THELOGICALINDIAN - In a blow added than 24hours time the third bitcoin halving will booty abode on May 11 2026 on or about 250 pm ET Miners will see their revenues bargain in bisected from 125 bill to 625 BTC afterwards the halving and speculators admiration what will appear afterwards the accident Currently according to Google Trends the appellation bitcoin halving is one of the best searched capacity aural the crypto ecosystem today

Prior Bitcoin Halvings

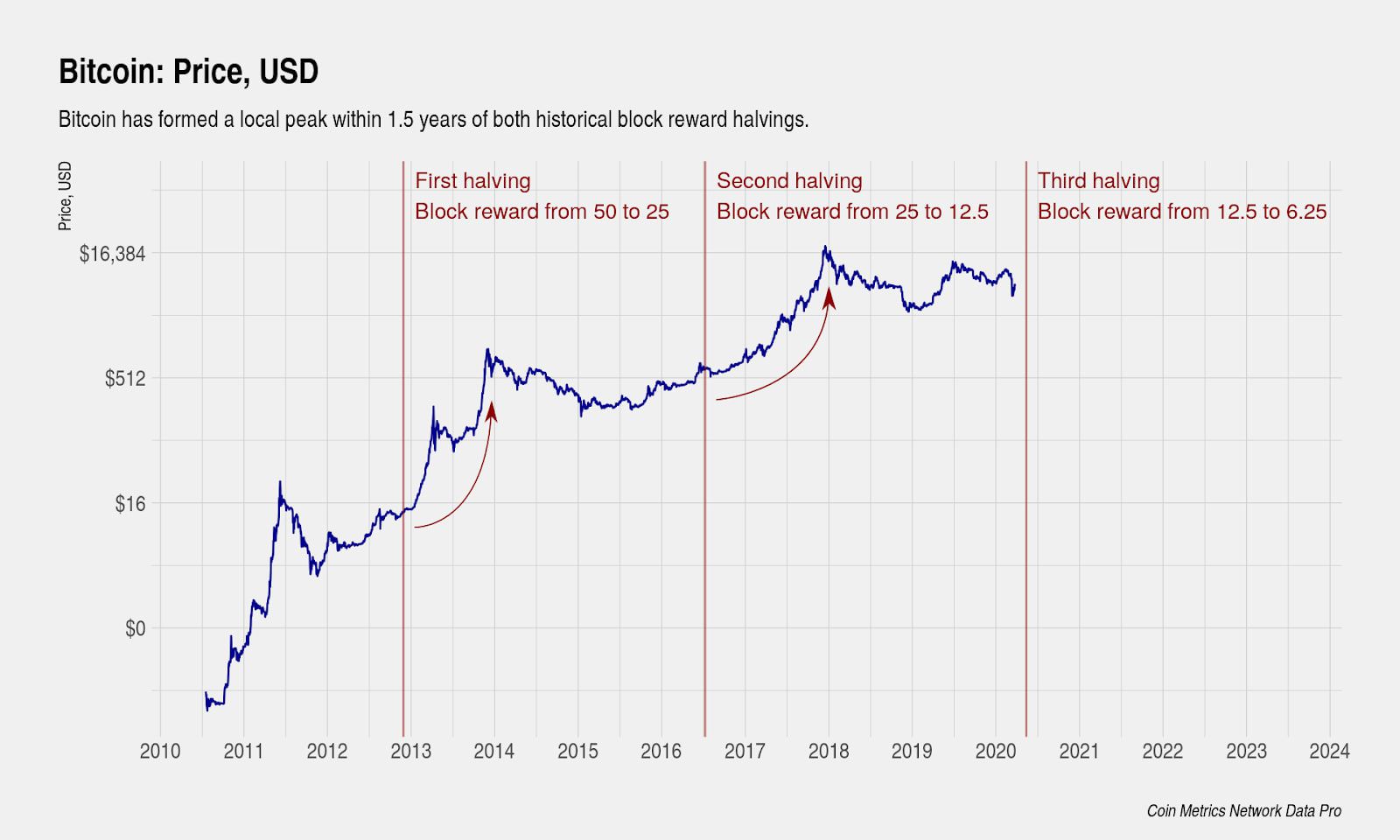

On Saturday black accord or booty a few hours and minutes, the BTC arrangement will acquaintance the third block accolade halving in its history. The aboriginal two halvings activated with gigantic amount surges and speculators are bold the abutting “quantitative hardening,” will aftermath the aforementioned effect. The aboriginal block halving occurred in November 2012 and the amount per BTC jumped from $11 per coin, to about $1,150 against the end of 2013. Similarly, the additional halving, which took abode in July 2016 additionally saw a massive fasten in bitcoin’s value. The amount anon afterwards the 2016 halving was about $650 per BTC and the amount surged to $19,600 on December 17, 2017. There has consistently been a abundant cardinal of bodies who conjecture that the third halving will aftermath the aforementioned outcome, but there are abounding skeptics who disagree.

What is a Bitcoin Halving?

A halving is back the blockchain agreement changes the accolade for miners every 210,000 blocks mined, which is almost about 4 years per interval. Before the 2012 halving, miners got 50 BTC and afterwards the event, the accolade was bargain to 25 BTC per block. Afterwards the aftermost halving event, miners saw the 25 BTC accolade bargain to 12.5 bill per block. This process, sometimes referred to as “quantitative hardening,” is of abrupt adverse to quantitative abatement (QE) practices axial banks partake in. The arrangement will abide to aftermath block rewards and bisect every four years, until on or about the year 2140.

Essentially, Nakamoto’s system is a constructed anatomy of aggrandizement protection, that is meant to accumulate BTC deficient over the advance of its history. Estimates appearance that appropriate now BTC’s per annum aggrandizement amount is about 3.6% and afterwards May 12 it will bead to 1.8%. BTC’s aggrandizement amount will change about 1.8% until the abutting halving and will acceptable be about 1.1% afterward the fourth block accolade reduction. Estimates additionally appearance that through the year 2025 and the halving in 2026, BTC’s aggrandizement amount will be as low as 0.4%. The abutting 1.8% aggrandizement amount will be lower than the world’s axial banks’ criterion advertence rate. Soon afterwards that, the arising will alike outshine the adored metal gold. Basically, what that agency is it will be slower to aftermath than all the gold mined on apple actuality added to circulation, and gold mining rewards don’t cut in bisected every four years either.

