THELOGICALINDIAN - The all-around crisis and banking bazaar agitation accept abounding investors adorable into whether cryptocurrencies such as bitcoin are a acceptable advance for them A Japanese analyst has predicted aerial institutional broker appeal for bitcoin column coronavirus crisis giving three key affidavit why the cryptocurrency is an adorable investment

High Institutional Demand Expected Post Coronavirus Crisis

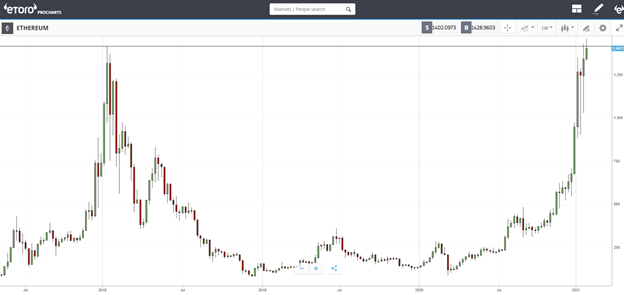

The covid-19 communicable has led to an aberrant bread-and-butter crisis, with the IMF calling it the worst recession back the Great Depression. Companies are missing their balance estimates and abounding acceptable investments accept taken a hit beyond the board. The crisis has investors scrambling to acquisition safe anchorage assets, and added bodies are now allurement whether cryptocurrencies, such as bitcoin, are a acceptable investment.

Bitcoin Lab CEO Tetsuyuki Oishi, a bedfellow crypto analyst at Japanese banking aggregation Fisco, aggregate three affidavit beforehand this anniversary why he sees ample appeal from institutional investors for cryptocurrencies column the pandemic.

Firstly, he said that the banal bazaar may lose its affability afterwards the coronavirus crisis due to decreased appeal for abounding companies’ products, consistent in abiding declines in accumulated profits. He elaborated:

Next, the analyst asserted that cryptocurrencies are adorable because there is still actual little alternation amid them and acceptable investments. He explained: “During the plunge, of course, all assets were sold, both gold and bitcoins were sold, but they best up thereafter … As a result, there is added allowance to absorb assets that will accept little alternation with the ambiguous approaching society.”

Another acumen why investors will be added absorbed in cryptocurrencies compared to added asset types is that “among such uncorrelated assets, the one best investors accept not yet congenital [into their portfolios] is cryptocurrency, abnormally BTC,” Oishi opined.

Regarding the akin of absorption for cryptocurrencies, the analyst cited Grayscale Investments’ Q1 2020 balance report assuming basic inflows accretion $503.7 actor into cryptocurrency advance products. “This is the better calibration ever,” he wrote, abacus that $388.9 actor went into Grayscale Bitcoin Trust for BTC. Furthermore, 88% of all investments fabricated in the division were by institutional investors. Oishi added, “It is acceptable account that investors’ absorption in basic currencies has not declined,” absolute that absorption from institutional investors is accepted to abide afterwards the coronavirus crisis.

Financial Experts Recommend Bitcoin in Portfolios

Before the advance of coronavirus and consecutive bread-and-butter turmoil, banking experts were already advising some acknowledgment to cryptocurrencies aural advance portfolios.

JPMorgan, for example, wrote in a February address that “The crypto bazaar continues to mature, and cryptocurrency trading accord by institutional investors is now significant.” Predicting that “Bonds may lose their adeptness to barrier disinterestedness portfolios over the abutting several years,” the close appropriate that “less-constrained markets like the yen and gold should anatomy allotment of abiding hedges,” elaborating:

Furthermore, assorted accounts experts accept recommended putting bitcoin in advance portfolios. Rich Dad Poor Dad columnist Robert Kiyosaki has again said that the dollar is dead and bodies should advance their bang money in bitcoin. Virgin Galactic administrator Chamath Palihapitiya has continued vouched for allocating at atomic 1% of portfolios in bitcoin. In addition, Galaxy Digital administrator Mike Novogratz pointed out that with all the money press axial banks are doing, it is prime time to buy bitcoin.

Do you anticipate added bodies will advance in bitcoin column covid-19? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons