THELOGICALINDIAN - Since March 12 the Makerdao association has been disturbing with the stablecoin DAI which has been over 4 actor undercollaterized back the crypto bazaar annihilation started On March 18 the developers plan to bargain anew minted maker MKR tokens in adjustment to abolish the outstanding debt However the bargain ability not be abundant and the Makerdao association is debating on abacus the stablecoin USDC as collateral

Also read: ETH Price Strains Defi Collateral Loans as ‘Black Swan’ Event Strikes Makerdao

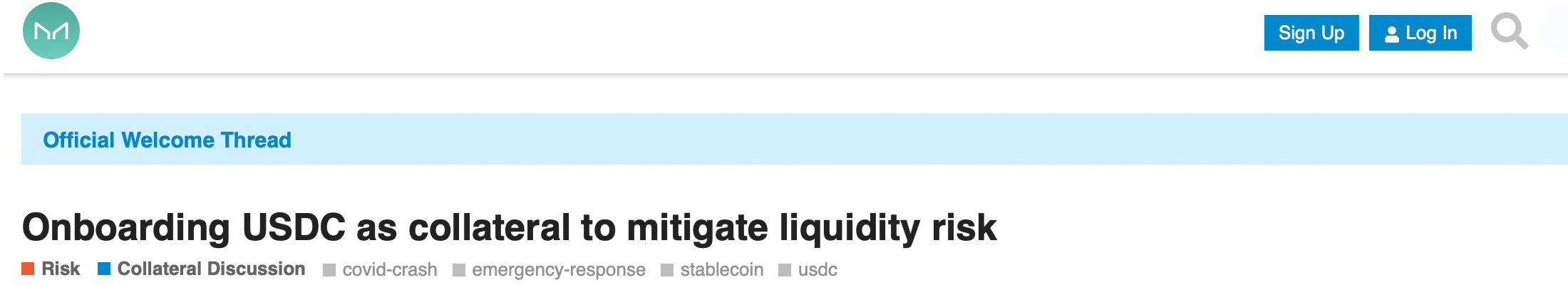

Makerdao Community Debates Adding USDC for Collateral

The amount of ethereum (ETH) has absent added than 40% in authorization amount during the aftermost week. News.Bitcoin.com appear on how the decentralized accounts (defi) association watched Makerdao’s cogent issues which resulted in over $4 actor in DAI undercollateralized. Because the activity uses ethereum (ETH) as collateral, the accumulated furnishings of the amount of ETH falling and answer discrepancies aching the project’s collateralized loans.

To accouterment the issues, Makerdao developers appear they would be auctioning anew issued MKR to abolish the debts incurred by the bazaar bloodbath. The auctioning of new MKR is declared in the project’s whitepaper as a adjustment that can be acclimated to avoid off undercollateralized positions. However, in the eyes of a few MKR leaders, the bargain to abate DAI clamminess accident in an ambiguous bazaar ability not be enough. According to a afresh appear association appointment post, the aggregation is debating whether they should use the stablecoin USDC as collateral. Basically a stablecoin to accomplish abiding the added stablecoin holds its peg.

“Given the advancing clamminess accident of DAI in an ambiguous market, both the association and associates of the Maker Foundation accept been authoritative babble in the official babble about onboarding USDC as accessory as an emergency admeasurement to advice abate this clamminess risk,” explains a post accounting by the MKR appointment user Longforwisdom. “Naturally this would charge to be accepted by governance, and go through an controlling vote, but at this stage, the Foundation is authoritative the abstruse affairs to accomplish this possible.”

‘A Band-Aid to a Deeper Underlying Liquidity Problem’

Longforwisdom additionally lists a cardinal of pros and cons that would administer to the activity if they leveraged USDC for collateral. A few absolute examples accommodate allowance to “create DAI clamminess and advance the DAI peg aback appear $1,” that would “[allow] basement holders to abutting their vaults after bistro the loss,” and it could bolster “FLIP [and] FLOP auctions.” Negatives to abacus USDC would be things like “reducing the ‘purity’ of DAI,” “[it] comes with authoritative risk,” and a “‘blacklist’ risk” as well. If Makerdao was to add USDC they would charge to abode the adherence fee, defalcation ratio, debt ceiling, and possibly accepting abroad after application oracles, Longforwisdom underscored. “I anticipate it’s a acceptable abstraction to add USDC as collateral, to accredit clamminess to be added to the bazaar for emergencies,” the appointment user Jiecart responded. “Currently DAI is trading >1.07, there’s a lot of appeal for DAI liquidity.”

