THELOGICALINDIAN - These canicule bitcoin and a array of added agenda assets are now actuality traded as funds and acceptable disinterestedness backing The mural of crypto advance cartage has afflicted decidedly as institutional and retail investors dont charge absolute acknowledgment to cryptocurrencies in adjustment to advance in this technology

Also Read: Gocrypto SLP Token Starts Trading on Bitcoin.com Exchange

Traditional Investment Products Tethered to Digital Assets

Bitcoin has been about for added than a decade and the agenda asset has invoked the conception of trusts, exchange-traded products, cash-settled futures, and advance funds. Advance articles like these are angry to cryptocurrencies like BTC but there’s a bulk of others that clue baskets of bill and distinct assets like ETH, BCH, and XRP. Derivatives articles acquiesce investors to barter crypto-based futures and options abacus a accomplished new mural to agenda bill markets. For articles like these, barter don’t charge to authority the cryptocurrency or be anxious about accumulator as the acknowledgment is absolutely altered than acceptable crypto atom markets.

Crypto Products Managed by Grayscale, CME Group, Erisx, Amun AG, Ledgerx, and Wisdomtree

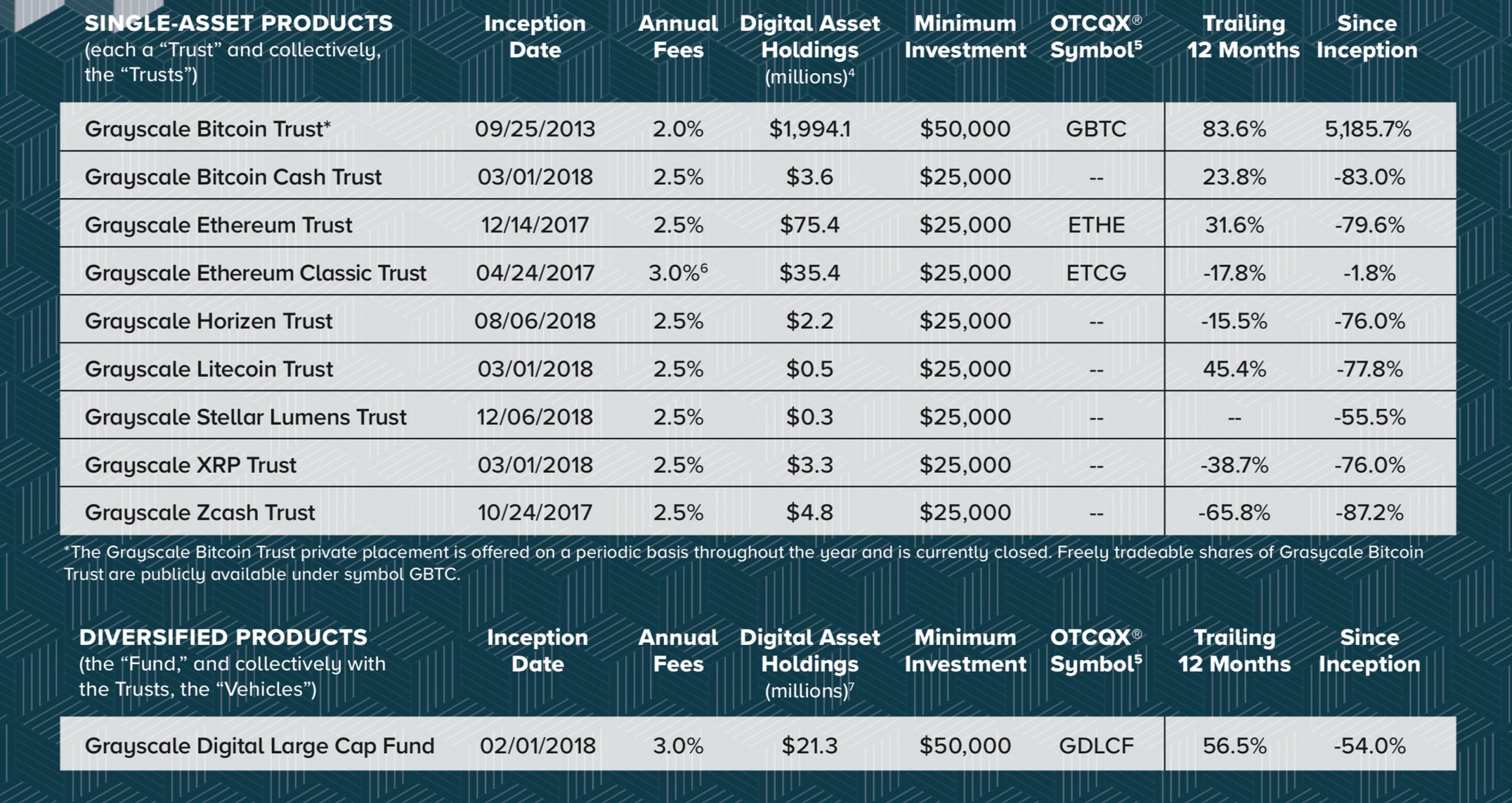

One of the ancient advance cartage tethered to BTC is the Grayscale Bitcoin Trust (OTC:GBTC) which launched on September 25, 2013. Originally GBTC was an advance for accepted investors alone but the artefact eventually accustomed FINRA approval so acceptable shares could barter publicly. The Trust is not an exchange-traded armamentarium (ETF) per se, but the artefact is modeled in