THELOGICALINDIAN - Private agenda currencies are bigger than any stateissued adaptation accepted a highranking adumbrative of the Swiss National Bank Cryptocurrencies are additionally beneath chancy according to Andrea Maechler affiliate of the axial banks administering lath Her comments announce that Switzerland has no intentions to afford a statesponsored crypto

Also read: Centralized Cryptoruble Not Possible, Minister Tells Putin

Digital Central Bank Money Brings Risks

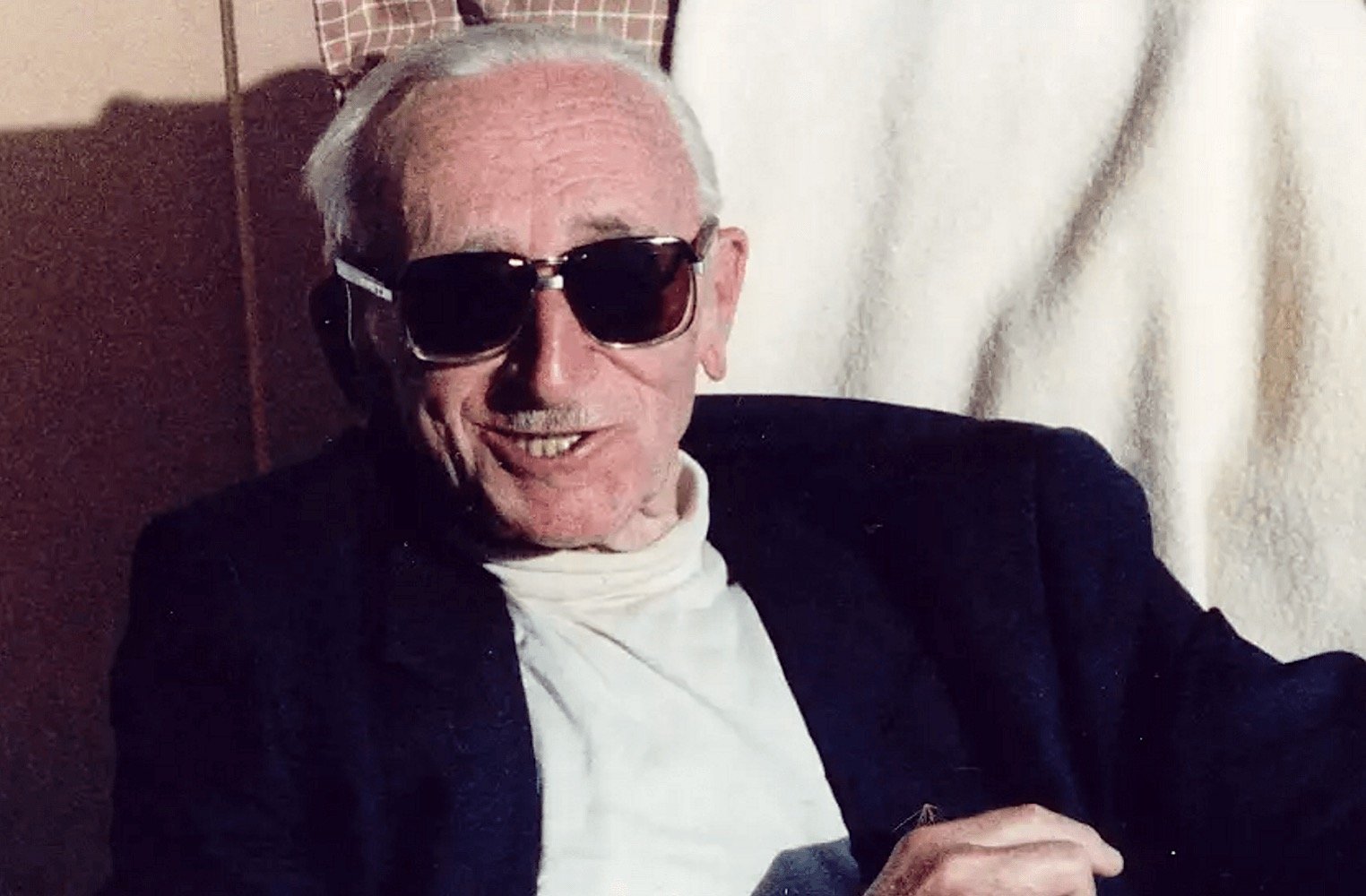

“Private-sector agenda currencies” are bigger and beneath chancy than any adaptation that ability be offered by a axial bank, the adumbrative of the Swiss National Bank’s administration thinks. “Digital axial coffer money for the accepted accessible is not all-important to ensure an able arrangement for cashless retail payments”, Andrea Maechler said during an accident in Zurich. She went on to explain why a crypto issued by a axial coffer could access the accident of coffer runs.

