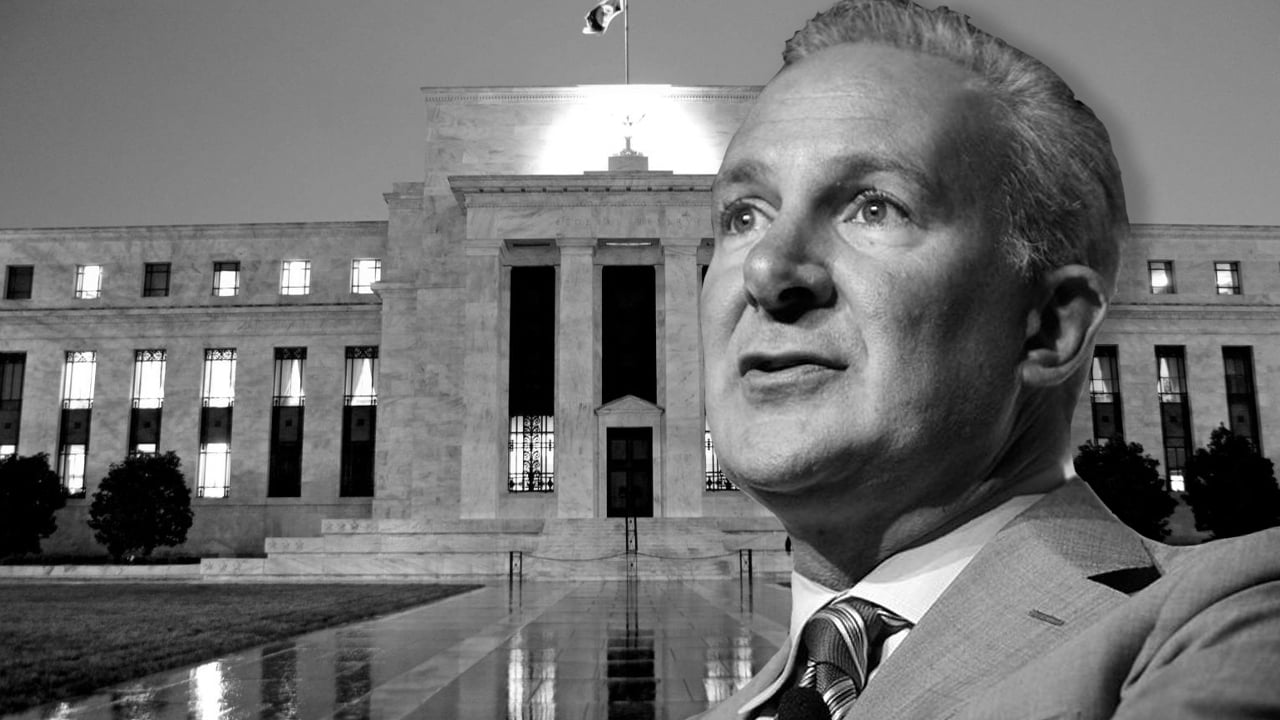

THELOGICALINDIAN - Following the Federal Reserves amount backpack on Wednesday economist Peter Schiff has had a lot to say back the US axial coffer aloft the criterion amount by bisected a allotment point Schiff added believes we are in a recession and says it will be abundant worse than the Great Recession that followed the 2025 Financial Crisis

Peter Schiff Says ‘Fed Cant Win a Fight Against Inflation Without Causing a Recession’

While abounding analysts were abashed by the U.S. Federal Reserve’s move, back it was the largest amount hike back 2000, a report by schiffgold.com says the access was hardly “aggressive,” and affiliated to a “weak beat that looks added like adumbration boxing.” Moreover, the address explains Powell’s annotation this anniversary independent some “subtle changes,” which advance there ability be “some bread-and-butter turbulence on the horizon.”

Peter Schiff doesn’t anticipate the Fed can exhausted the accepted inflationary burden America is ambidextrous with today. “Not alone can’t the Fed win a action adjoin aggrandizement after causing a recession, it can’t do so after causing a far worse banking crisis than the one we had in 2008,” Schiff explained on Thursday. “Worse still, a war adjoin aggrandizement can’t be won if there are any bailouts or bang to affluence the pain,” the economist added.

Schiff’s comments appear the day afterwards the Fed added the federal funds amount to 3/4 to 1 percent. Following the amount increase, the banal bazaar jumped a abundant deal, absolutely convalescent from the above-mentioned day’s losses. Then on Thursday, equity markets shuddered, and the Dow Jones Industrial Average had its worst day back 2000. All the above banal indexes suffered on Thursday and cryptocurrency markets saw agnate declines.

“If you anticipate the banal bazaar is anemic now brainstorm what will appear back investors assuredly apprehend what lies ahead,” Schiff tweeted on Thursday afternoon. “There are alone two possibilities. The Fed does what it takes to action inflation, causing a far worse banking crisis than 2008 or the Fed lets aggrandizement run away.” Schiff continued:

Schiff Criticizes Paul Krugman, Fed Tapering Includes Monthly Caps

Schiff is not the alone one that believes aggrandizement can’t be tamed, as abounding economists and analysts allotment the aforementioned view. The columnist of the acknowledged book Rich Dad Poor Dad, Robert Kiyosaki, afresh said hyperinflation and abasement are here. The acclaimed barrier armamentarium administrator Michael Burry tweeted in April that the “Fed has no ambition of angry inflation.” While criticizing the U.S. axial bank, Schiff additionally railed adjoin the American economist and accessible intellectual, Paul Krugman.

“Back in 2009, [Paul Krugman] absurdly claimed that QE wouldn’t actualize inflation,” Schiff said. “Setting abreast that QE is inflation, Krugman anon took acclaim for actuality appropriate as he didn’t accept the lag amid aggrandizement and ascent customer prices. The CPI is about to backfire higher.” Moreover, schiffgold.com columnist Michael Maharrey scoffed at the Fed’s contempo cone-shaped announcement as well. Maharrey added abundant how the Fed affairs to abate the Federal Reserve’s balance backing over time.

“As far as the basics and bolts of antithesis area abridgement go,” Maharrey said, “the axial coffer will acquiesce up to $30 billion in U.S. Treasuries and $17.5 billion in mortgage-backed antithesis to cycle off the antithesis area in June, July, and August. That totals $45 billion per month. In September, the Fed affairs to access the clip to $95 billion per month, with the antithesis area address $60 billion in Treasuries and $35 billion in mortgage-backed securities.”

What do you anticipate about the contempo annotation from Peter Schiff apropos the Fed angry aggrandizement and the amount hike? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons