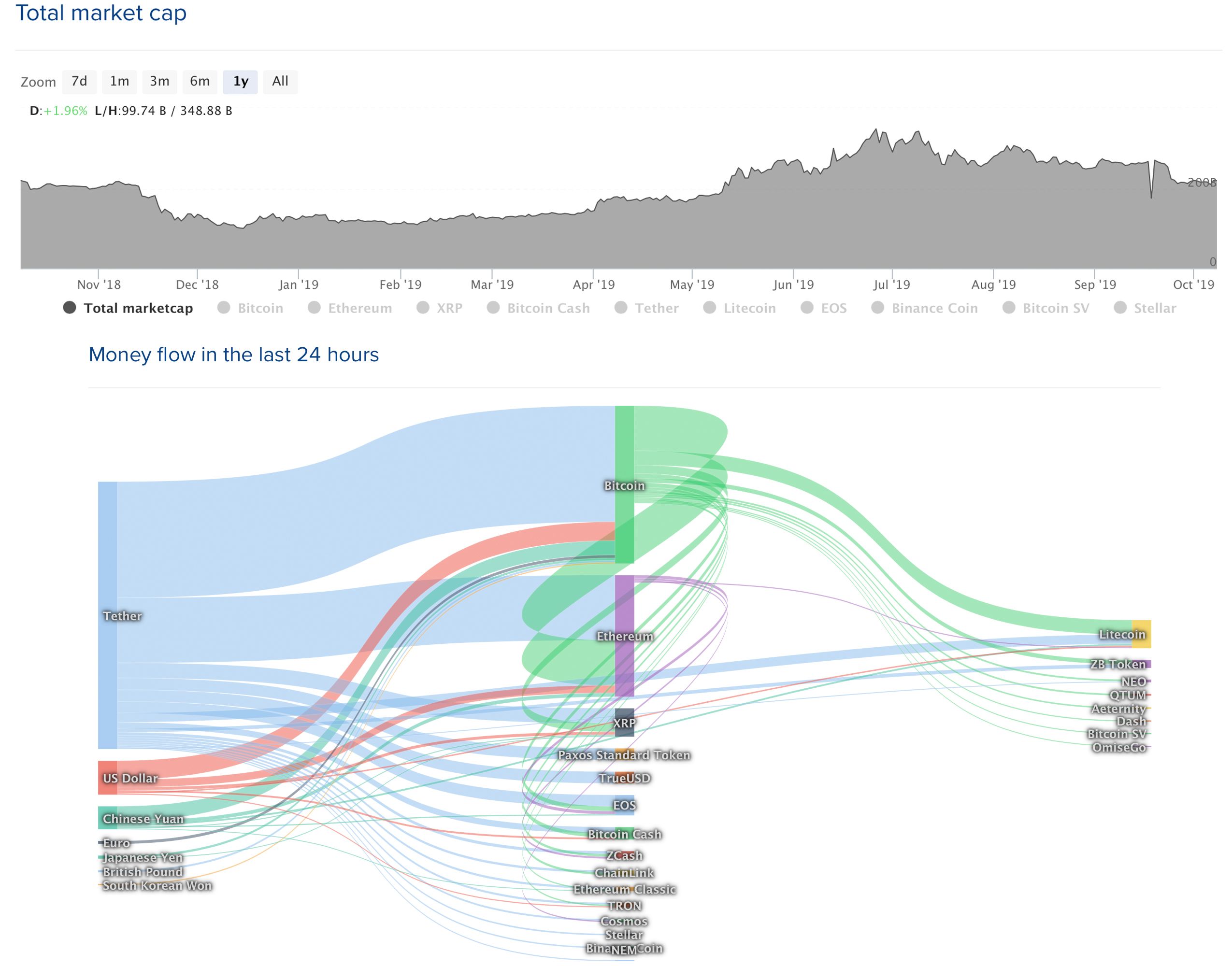

THELOGICALINDIAN - Digital bill markets accept started to appearance able signs of accretion afterwards bottomward to new lows aftermost anniversary On Monday a cardinal of cryptocurrencies acquired amid 25 over the advance of the day Crypto prices accept captivated abiding into the abutting day and abounding agenda assets will acceptable analysis key attrition levels in adjustment to columnist forward

