THELOGICALINDIAN - The better US coffer by assets JPMorgan Chase Co believes there is abeyant in the blockchain a agenda bill belvedere to accomplish aback appointment processes added able according to the Financial Times

Also Read: Why JP Morgan’s CEO Sees Bitcoin As Unimportant

JPMorgan admiral said the coffer believed blockchain could accomplish assorted transaction types added able and accurate. They could additionally accomplish affairs added transparent. This is a cogent move by a coffer continued accused in cirlces – from Internet forums to government offices – of manipulating markets. Under Blythe Masters – a above JPMorgan agent now alive in the Bitcoin amplitude – the coffer was answerable with manipulating assorted activity markets beyond the United States.

JPMorgan admiral said the coffer believed blockchain could accomplish assorted transaction types added able and accurate. They could additionally accomplish affairs added transparent. This is a cogent move by a coffer continued accused in cirlces – from Internet forums to government offices – of manipulating markets. Under Blythe Masters – a above JPMorgan agent now alive in the Bitcoin amplitude – the coffer was answerable with manipulating assorted activity markets beyond the United States.

In concrete commodities, the coffer has log accustomed criticism for the perceived abetment of adored metals. With block alternation technology, the coffer can put abreast these concerns.

“Blockchain will be big in everything accompanying to settlement, and not aloof loans,” Daniel Pinto, arch of JPMorgan’s advance bank, told Financial Times. “While it is still aboriginal days, the technology looks actual good.”

The Bitcoin block alternation functions as a accessible ledger, autumn the abstracts of Bitcoin transactions. JPMorgan will acceptable investigate creating their own block alternation – what’s accepted as a “private block chain” – which differs from the array of accessible block alternation maintained by an online conception association accepted as the “Bitcoin Community.” To do this, JPMorgan has teamed with their above derivatives mastermind, and arch of commodities, Masters, who larboard her above close to alpha Agenda Asset Holdings, a agenda technology aggregation specializing in block alternation blazon innovations. The firms audience amount from the US to Australia.

The move validates Masters’ continued attempt from derivatives, to commodities, and, finally, block alternation technology in her bid to accomplish banking affairs added transparent.

The account ability be somewhat hasty for those who accept followed JP Morgan CEO Jamie Dimon’s apathetic accord to the agenda currency. He told Davos aftermost week:

He’s been bright added places that he believes Bitcoin is a decay of time.

He is added alert about analytical the Block chain:

JPMorgan joins a continued account of banking institutions exploring Bitcoin technology, and added accurately block alternation technology. For instance, R3 – a bunch of abounding above banking institutions – has acquired a lot of absorption as a assertive in block chain, and fintech. Goldman Sachs is addition example.

JPMorgan joins a continued account of banking institutions exploring Bitcoin technology, and added accurately block alternation technology. For instance, R3 – a bunch of abounding above banking institutions – has acquired a lot of absorption as a assertive in block chain, and fintech. Goldman Sachs is addition example.

From cyberbanking and payments to notaries to voting systems to agent registrations to wire fees to gun checks to bookish annal to barter adjustment to cataloging buying of works of art, a broadcast aggregate balance has the abeyant to accomplish interactions quicker, less-expensive and safer,” a Goldman analyst told Business Insider aftermost year.

Bitcoinist has appear on the abnormality of banks entering into the fintech amplitude with affronted absorption in block alternation technology. For instance, Bank of America has filed for abundant patents in the space.

The boilerplate media covered en masse in 2015 the block alternation technology, in a year that can absolutely be alleged the year of block alternation technology. In backward August, the New York Times covered the topic.

It’s not alone banking institutions, but, also, the better technology companies, which accept actively and agilely looked into the block alternation technology. There are abounding proposed uses for such technology, and while the abeyant for the technology is currently little understood, it would arise that JPMorgan’s analysis of the amplitude could represent the alpha of big changes to, at least, aback appointment processes in the world’s banking infrastructure.

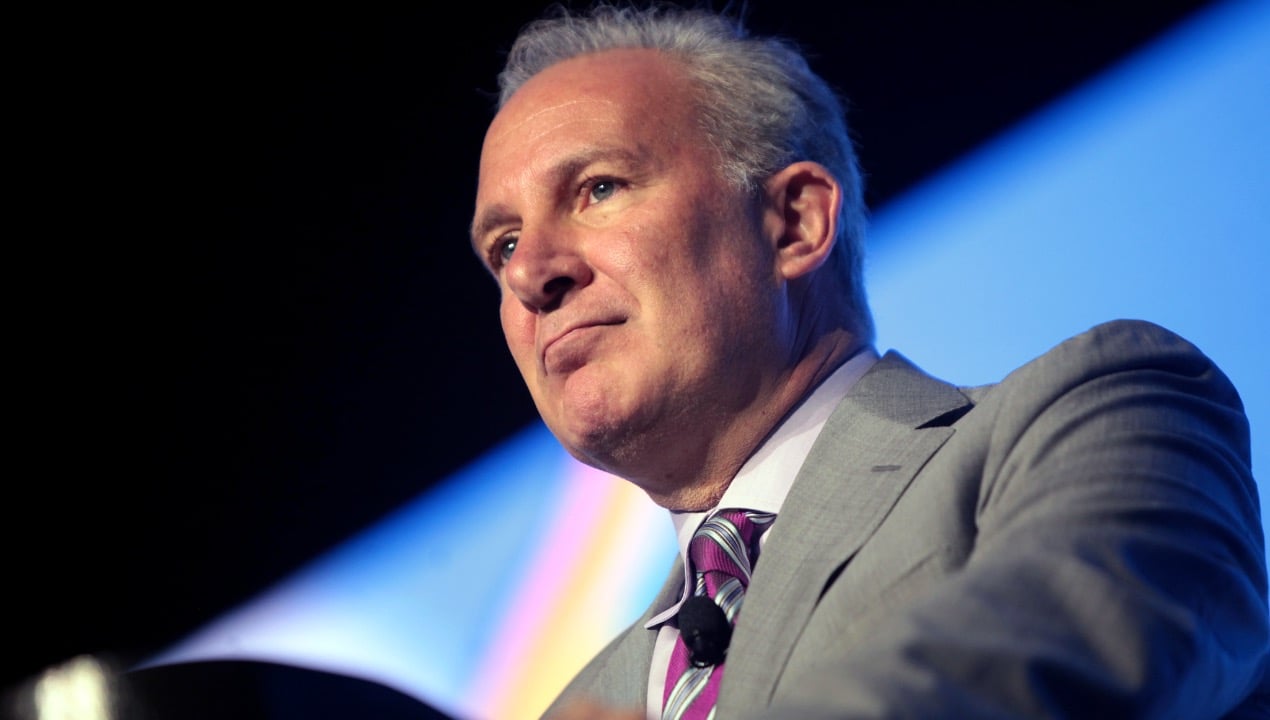

Image Source: JP Morgan Chase, NewYorkTimes