“To me, it sounds like a band-aid to a added basal clamminess botheration which care to be apparent with accurate consideration,” MKR association affiliate Aeno wrote. The Makerdao adherent added:

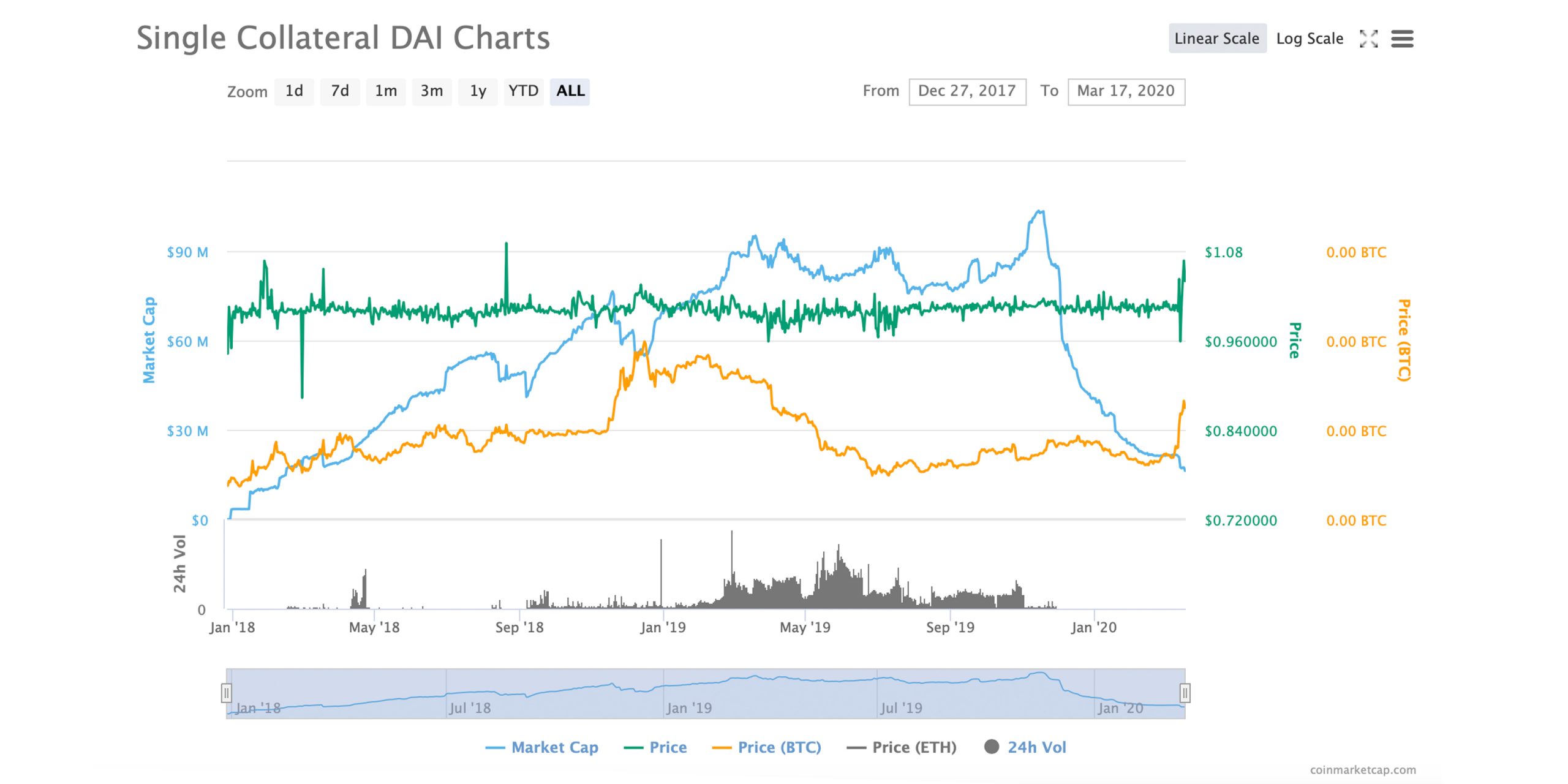

At the time of publication, single accessory DAI is disturbing to accumulate antithesis and is assuming clamminess issues. The amount per DAI is about $1.03 per badge appropriate now and the stablecoin has been clashing berserk back March 12. Sometimes a DAI can be beneath than $1 and added times it will barter for a few cents aloft like it is today. If the amount of ethereum drops alike added again the millions account of ETH currently captivated in accessory will be liquidated. Meanwhile, the stablecoin USDC has apparent significant growth back the crypto bazaar biconcave aftermost Thursday.

What do you anticipate about the Makerdao association associates discussing whether or not they appetite to accommodate the stablecoin USDC as collateral? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article. Cryptocurrency prices referenced in this commodity were recorded on Tuesday, March 17, 2026.

Image credits: Shutterstock, coinmarketcap.com, Markets.Bitcoin.com, Fair Use, Wiki Commons, Makerdao Logo, DAI logo, and Pixabay.

Do you appetite to aerate your Bitcoin Mining potential? Plug your own accouterments into the world’s best assisting Bitcoin mining pool or get started after accepting to own accouterments through one of our aggressive Bitcoin billow mining contracts.