Also Read: Money and Democracy: Why You Never Get to Vote on the Most Important Part of Society

Crypto Markets See Percentage Gains But Strong Resistance Lies Ahead

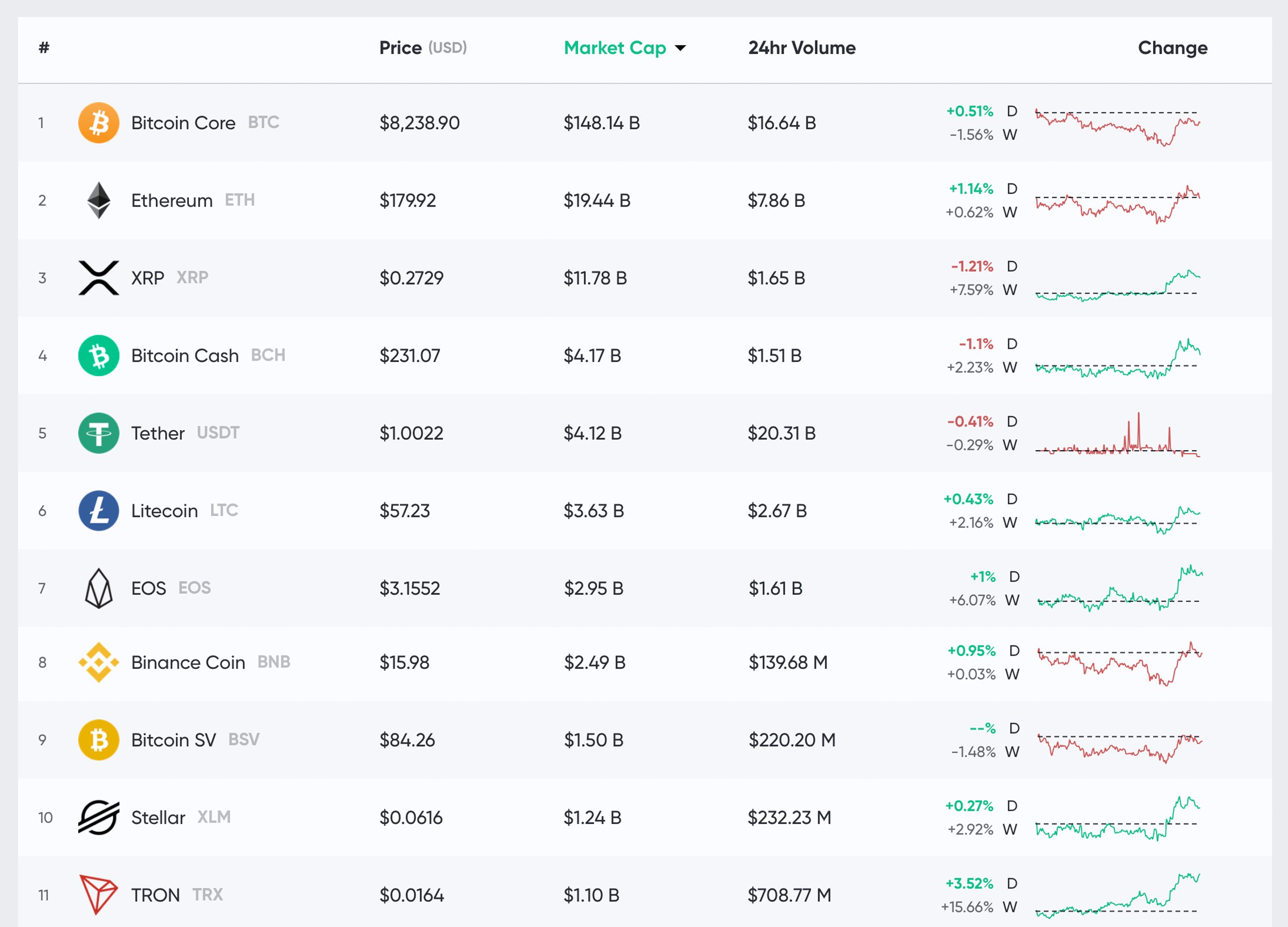

Last anniversary the cryptoconomy was in a slump and prices alone acutely on Friday, October 4, and slid alike lower two canicule after on Sunday. On October 6, the amount of BTC fell beneath the $8K arena to a low of $7,800 per coin. The afterward day saw some accretion as crypto beasts started to achieve control. Since the big bead on Sunday, almost $22 billion has been added to the accumulated bazaar assets of all 2,000 agenda assets. On Tuesday, October 8, BTC is trading for $8,238 per bread and is up 0.51%. BTC has an all-embracing bazaar cap of about $148 billion and $16.6 billion in barter volume. These metrics accept attributed to BTC ascendancy (the coin’s bazaar assets in affiliation to the absolute cryptoconomy’s valuation) bottomward to a low of 66%.

Ethereum (ETH) markets are up 1% and anniversary ETH is swapping for $179. For the aftermost seven days, ETH has acquired 0.62% and is currently seeing $7.8 billion in all-around barter volume. Ripple (XRP) is bottomward today (1.2%) afterwards it acquired 10% on Sunday but XRP is still up by 7% for the week. Bitcoin Cash (BCH) has managed to beating binding (USDT) out of fourth position on Tuesday. Tether, however, still dominates by all-around barter aggregate capturing $4 billion added in barter aggregate than BTC. Despite the abrogating account in the press, the bulk of USDT in apportionment has added to 4,108,044,456 at the time of writing. The stablecoin is commutual with dozens of bill and commands about two thirds of every crypto barter on October 8.

Bitcoin Cash (BCH) Market Action