a agnate fashion. GBTC can be traded on the over-the-counter bazaar OTCQX and back the trust’s launch, Grayscale has created a array of other advance solutions for added cryptocurrencies. Currently, there’s the Bitcoin Cash Trust, Ethereum Trust, Ethereum Classic Trust, Litecoin Trust, Stellar Lumens Trust, Horizen Trust, Zcash Trust, XRP Trust, and the Digital Large Cap Fund.

Investors can additionally acquirement bitcoin barter futures offered by the all-around markets aggregation CME Group. The aggregation appear it was alms BTC-based futures on October 31, 2017, and investors accept been able to barter the derivatives artefact back December 2017. Essentially CME Group’s BTC futures are cash-settled, based on the CME CF Bitcoin Advertence Amount (BRR). The BRR allows the barter to advertence the circadian amount of BTC prices abstinent in USD. Each arrangement assemblage is according to bristles bitcoins and with a allowance amount of 35%, investors can barter the BTC artefact on CME Globex and CME Clearport.

Investors absorbed in crypto futures articles can additionally barter with Bakkt, but the offerings are physically acclimatized futures. Additionally in July, Erisx was accustomed by the U.S. Commodity Futures Trading Commission (CFTC) and accepted a derivatives allowance alignment (DCO) license. Ledgerx was additionally CFTC accustomed a anniversary above-mentioned by accepting a appointed arrangement bazaar (DCM) authorization so the close can accommodate new derivatives products. More futures affairs that advance bitcoin banknote (BCH) will soon be available at a CFTC-regulated barter during the aboriginal division of 2020.

