THELOGICALINDIAN - Computer science assistant Jorge Stolfi has angered bitcoiners with his acquiescence to the SEC apropos a proposed Bitcoin advance fund

Also read: SolidX Files to Become First Bitcoin ETF on NY Stock Exchange

As allotment of its approval action to be listed on the Bats BZX Exchange, capacity of the COIN ETF were appear today in the US Federal Register. Any absorbed parties accept 45 canicule to abide an assessment to the US Securities and Exchange Commission.

To be listed, BZX Rule 14.11(e)(4), which covers commodity-based assurance shares, needs to be amended.

Stolfi Warns SEC Against Bitcoin Investment

Recommending adjoin any legitimizing of bitcoin as an advance vehicle, Professor Stolfi compared Bitcoin both to a “penny stock,” “shares for a aggregation with no assets, no articles and no staff,” and a “pure ponzi arrangement like Madoff’s fund.”

Recommending adjoin any legitimizing of bitcoin as an advance vehicle, Professor Stolfi compared Bitcoin both to a “penny stock,” “shares for a aggregation with no assets, no articles and no staff,” and a “pure ponzi arrangement like Madoff’s fund.”

The Brazilian academic, who is a abounding assistant at the University of Campinas and a above administrator of its Institute of Computing, is accepted as a analyzer of Bitcoin and cryptocurrencies in general.

Unlike stocks and bonds, he wrote, advance in Bitcoin does not pay assets and is not ashore in any fundamentals.