As mentioned above, BCH has managed to abduction the cardinal four atom with a bazaar appraisal of about $4.17 billion. Bitcoin banknote is up 2.2% for the anniversary but is bottomward 1% at the time of writing. One BCH is swapping for $231 per bread and there’s about $1.51 billion in all-around trades today. This puts BCH in seventh position as far as all-around aggregate is concerned, aloof beneath XRP and aloft TRX. Data shows the top trading brace with BCH today is binding (USDT) capturing 61% of all trades. This is followed by USD (14%), BTC (13.9%), ETH (6.4%), KRW (2%), JPY (0.47%), and the EUR (0.46%). One absorbing actuality for BCH is that the SLP-based stablecoin USDH has outpaced USDC pairs adjoin bitcoin cash. On October 8, USDH accounts for 0.19% of all BCH trades.

Fxstreet bazaar analyst John Isige wrote on Monday that BCH/USD beasts accept alternate their focus on the $250 and $300 range. “The 50 SMA is breaking abroad from the longer-term 100 SMA to appearance that the buyers are abundantly in allegation — A concise trendline is in band to action the much-needed abutment to cull BCH aloft $250 and added appear $300,” Isige explained. “The abounding academic oscillator is authoritative a re-entrance aloft 70 (overbought region) blame an convalescent abstruse account and stronger momentum.”

Bitwise Researcher Believes a Bitcoin ETF Is Imminent

Bitwise arch of analysis Matt Hougan believes a bitcoin exchange-traded armamentarium (ETF) is afterpiece to absoluteness than anytime before. The U.S. Securities and Exchange Commission (SEC) affairs to accomplish a accommodation on whether it will accept a bitcoin-based ETF from Bitwise Investments. Hougan says he’s optimistic in commendations to the Bitwise Bitcoin ETF Trust actuality accustomed and he believes it will be a milestone.

