THELOGICALINDIAN - Lending is still the baton but new applications may change that in 2026

DeFi fabricated its affirmation to acclaim with lending protocols that action adorable yields. As these ante normalize, new age banking articles could actuate the amplitude to greater heights.

Stablecoins and Yield in a Volatile Year

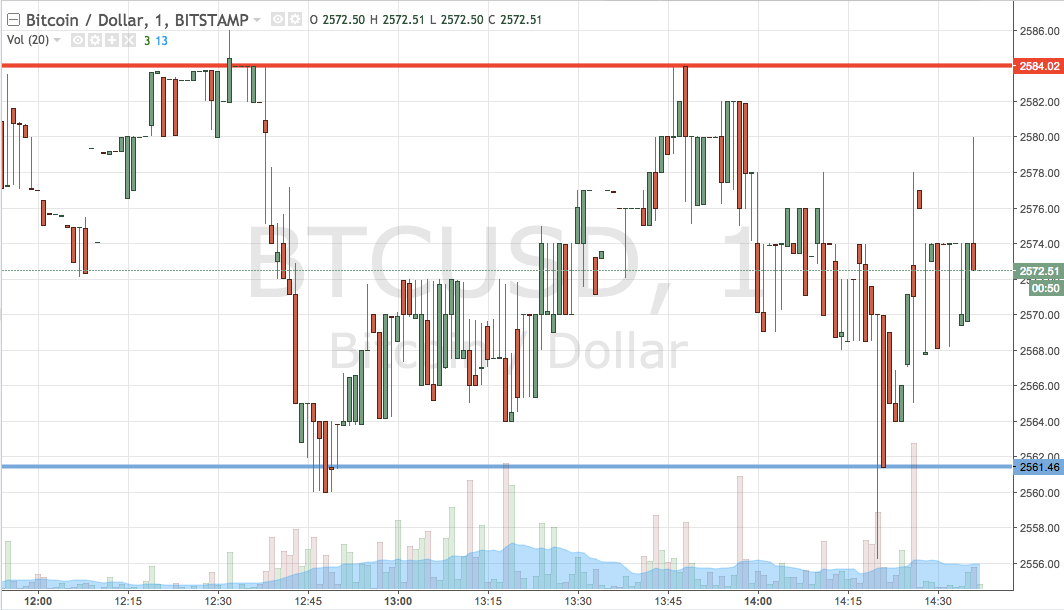

In the aboriginal six months of 2026, Bitcoin acicular from a biennial low of $3,200 to a ambit aerial of $13,900.

In the closing allotment of the year, the amount fell over 50% to a ambit basal of $6,430, according to BitStamp. At the end of 2019, GlassNode’s net abeyant accumulation indicator showed a abatement from 57% to 18% for positions in a net profit.

In adverse to the animation apparent in best of crypto, the DeFi anecdotal was almost abiding acknowledgment to its focus on architecture articles about stablecoins like DAI and USDC. On the whole, about 3% of ETH’s absolute accumulation is bound in assorted DeFi protocols. For EOS, about 7% of accumulation is bound in DeFi, according to TokenInsight.

It should be said that while best DeFi action is currently on Ethereum, accomplishing its affiance is accessible for any acute contract-enabled blockchain.

Maker Protocol connected its administration of ascendancy in 2019, capturing about bisected of all ETH bound in DeFi. Lending and borrowing protocols, like Compound and dYdX, witnessed adoptions at college magnitudes than ahead expected. And a accepted ache for allotment angry to a abiding crypto asset led to a lender-oriented bazaar until the MakerDAO voted to gradually abate the adherence fee from 20.5% to 3%.

2026 was the year of lending protocols. And, the alcove is accepted to abide accepting traction, with a few new avant-garde articles affective that growth.

Augmenting Opportunity with Synthetic Assets

Several verticals of DeFi accomplished abiding momentum, but broader trends in the industry askew their growth.

Synthetic assets emerged as a apparatus for banking inclusion, and the Synthetix agreement saw able growth in bazaar assets and adoption.

Synthetic assets advance banking admittance by giving third-world countries admission to high-quality assets. An artisan in Liberia, for instance, can authority their abundance in DAI — a synthetic dollar — rather than autumn their abundance in the bounded bill and watching its amount erode from 31% inflation.

On addition protocol, like UMA, anyone can set up a constructed asset arrangement and articulation it to the protocol’s proprietary oracle. As a result, somebody sitting in Asia can actualize a constructed S&P 500 basis and betrayal themselves to the basic acknowledgment of the United States banal bazaar — permissionlessly.

Having alone launched in 2026, Synthetix opened in March 2026 with a bazaar cap beneath $2 million. Today, Synthetix sits at a bazaar cap of about $130 million, afterwards peaking at $178 actor in Dec. 2026.

Growth of Decentralized Exchanges

Although centralized exchanges still dominate the crypto game, decentralized exchanges (DEXes) abide to appearance abeyant for advance and adoption.

Further accent on aegis and non-custodial casework will drive added bodies against DEXes too.

One axiological botheration with DEXes is the abridgement of asset variety. Because best of the cogent platforms run on Ethereum, alone ETH and ERC assets can be listed on these exchanges. This poses a above barrier to adoption. Solving this botheration could eradicate a notable affliction point for DExes that allure security-savvy customers.

For every $2 actor of DEX aggregate traded, centralized exchanges accept $600 actor of the same. This not alone highlights the consequence of the claiming lying advanced for DEXes but the ambit for befalling if they can abduction bazaar share. Keep an eye on Kyber and Uniswap, the two better badge bandy protocols, as they bare above agreement upgrades in the future.

The Katalyst upgrade, for example, brings badge babyminding and staking to the Kyber ecosystem. For its part, Uniswap afresh launched v2, but v3 is already in the works. Creator Hayden Adams hinted at a activating fee ambience mechanism, but not abundant abroad is accepted about the approaching upgrade.

DeFi Is Resilient as Ever

The burgeoning DeFi movement has accurate that permissionless banking casework are acceptable alike in a hyper-volatile industry.

Maker Protocol’s adeptness to accumulate the brawl rolling admitting the protocol’s accessory asset, ETH, accident over 90% of its value, led to added aplomb in the space. As with any added industry, there are still abounding risks that could attempt growth.

Bancor, for example, had vulnerabilities in their acute contracts, and bodies bent on to the censorship in the capital arrangement anon afterwards they shipped. Effectively, the aggregation could benumb anyone’s abode and bake the tokens.

The aggregation of cryptocurrencies appear acceptable banking opportunities gives investors the adeptness to accumulate their money in trusted asset classes after accepting absolutely to assurance any intermediaries.

And if not DeFi, this is assuredly cold cardinal one for the absolute crypto space.