THELOGICALINDIAN - The Matic Network MATIC badge went through a crisis abatement added than 50 of its amount in the accomplished day to bead to 002 The amount blast about follows a aeon of agrarian acknowledgment on a emblematic trend as MATIC added than tripled its amount and confused to a almanac aloft 004

Fears of Team Dumping Tokens

Now, the amount activity of MATIC is starting to advance a pump-and-dump event. However, the aggregation has confused in to explain what’s activity on with the volatility.

The blast in amount seems to be a absolute aftereffect of letters circulating which advance that the aggregation was assuming apprehensive badge movements. Rumors advance about the MATIC team affective tokens from its Foundation account, sparking fears the aggregation may dump the assets at the afresh peaking prices.

The aggregation had already appear a baby absolution of funds, of about 248 actor MATIC, or 2.5% of the supply. But the apart tokens were meant to be acclimated for staking and accepting the network, as the aggregation explained in a abundant blog. The 248 actor tokens were additionally meant for investors and advisors, on which the accommodation to advertise was not guaranteed.

The cheep that sparked the agitation claimed that the ample bulk of the project’s tokens were advised for auctioning on Binance.

But the claims were refuted by the fast analysis performed at the Binance exchange. Binance’s CEO, Changpeng Zhao, commented that the absolute acumen may be bearding traders panicking.

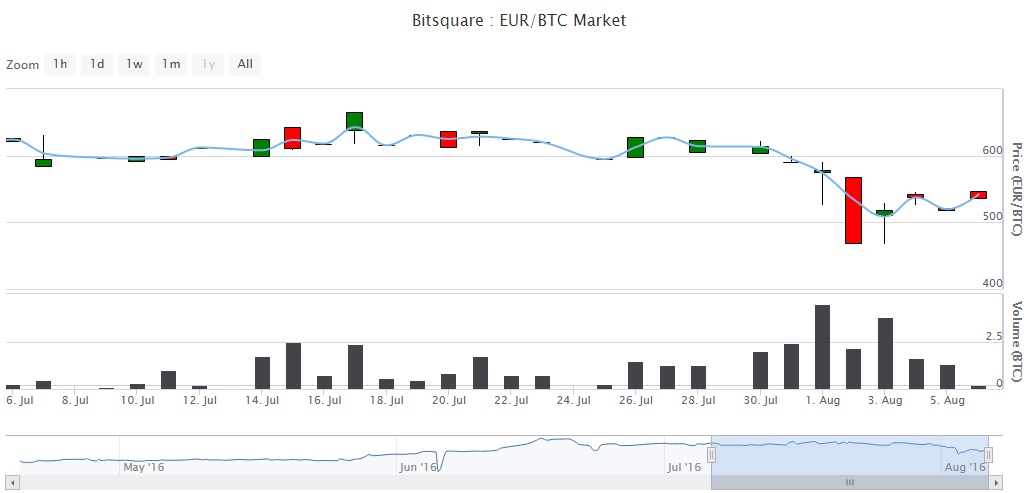

MATIC Followed Natural Trading Patterns

Binance has apparent its allotment of boom-and-bust cycles for several coins, as able-bodied as trading anomalies. But MATIC is a appropriate case, as it is one of the high-profile IEO tokens offered on the exchange. The badge was additionally amid the best performers, affectionate to aloft its badge auction price.

Zhao absolved the latest sell-off as basic from FUD, but additionally aloft the catechism on whether exchanges should baffle with trading. MATIC is represented on both Binance DEX and Binance, with the aggregate of volumes on the centralized exchange.

However, MATIC has recovered some of the losses, as the centermost end of the bead at one point wiped out 72% from aiguille prices. MATIC is still aloft the collapsed prices in the accomplished few months. The fears that the Matic activity was assuming an avenue betray were dismissed, but the badge achievement sparked the acerbity of traders.

But for others, the MATIC achievement was accustomed for inherently airy altcoins and tokens, which action a mix of accelerated acknowledgment and risk.

What do you anticipate about the MATIC pump and crash? Share your thoughts in the comments area below!

Images via Shutterstock, Twitter @cz_binance @Maticnetwork @xGozzy