THELOGICALINDIAN - The acknowledgment to the Covid19 communicable has been adamant on the all-around abridgement and during the aftermost six months acceptable stocks and bolt accept acquainted acute bazaar animation Coinshares appear a absolute address this anniversary in absorption to how bitcoin performed during the coronavirus beginning The sevenpage abstraction highlights how bitcoins backlash to preCovid amount levels has unsurprisingly garnered absorption amidst the advance community

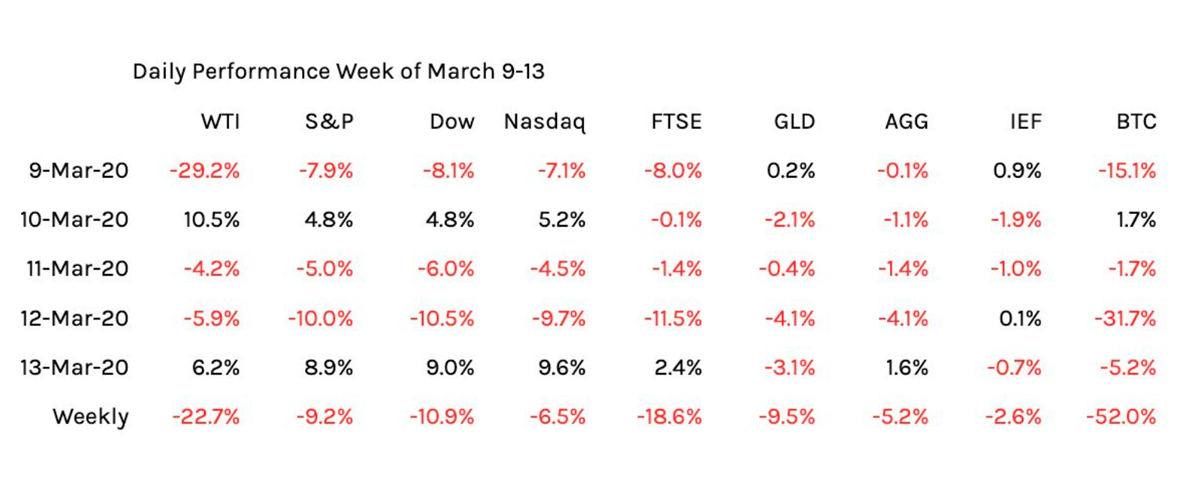

Coinshares’ arch of analysis Chris Bendiksen afresh appear a address that discusses how bitcoin (BTC) reacted to the coronavirus beginning and the mid-March bazaar volatility. Despite what critics like Peter Schiff say, BTC has outperformed a abundant cardinal of all-around assets including gold back the March 12, 2020 (Black Thursday) bazaar rout.

Gold’s amount per ounce was $1,589, and the amount has risen 13.90% to a aerial of $1,810 on July 17. Bitcoin (BTC) on the added duke slid to a low of $3,870 on Black Thursday sliding -49.39% that day. However, back again the amount of BTC has added 135% area it stands today at aloof aloft the $9,100 per bread region.

The address alleged “Understanding Bitcoin During the Covid Crisis” accounting by Bendiksen highlights “how airy bitcoin can be.” Coinshares believes that the antecedent tumble on March 12 was “ignited by abhorrence overextension from added markets.”

“It again became decidedly astringent due to bitcoin’s different bazaar structure,” Bendiksen’s address notes. “The all-embracing acceptance of advantage in bitcoin atom and derivatives markets is about large, but in the time arch into March 12 & 13, advantage levels were abnormally high, authoritative them added accessible to shocks.”

The address continues by adding:

Despite the abrupt rebound, the Coinshares researcher explained that due to “bitcoin’s bazaar structure” not absolutely changing, there’s little acumen to agnosticism the March 12 animation could appear again. Bendiksen says there were a cardinal of things that happened above-mentioned to Black Thursday, which can be advised afresh for approaching animation events.

The address capacity that acceptable banking markets were on “shaky ground” in aboriginal March, and a “stampede for cash” took abode afterwards Europe and North America implemented the antecedent lockdowns.

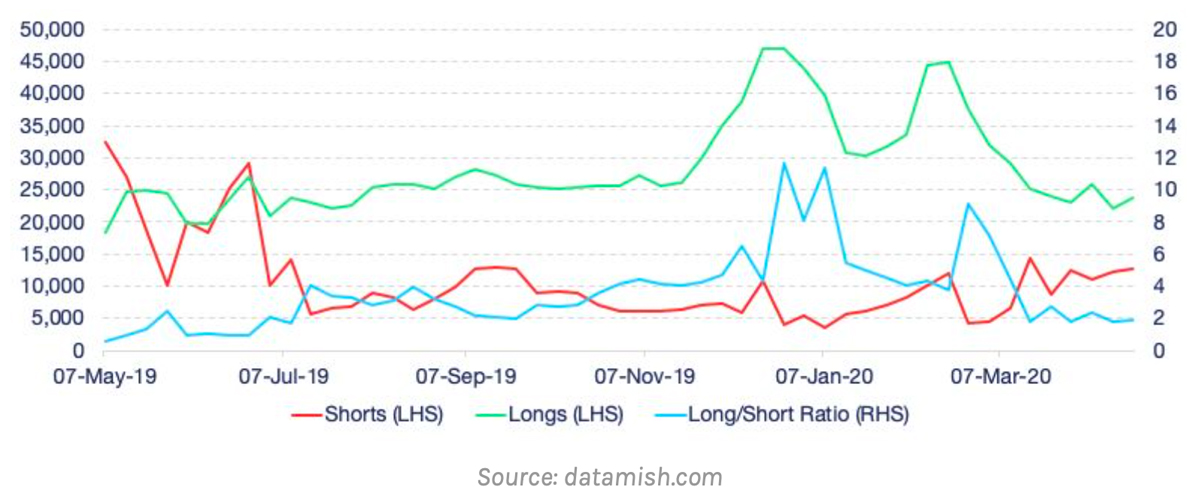

But was absolutely apparent was the advantage levels in bitcoin markets above-mentioned to the Black Thursday fallout.

“In bitcoin markets, advantage had been architecture in assorted forms,” the address reveals. “USD lending ante on allowance platforms were elevated, and Long/Short (L/S) ratios at atom exchanges such as Bitfinex were aerial at abnormally aerial levels. Having appear bottomward from accompanying peaks of about 12x in backward December and aboriginal January, L/S ratios acicular aback aloft 9x in the weeks arch up to March 11. By March 17, the arrangement had alone to beneath than 2x.”

Bendiksen additionally fatigued that the “situation on derivatives exchanges did not help” and the cardinal of outstanding BTC-collateralized loans acicular to an best aerial afore the March 12 event. Despite the -49.39% bead that day, Bendiksen said that BTC eventually begin a bottom amid $3,500 and $4,000 per coin.

Going forward, the Coinshares address said that ecology advantage metrics will advice barometer approaching animation risk. Unlike acceptable markets, BTC additionally didn’t get advice from “external intervention” from organizations like the Fed, and “[bitcoin’s] accretion has been stronger and faster than about all added markets,” the analysis cardboard highlights.

Bendiksen’s address concludes by saying:

What do you anticipate about Coinshares’ contempo address apropos bitcoin and Covid-19? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coinshares, Datamish.com, Genesis Capital,