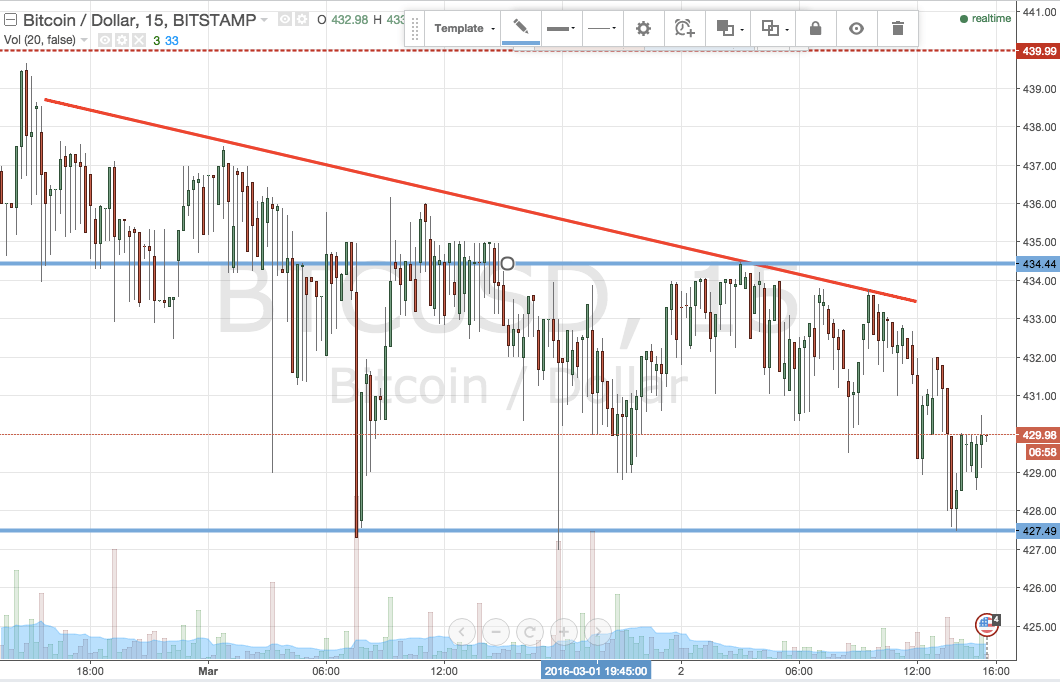

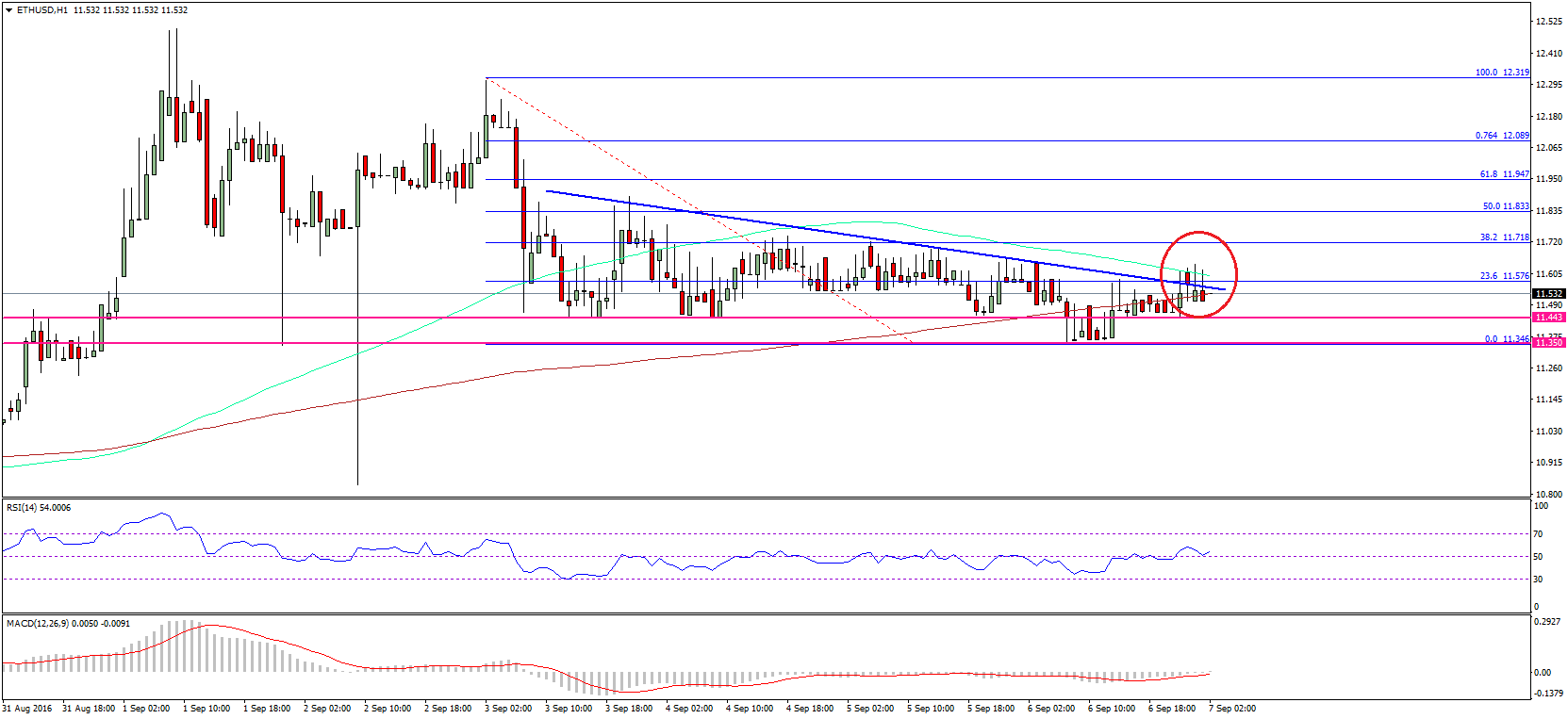

The actual amount animation that draws investors to Bitcoin precludes its use as a able currency, Stolfi said, authoritative its alone purpose for absolute that of a abstract token.

Risks & Potential Manipulation

That bitcoin can be spent by anyone in control of the appropriate clandestine keys, after any anatomy of character appropriate to authorize ownership, “creates a aegis accident that is absurd to quantify.”

In a addition aimed added accurately at the ETF plans, Stolfi said low clamminess at the Gemini bitcoin barter created an befalling to dispense the amount of bitcoin in adjustment to access the amount of the ETF.

The alone purpose for the ETF is to allure institutional investors (such as retirement funds) who would not contrarily participate in bitcoin, does not add any “productive mechanism” to bitcoin, he concluded.

Among added topics, Stolfi has ahead accounting accessories opposing DRM and Big Entertainment’s access on the technology sector, supporting the work of Julian Assange and Wikileaks, and railing against agitable email spam filters.

His SEC acquiescence echoes credibility he fabricated in a 2013 blog column blue-blooded “Cuidado com Bitcoin!” (Beware of Bitcoin). It appears he has not wavered from his antecedent angle in the three years hence, admitting the change of Bitcoin from a analytical agreement to a beginning fintech industry.

Reaction to the Criticism

Some in Bitcoin may absolutely accede with some of those points, or catechism why Bitcoin needs an exchange-traded armamentarium (ETF) or institutional investors. Stolfi’s allegory of bitcoin to a penny banal and Ponzi scheme, however, forth with the accepted criticism that its amount is based on nothing, is riling Bitcoin supporters.

Some in Bitcoin may absolutely accede with some of those points, or catechism why Bitcoin needs an exchange-traded armamentarium (ETF) or institutional investors. Stolfi’s allegory of bitcoin to a penny banal and Ponzi scheme, however, forth with the accepted criticism that its amount is based on nothing, is riling Bitcoin supporters.

Some acicular out that such criticisms could appropriately be directed at gold, yet the metal is at the foundation of several accepted instruments. Bitcoin’s cutting-edge attributes additionally makes it difficult to assort precisely, agreeable comparisons to any cardinal of absolute instruments and technologies – both acceptable and bad.

Bitcoin Investment Funds Growing

The advertisement and accessible submissions action is a basic footfall appear the ETF gaining approval to be accept on Bats Global Markets’ BZX, one of two exchanges it operates in the US. Bats is the third-largest barter abettor in the country.

The SolidX Bitcoin Trust has activated to the SEC to acquiesce advertisement on the New York Stock Exchange, while COIN ETF additionally affairs to barrage on Bats BZX. Grayscale’s Bitcoin Advance Trust, by Barry Silbert’s Digital Currency Group, became the world’s aboriginal bitcoin-based advance armamentarium in 2015 on the OTC Markets Group’s OTCQX exchange.

Does Professor Stolfi accomplish any accurate credibility about bitcoin? Do you anticipate it would acceptable amplitude the SEC’s assessment in bitcoin investments?

Images address of ownthedollar.com, github.com, vetr.com, cnbc.com