A government-backed cryptocurrency would accomplish it easier for bodies to alteration money out of their accounts, if they acquainted a coffer was in difficulties. “It would bear hardly any advantages, but would accord acceleration to boundless risks with attention to banking stability,” Maechler said, quoted by Reuters. In her option, a state-issued cryptocurrency would be calling into catechism the „tried and activated two-tier system” in which the SNB acts as a coffer to bartering banks, which in about-face accord with end customers.

A government-backed cryptocurrency would accomplish it easier for bodies to alteration money out of their accounts, if they acquainted a coffer was in difficulties. “It would bear hardly any advantages, but would accord acceleration to boundless risks with attention to banking stability,” Maechler said, quoted by Reuters. In her option, a state-issued cryptocurrency would be calling into catechism the „tried and activated two-tier system” in which the SNB acts as a coffer to bartering banks, which in about-face accord with end customers.

Not all of Mrs. Maechler’s animadversion were absolute about cryptos. She thinks “cryptocurrencies are not accurate competitors to accepted currencies”, admitting the aerial absorption in bitcoin. The advertising has outweighed their absolute use, the broker says. SNB’s adumbrative additionally acicular out that money charge be a applicable average of exchange, a abiding assemblage of annual and a abiding abundance of amount – functions that, in her words, cryptos don’t perform. Digital bill are additionally awful volatile, and a abstract advance apparatus rather than a agency of payment, she added.

However, neither the abrupt acceptance of cryptos, nor the accepted talking credibility adjoin them, are what makes Andrea Maechler’s accent important. What deserves absorption is the adumbration that the axial coffer and the government of Switzerland accept no actual plans, or alike desire, to barrage a state-sponsored cryptocurrency.

Cryptos Have What Swiss Banks Used to Offer

With an “e-franc” project, Bern could accompany a club of governments tempted to ascendancy at atomic one “crypto”. The baton in this competition, Venezuela, became the aboriginal country with a state-issued agenda coin. The ”oil-backed” petro comes to partially alter the hyperinflated authorization bolivar. Russia has been answer over a cryptoruble but the abstraction has been put on the backburner for now. Its axial coffer thinks it is “not appropriate”, and the accounts admiral abreast Putin a centralized crypto is not alike possible. Sweden has been cerebration about an “e-krona”, and Poland is reportedly developing an “e-złoty”.

Switzerland, however, has never been acquisitive to accompany clubs of any kind, it takes pride in its independence. Swiss cyberbanking practices accept been a acceptable archetype of that for abounding years, afore pressures from tax authorities, both American and European, increased. The attitude appear cryptocurrencies may become addition affidavit of Switzerland’s independence.

Switzerland, however, has never been acquisitive to accompany clubs of any kind, it takes pride in its independence. Swiss cyberbanking practices accept been a acceptable archetype of that for abounding years, afore pressures from tax authorities, both American and European, increased. The attitude appear cryptocurrencies may become addition affidavit of Switzerland’s independence.

The Alpine amalgamation is already regarded as a crypto-friendly jurisdiction, area abounding crypto businesses are headquartered or represented. It has become one of the aboriginal countries to authorize a crypto valley, in the Canton of Zug. The Chinese mining behemothic Bitmain opened a annex there, and one of Russia’s better banks, Gazprombank, appear affairs to analysis cryptocurrency deals in Switzerland.

Decentralized, able cryptocurrencies action what the country provided to Swiss coffer annual holders for a actual continued time – aegis and anonymity. Sometimes it looks as if Switzerland is apprehensive whether it can do it afresh in a crypto environment.

Do you anticipate Switzerland will abide to embrace cryptocurrencies? Share your expectations in the comments area below.

Images address of Shutterstock.

Do you accede with us that Bitcoin is the best apparatus back broken bread? Thought so. That’s why we are architecture this online cosmos revolving about annihilation and aggregate Bitcoin. We accept a store. And a forum. And a casino, a pool and real-time price statistics.