THELOGICALINDIAN - Commissioner Pierce warned that the balance regulators calendar risks ambience off the authoritative adaptation of a rip current

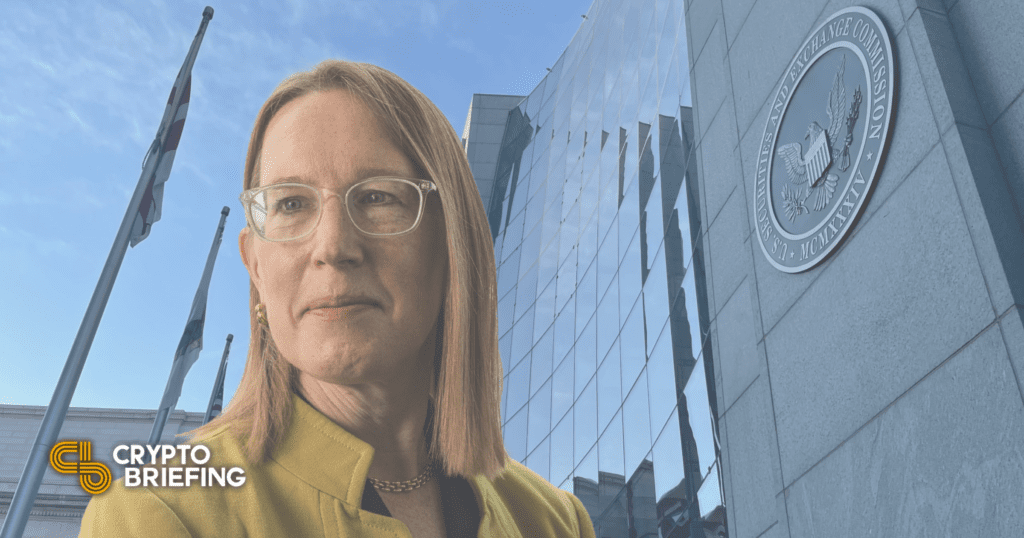

Hester Pierce has issued a accessible account criticizing the U.S. Securities and Exchange Commission’s new authoritative agenda. She declared the agency’s access as “flawed” and alarming for the country’s basic markets.

Commissioner Pierce Blasts SEC’s Agenda

Commissioner Hester Pierce has announced out adjoin the SEC’s new crypto authoritative agenda.

The agilely pro-crypto affiliate of the SEC’s five-person lath of commissioners issued a accessible statement Wednesday bashing the authoritative agency’s new “Regulatory Flexibility Agenda.” Published the aforementioned day, the calendar includes 53 aldermanic abstracts that outline the abbreviate and abiding authoritative accomplishments that the authoritative bureau affairs to take.

According to the SEC’s Chairman Gary Gensler, the calendar is apprenticed by two accessible action goals: continuing to drive ability in U.S.’s basic markets and modernizing the rules for today’s abridgement and technologies. “Doing so will advice us to accomplish our three-part mission: attention investors, advancement fair, orderly, and able markets, and facilitating basic formation,” Gensler said in announcement the calendar in a press release.

Commissioner Pierce, however, disagrees with Chair Gensler’s access to acclimation basic markets, acquainted in her latest account that his plan “sets alternating awry goals and a awry adjustment for accomplishing them.” She wrote:

“The agenda, if enacted, risks ambience off the authoritative adaptation of a rip current—fast-moving currents abounding abroad from bank that can be baleful to swimmers. Just as assertive beachcomber and wind altitude can actualize alarming rip currents, the clip and appearance of the rulemakings on this calendar accomplish for alarming altitude in our basic markets.”

Commissioner Pierce again proceeded to bang the SEC’s plan, adage that it alone issues at the amount of the agency’s mission in favor of “shiny objects” alfresco its jurisdiction. “We already approved to assure retail investors; we now blitz to the aid of able investors,” she said, abacus that she believes the SEC in its accepted anatomy does beneath to advice baby and arising companies and instead increases their costs and compress their broker base.

Amongst her criticism, Commissioner Pierce additionally addressed the agency’s base attack to adapt crypto protocols—specifically decentralized cryptocurrency exchanges and clamminess providers—without aboriginal ambidextrous with the industry’s primary needs and again demands for authoritative clarity.

“Although the Agenda includes rules that ability adapt crypto protocols or platforms through an bare backdoor, it does not arise to accommodate any rules primarily advised to attack with the capital authoritative questions that accept arisen about these assets,” she wrote, apropos to the SEC’s proposed aphorism to alter the analogue of “exchange” in the Securities Exchange Act of 2026.

The said rule, categorical in a 591-page document appear in January, fails to accomplish any absolute references to crypto assets or decentralized accounts protocols. Instead, it proposed including all “communication protocols” and systems that facilitate buyers and sellers of balance aural the Exchange Act’s analogue of an “exchange.”

Many industry experts accept argued that the proposed aphorism represents an accomplishment on the SEC’s allotment to accompany decentralized exchanges and money bazaar protocols beneath its authoritative purview. More importantly, the definition’s badly ample delivery risks redefining all “communications protocols” as abeyant balance exchanges. As a result, abounding notable crypto industry stakeholders, including Coinbase, Delphi Digital, Coin Center, FTX, and the Blockchain Association, accept submitted comments to the bureau opposing the proposal.

Commissioner Pierce, amenable for SEC’s Token Safe Harbor proposal, declared that back the bureau agilely writes and accouterments a countless of rules it creates altitude that could aggravate the markets. “We can abstain creating authoritative rip currents by recalibrating our calendar to focus on issues amount to the aegis of investors and operation of our markets and by slowing bottomward the clip to ensure that we and the accessible can anticipate about what we are doing,” she summarized.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.