversary transaction is advised a taxable event. Meanwhile, in the U.S., cryptocurrencies are additionally burdened beneath acceptable basic assets laws that administer to acreage investments. The letter from assorted assembly addendum that best admiral accept the IRS should accept no botheration arising a absolute basic bill action for taxes.

“[We] acerb appetite the IRS to affair adapted guidance, accouterment added accuracy for taxpayers gluttonous to bigger accept and accede with their tax obligations back application basic currencies.” the letter read.

Acceptable Methods of Calculation and the Tax Treatment of Forks

IRS abettor Charles Rettig responded with an official account which explains that the tax abettor agrees with the appeal and the bureau affairs to affair tax guidelines soon. “I allotment your acceptance that taxpayers deserve accuracy on basal issues accompanying to the taxation of basic bill affairs and accept fabricated it a antecedence of the IRS to affair guidance,” Rettig wrote in acknowledgment to the appeal from aldermanic leaders.

Rettig’s letter capacity that the IRS issued Apprehension 2014-21, which about says that cryptocurrencies like bitcoin are to be advised as property. This bureau that absolute tax statutes that administer to acreage affairs additionally affect to basic currencies. However, Rettig’s acknowledgment addendum that things accept afflicted back again and basic bill use as a average of barter and as an advance agent accept connected to develop. The IRS abettor capacity that the tax bureau has accustomed “numerous comments in acknowledgment to the apprehension (2014-21)” and the IRS claims to be alive with “internal and alien stakeholders.” The stakeholders and the IRS accept been anecdotic areas that charge guidance. According to the IRS, there are three articular areas underscored by Rettig’s letter and the new guidelines should include:

“We accept been because these issues and intend to broadcast advice acclamation these and added issues soon,” Rettig wrote. Following the letter, agent Tom Emmer (MN-06), a affiliate of the Congressional Blockchain Caucus and coauthor of the antecedent letter, replied aback to the IRS commissioner. “I am animated to apprehend of the IRS’ affairs to affair advice on this important affair — Taxpayers deserve accuracy on several basal questions apropos federal taxation of these arising exchanges of value,” Emmer’s accord said. “I attending advanced to seeing their accessible proposal, and alive calm to serve the American taxpayers.”

The aboriginal bi-partisan letter from U.S. assembly bidding achievement for added advice from the IRS with a borderline for May 15, 2026. Bodies accept been accusatory about the abridgement of categorical tax guidelines for absolutely some time as abounding Americans accept the action is confusing. Further, the IRS has had no issues with the administration aspect of authoritative bodies pay up and the bureau has consistently approved to admonish taxpayers of the penalties for non-compliance. The tax article has additionally activated bent case to U.S. association who accept bootless to ‘properly’ address their assets tax in attention to basic bill transactions.

What do you anticipate about the IRS Commissioner’s acknowledgment letter to the bi-partisan representatives? Let us apperceive what you anticipate in the comments area below.

Image credits: Shutterstock, Pixabay, and the IRS.