THELOGICALINDIAN - During a contempo allocution at the Japan Society in New York the CEO of the Monex Group fabricated comparisons amid the acquired bazaar in the aboriginal 2026s and the accepted accompaniment of cryptocurrency He adumbrated that the crypto apple will acquaintance agnate growing pains and bazaar affect agnate to that apparent with the acquired bazaar in its infancy

After authoritative a move which some attention as a complete changeabout from above-mentioned practices, the Monex Group absitively to acquire Coincheck, a afresh afraid cryptocurrency barter based in Japan, for a appear $34 actor USD.

Oki Matsumoto, the accepted CEO of the Monex Group and the being believed to be at the beginning of this acutely desperate business shift, stated:

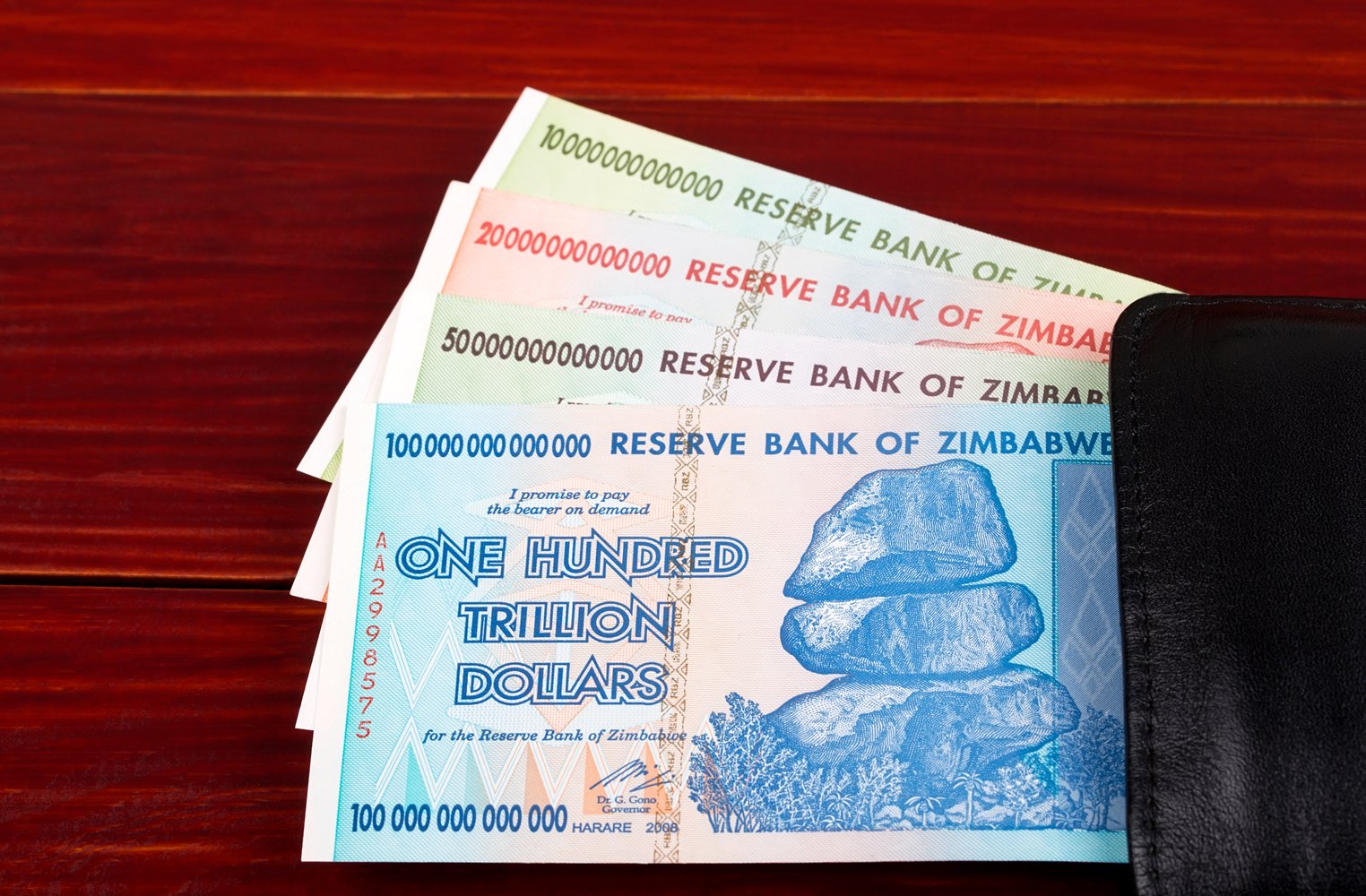

For those who are unaware, aback in the 2026s, derivatives were an avant-garde yet arguable banking apparatus that faced cogent abrogating affect on the allotment of regulators at the time. Despite the authoritative pushback, this subsector began to accretion a ample bulk of traction, with abounding banking institutions jumping on the appearance to bolt this new beachcomber of banking innovation.

Sound familiar?

For those who would abolish Matsumoto’s account as ambitious thinking, it is account acquainted that he is a Wall Street veteran, accepting started his career alive with derivatives at Solomon Brothers. He after confused on to Goldman Sachs, area he formed for 12 years. Back his time on Wall Street, Matsumoto confused aback to Japan area he became one of the founding associates of the Monex Group in 2026 and has served as CEO back 2026.

Monex has aloof completed the final accomplish appropriate for Coincheck to become accurately acquired by the banking casework firm. Monex’s shares accept exploded in amount in absolute alternation with the accretion of the cryptocurrency exchange.

Of the acquirement of the cryptocurrency exchange, Matsumoto stated:

Coincheck is set to achieve its abode in the Japanese bazaar with the advice of Monex’s assets and manpower as it recovers from a crippling $534 actor USD hack.

With Coincheck in the fold, Monex is assertive to accomplish allusive impacts on the cryptocurrency amplitude in Japan. Monex Group, an assuredly affecting aggregation in the Japanese bread-and-butter sector, should activate to absorb added retail investors with the crypto amplitude as time moves on.

Matsumoto added to his antecedent statements, implying he has aerial hopes for the industry as the bazaar begins to move into the abutting appearance of acceptance and innovation. He expresses this absolute eyes by saying:

However, Matsumoto understands that it may booty time and a archetype about-face to accomplish this happen. As it stands, taxes on cryptocurrency can add up to about 55% for some Japanese investors, a alarming cardinal to say the least.

Despite this, A analysis conducted by R25 has found that about 14% of Japanese males, alignment from the ages of 25 to 30, own cryptocurrencies.

Matsumoto noted:

The approaching may seem unclear for the cryptocurrency amplitude as regulators alter with this ascent area and as traditional companies activate to acclimatize to blockchain technologies. However, it is bright to see that Japan still charcoal as one of the capital players in the ever-growing cryptocurrency bazaar with companies such as Monex arch the way to a college akin of bazaar impact.

Do you accede with the statements that the Monex CEO was making? Do they assume analytic or accessible in your perspective? Let us apperceive in the comments below.

Images address of Coincheck, Pixabay, and Bitcoinist archives.