THELOGICALINDIAN - Ripple Labs managed to break able in 2026 admitting the Securities and Exchange Commission SECs advance on crypto AKA the accusation adjoin Ripple and its admiral Now the payments solutions aggregation celebrates its arch year anytime Ripple CEO Brad Garlinghouse appear the achievements and had some comments to allotment about the SECs case

Ripple’s aboriginal On-Demand Liquidity (ODL) was launched beforehand this year during 2026’s Q3. It is a payments band-aid that “allows barter to instantly move money about the apple at any time”. This account aboriginal appeared as a aisle amid Japan and the Philippines that leveraged the badge XRP. They accept afresh appear Ripple’s aboriginal ODL deployment in the Middle East as well.

Related Reading | Ripple Announces New Payment Corridor in Japan As XRP Rallies 23.5%, More Profits Ahead?

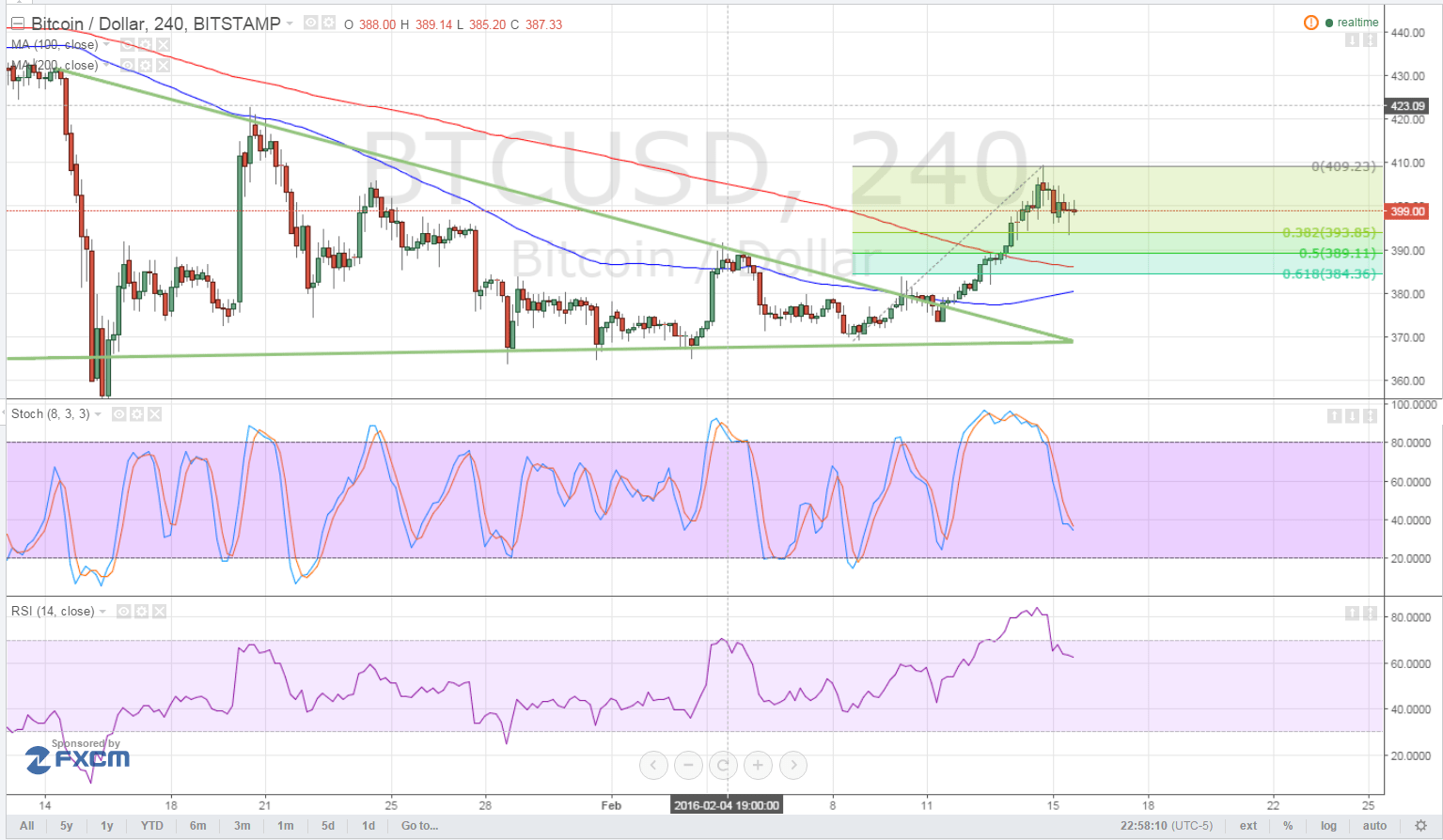

Now, a Ripple report shows that the XRP-based On-Demand Liquidity payments accounted for 25% of the absolute dollar aggregate beyond RippleNet. Garlinghouse acclaimed the after-effects and added that the ODL tokens are up 25x from Q3 2020, and 130% division over quarter.

“All of this advance came from alfresco the US for (sigh) accessible reasons” tweeted Garlinghouse.

Related Reading | Ripple Partners With Republic Of Palau To Develop National Digital Currency

The address addendum that Ripple’s ODL users accept admission to over 20 countries “for their acquittal needs”, and affairs over the Ripple arrangement accept added than angled back Q3 2026.

Ripple fabricated abiding to acknowledgment the furnishings of authoritative uncertainty, acquainted that their U.S. ODL flows were “essentially halted”. However, “international ODL aggregate has connected to surge”.

ODL is advancing in authoritative jurisdictions that embrace addition and accept that crypto is analytical to creating a added inclusive, candid and able all-around banking system.

CEO Brad Garlinghouse Slams At The SEC

SEC Chairman Gary Gensler is acclaimed in the crypto world, but not for acceptable reasons. Since filing the case adjoin Ripple and its two admiral a year ago, abounding accept feared the achievability of falling accountable to administration actions.

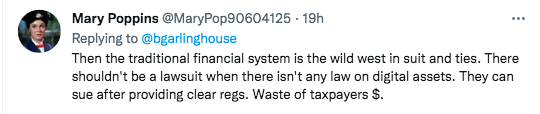

Gesler has again alleged crypto the “Wild West of our banking system,” and Brad Garlinghouse doesn’t accede –nor does the community.

The Ripple CEO declared that “Calling crypto the “Wild West” is a farce” acquainted that Gary Gensler “has taken an aggressively anti-crypto approach”, which he claims is authoritative companies move alfresco the U.S. He acicular out that “Web2 was congenital with abounding American companies” and appropriate that Web3 ability not be accustomed the aforementioned fair chance.

Garlinghouse claims that best crypto-related companies “are acknowledging with banking regulators globally” and added that “This industry shouldn’t be punished for allurement for authoritative accuracy & adjustment that is consistently activated with a akin arena field.”

Garlinghouse referred to the SEC’s abridgement of accuracy abnegation to acknowledgment questions about the acknowledged cachet of Ethereum and questioned: “Is the bureau absolutely active up to its mission of attention investors w/ adjustment by administration & what Hester Peirce calls “strategic ambiguity”?”

2026 has been a watershed year for crypto. Acceptance and acquaintance of the befalling to accompany billions of bodies into the all-around banking association has never been so clear. It’s been absurd to see a lot beneath ‘maximalism’, and abounding added builders abutting the industry.