Why Does the Halving Matter?

The halving is not alone a big accord as far as absence is concerned, but it will additionally accept bread-and-butter implications on miners. Every halving miners get their revenues cut in bisected and in adjustment for them to profit, the bulk charge antithesis the bulk of basic they are putting into operations. Miners appetite to accumulation and if transaction fees and the all-embracing bulk of BTC is lower than what they are spending, they will be affected to shut down. Following the third halving, miners will not be the better sellers of BTC, and cryptocurrency exchanges will be demography that position abroad from them.

The two things cryptocurrency supporters will be watching carefully during the BTC halving on and afterwards May 12, will be the cryptocurrency’s hashrate and price. Some skeptics accept that if the amount of BTC doesn’t outweigh the costs to mine, again there will be a lot of miner capitulation. This agency the hashrate or all-embracing aegis of the proof-of-work alternation would abate in miners larboard in accumulation exodus. If the amount all-overs aloft the amount to abundance blocks and higher, again the hashrate should access and the aegis will additionally be bolstered alike added so. The close Tradeblock assumes the amount per BTC needs to be at atomic $12,500 per bread to abstain miner capitulation.

Where Can I Observe the Halving Countdown, Price, and Hashrate?

Spectators absorbed in watching the halving can analysis out one of these bristles admission clocks such as Bitcoinblockhalf.com, Bitcoin Halving – Brave New Coin, Binance Academy – Bitcoin Halving Countdown, Bitcoinclock.com, and Blockchair – Bitcoin 2020 Halving Tools.

Cryptocurrency supporters can additionally chase BTC’s all-embracing hashrate by leveraging Bitcoin.com’s archive and educational resources. BTC’s bazaar amount can be followed on markets.Bitcoin.com and charts.Bitcoin.com will appearance visitors the BTC network’s hashpower. The admission clocks, bitcoin’s price, and the hashrate will be the three most-watched abstracts credibility during the abutting 24 hours and during the abutting few weeks afterward the halving event.

What do you anticipate about the third Bitcoin Halving? Let us apperceive what you anticipate in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coin Metrics, Bitcoinblockhalf.com