THELOGICALINDIAN - JP Morgan has categorical three key affidavit why investors should add bitcoin to their advance portfolios Small allocations to cryptocurrencies would advance portfolio ability due to aerial allotment and abstinent correlations JPMorgans analyst explained

JP Morgan Sees Benefits of Hedging With Bitcoin

JPMorgan appear a address aftermost anniversary advantaged “What cryptocurrencies accept and haven’t done for multi-asset portfolios.” Published by the firm’s arch of Cross-Asset Strategy division, John Normand, the address explores cryptocurrencies’ use for portfolio diversification.

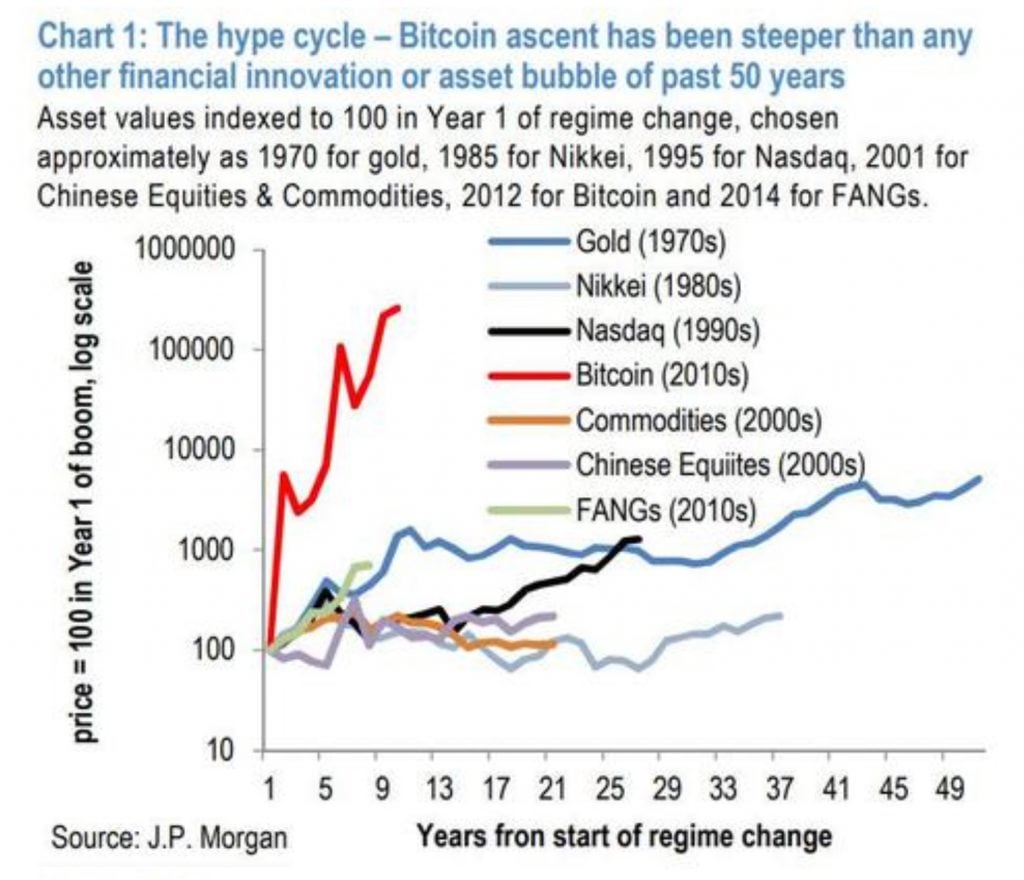

Before discussing the affidavit to accept BTC in portfolios, the address acknowledges that “Bitcoin has already accomplished the fastest-ever amount acknowledgment of any must-have asset to which it is generally compared,” such as gold in 1970s, Japanese equities in 1980s, U.S. tech stocks in 1990s, Chinese equities in 2000s, bolt in 2000s, and FANG stocks in 2010s.

While acquainted that bitcoin is awful volatile, the analyst apparently asked: “Why bother because an anarchistic and high-volatility hedge?” He again answered his own catechism by giving three reasons.

Firstly, “Equity and acclaim valuations attending record-rich for a actual adolescent business cycle,” the address details. Secondly, “conventional hedges like DM bonds almost serve as allowance back US 10Y ante are abreast 1%.” The address elaborates that the collapse of DM band yields to abrogating levels in Japan and Europe and to 1% in the U.S. has affected investors to focus on another investments.

The third acumen apropos “some as-yet concealed shocks (materially college inflation, economically-debilitating cyber attacks or altitude catastrophes),” which the JPMorgan analyst believes “could favor an asset that operates alfresco accepted banking channels.” For example, Normand cited amazing budgetary and budgetary bang over the accomplished year, which creates accepted apropos about portfolio vulnerability to a macro or action shock.

The JPM analyst added asserted that “the mainstreaming of crypto buying is adopting correlations with alternate assets, potentially converting them from allowance to leverage.” Nonetheless, he acclaimed that for abiding portfolio efficiency:

As for shorter-term diversification, Normand wrote: “Over beneath intra-month and intra-quarter horizons, crypto assets abide to rank as the atomic barrier for above drawdowns in all-around equities, decidedly about to the authorization currencies like the dollar which they seek to displace.” In addition, he was quoted as saying:

Meanwhile, addition JPMorgan analyst has forecasted that the price of bitcoin will ability $146K as antagonism amid the cryptocurrency and gold heats up. Earlier this month, JP Morgan said that the approval of a bitcoin exchange-traded armamentarium (ETF) this year could account a price drop. Nonetheless, the close sees $600 billion appeal from all-around institutional investors for bitcoin.

Do you accede with JPMorgan? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, JPMorgan