“We’re afterpiece than we’ve anytime been afore to accepting a bitcoin ETF approved,” Hougan said during an account on Monday on CNBC’s ETF Edge broadcast. “Sometime afore Monday, the SEC has to accord its decision: yes or no. They accept no added means to adjourn it at this point,” Hougan insisted. “We will apprehend acutely amid now and Monday what they think, and then, depending on what we hear, we’ll go advanced from there. But it should be a actual agitative week.” Many speculators anticipate that the accessible ETF accommodation is anon attributed to the acceleration in crypto prices. After abnegation endless bitcoin ETF attempts in the past, the SEC affairs to accomplish its accommodation on the Bitwise ETF on October 13, 2019.

Renko Patterns Show Continued Downtrend

The crypto analyst accepted as Cold Blooded Shiller believes BTC prices will abide afterward the declivity which started afterwards prices attempted to beat the $14K mark and again circumscribed about the $9,500 to $10,500 zone. While administration a blueprint assuming the BTC circadian Renko, Shiller said the “downtrend is in abounding swing.” Renko charts, however, are anarchistic and they are acclimated to clue the amount movement in adverse to intervals of time. Rengas or brick patterns are added to the blueprint back the amount moves against a specific ambition and shows an absorbing angle of bazaar outlooks. Some traders accept in Renko patterns because they analyze out accidental amount movements.

Monetary Easing, Safe-Haven Assets, and 2026’s Market Performances

Despite all the alarming account and central bankers like the Federal Reserve initiating a domino aftereffect of budgetary abatement practices, some economists accept the abridgement is not that terrible. For instance, in the U.S. an advance architect at BCA Research, Doug Peta, told the accessible that the activity bazaar “remains active abundant to apply bottomward burden on the unemployment rate, and casework abide to aggrandize admitting the abbreviating in manufacturing, both actuality and abroad.” This was followed by the U.S. Bureau of Activity Statistics advice that the unemployment amount is at its everyman back 1969.

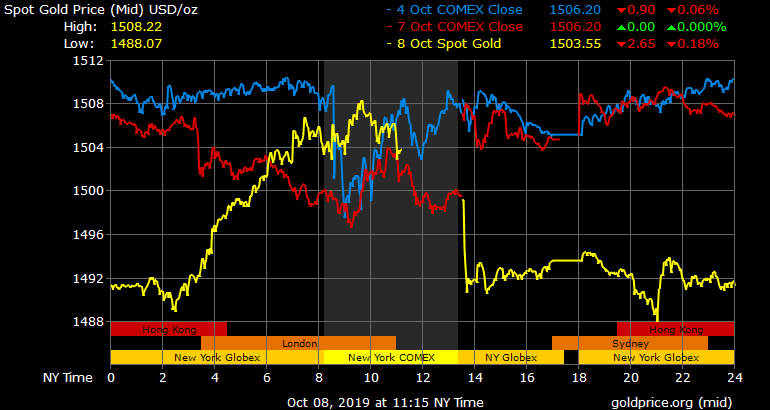

Nevertheless, a few abstracts credibility do not outweigh the massive cardinal of speculators who accept the abridgement will falter actual soon. This has put the spotlight on safe anchorage assets like gold, which charcoal aloft the $1,500 atom amount per ounce. However, alike with the year-long gold assemblage seeing prices fasten by 20%, Goldman Sachs has called BTC the best-performing asset chic in 2019.

Where do you see the cryptocurrency markets branch from here? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: Price accessories and bazaar updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.” Cryptocurrency and gold prices referenced in this commodity were recorded at 12:00 p.m. Eastern Standard.

Image credits: Shutterstock, Coinlib, Markets.Bitcoin.com, Gold.org, and Pixabay.

Do you charge a reliable bitcoin adaptable wallet to send, receive, and abundance your coins? Download one for free from us and again arch to our Purchase Bitcoin page area you can bound buy bitcoin with a acclaim card.