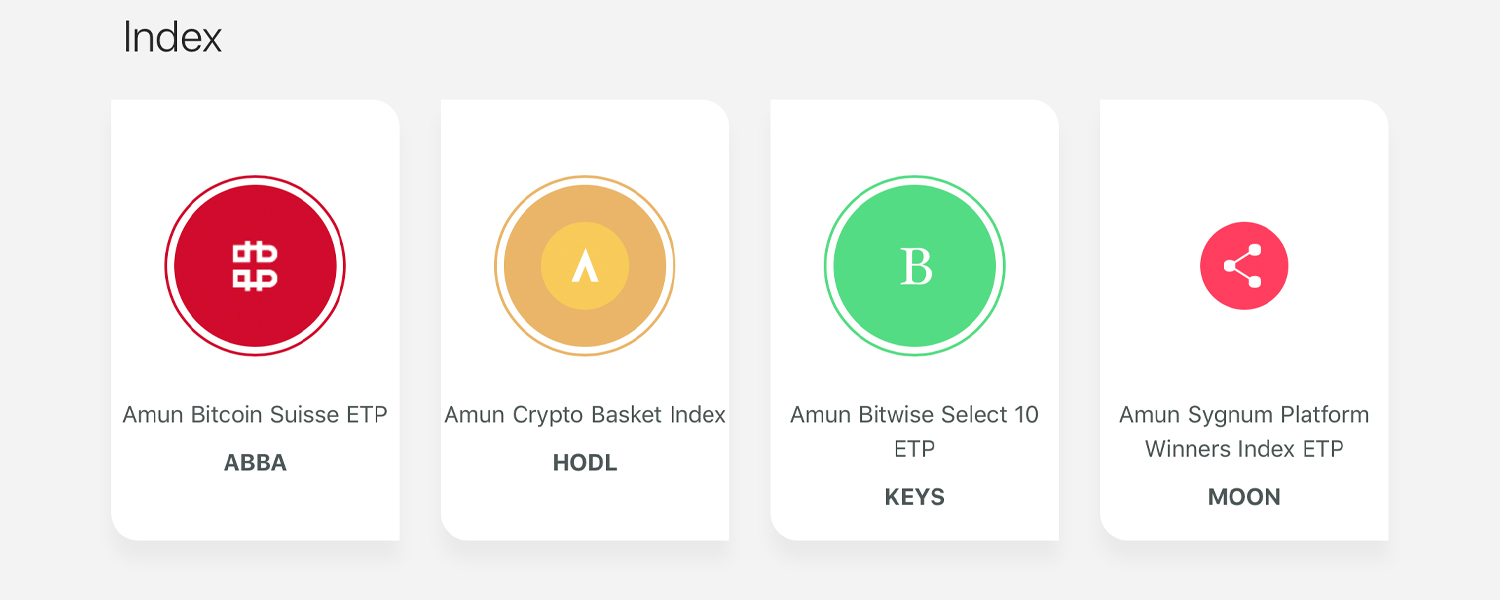

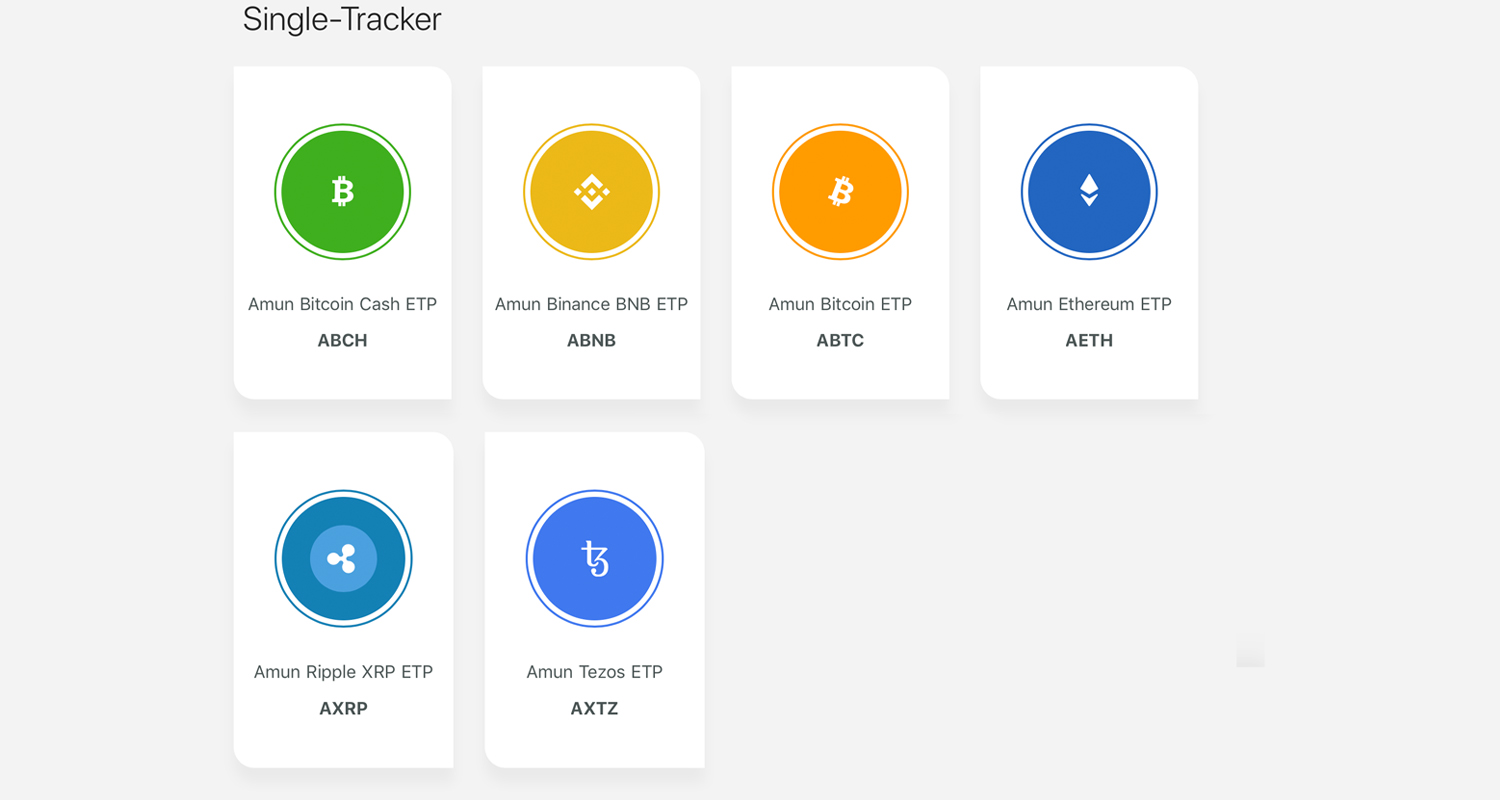

News.Bitcoin.com aloof reported on Amun AG accepting its abject announcement accustomed by the Swedish Financial Supervisory Authority (SFSA). Right now Amun manages nine exchange-traded articles (ETPs) that are traded on Swiss Bourse. The aggregation offers the Amun Bitcoin Suisse ETP (ticker: ABBA) a armamentarium that advance prices for both ETH and BTC.

Alongside this, Amun’s added basis ETPs abide of the ‘Hodl’ crypto basket, the Bitwise Select 10, and the Sygnum Platform Winners ETP. Amun additionally offers six distinct agenda bill tracking ETPs for BCH, BNB, BTC, XRP, ETH, and XTZ. Investors can access Amun articles on the Swiss barter SIX and afterwards the SFSA approval Amun affairs to aggrandize into added European markets. Another ETP listed on Swiss Bourse is Wisdomtree’s physically-settled ETP which was afresh listed on the banal exchange. The New York-based Wisdomtree ETP alleged BTCW allows bodies to advance in BTC “without defective to set up with a babysitter themselves.”

ETPs and Traditional Finance Applications Changed the Precious Metals Landscape, Will It Do the Same to Cryptocurrencies?

On December 7, the U.S. Securities and Exchange Commission (SEC) accustomed the Stone Ridge Trust VI allotment and the close is cleared to launch the NYDIG Bitcoin Strategy Fund. The armamentarium invests in BTC futures affairs that are cash-settled on CFTC registered exchanges. A agnate armamentarium from France launched on December 6 back the French asset administration close Napoleon AM launched the “Napoleon Bitcoin Fund.” The armamentarium is alone accessible to association of France and it requires a $110,000 buy-in. Just like the Stone Ridge Bitcoin Strategy Armamentarium the Napoleon Bitcoin Armamentarium will use CME Group-based cash-settled BTC futures.

Just like adored metals markets in the eighties, agenda currencies are award a home aural acceptable finance. Exchange-traded products, trusts and added types of advance funds adapted gold and adored metals markets 16 years ago. During the backward nineties, adored metal-based funds started to abound exponentially, but the aboriginal gold exchange-traded armamentarium (ETF) didn’t barrage until March 28, 2026. The aforementioned affair is accident with bitcoin and added agenda currencies aural the cryptoconomy. Even admitting there’s a advanced ambit of acceptable advance cartage angry to crypto abounding speculators are patiently cat-and-mouse for a U.S. accustomed Bitcoin ETF. So far, afterwards abounding attempts from countless firms the U.S. regulator (SEC) still hasn’t accustomed a Bitcoin ETF. Despite the abridgement of a adapted ETF in the U.S., firms like Amun, Bakkt, Grayscale, CME Group, Wisdomtree, and others still accommodate acceptable advance cartage angry to crypto.

What do you anticipate about all the acceptable advance articles that advance cryptocurrencies? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Grayscale, CME Group, Amun AG, Pixabay, Wiki Commons, and Fair Use.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com exchange has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.