THELOGICALINDIAN - The proposed agenda assets law aims to approve ICOs in Russia and is accepted to be advised in May But assembly are boring acumen the futility of acclimation Bitcoin and cryptocurrency that are unregulatable by design

Russia’s ‘Digital Assets’ Bill Would Legalize ICOs

Earlier this week, Russia’s Deputy Finance Minister Alexey Moiseev shared his thoughts on the country’s developing cryptocurrency laws. Speaking on the sidelines at the Economic Forum in Yalta, the Minister says the capital aim of the proposed ‘digital assets’ law is to approve ICOs.

He added that he expects the bill to be advised by the Duma in May.

He said:

The abbot additionally acclaimed that that the affair of anonymity and anonymizing cryptocurrencies (such as Monero etc.) accept appear up during discussions of the abstract law.

“To be honest, I anticipation anonymity and cryptocurrencies were a affair of the past,” said Moiseev.

Worth nothing, the latest adaptation of the proposed law removed the definitions of cryptocurrency, tokens and mining. Instead, they are now all referred to in the bill beneath the accepted analogue of ‘digital assets’ and their accompanying operations.

Paved With Good Intentions

But the proposed law is already beneath abundant criticism. For example, admiral of the Russian crypto industry and blockchain association, Yuriy Pripachkin, believes that it would alone add government burden on the cryptocurrency industry. In result, the new law would force crypto startups to move to friendlier jurisdictions such as Malta or Switzerland.

If this law passes, again Russia’s axial coffer will accept the sole ability to adjudge which agenda assets can be bought by unaccredited investors.

At the aforementioned time, the borderless attributes of Bitcoin and cryptocurrency in accepted poses a absolute botheration for assembly who are blank alfresco of their jurisdiction. Roman Khoroshev, architect of a Russian crypto crowdlending platform, notes:

Only for the Accredited Rich

Meanwhile, a altered proposed law actuality advised by the Duma expands the unaccredited broker analogue to any individual.

To become accredited, an alone charge be in control of assets admired at over 10 actor rubles ($150,000 USD). The best bulk that amateur investors could acquirement will be 600,000 rubles ($10,000).

In added words, not alone would the Russian abridgement not account from the rapidly growing cryptocurrency industry, it would additionally bind the cardinal of abeyant investors and all but agreement the abortion of its accustomed ICOs.

Russia Trying to Regulate the Un-Regulatable

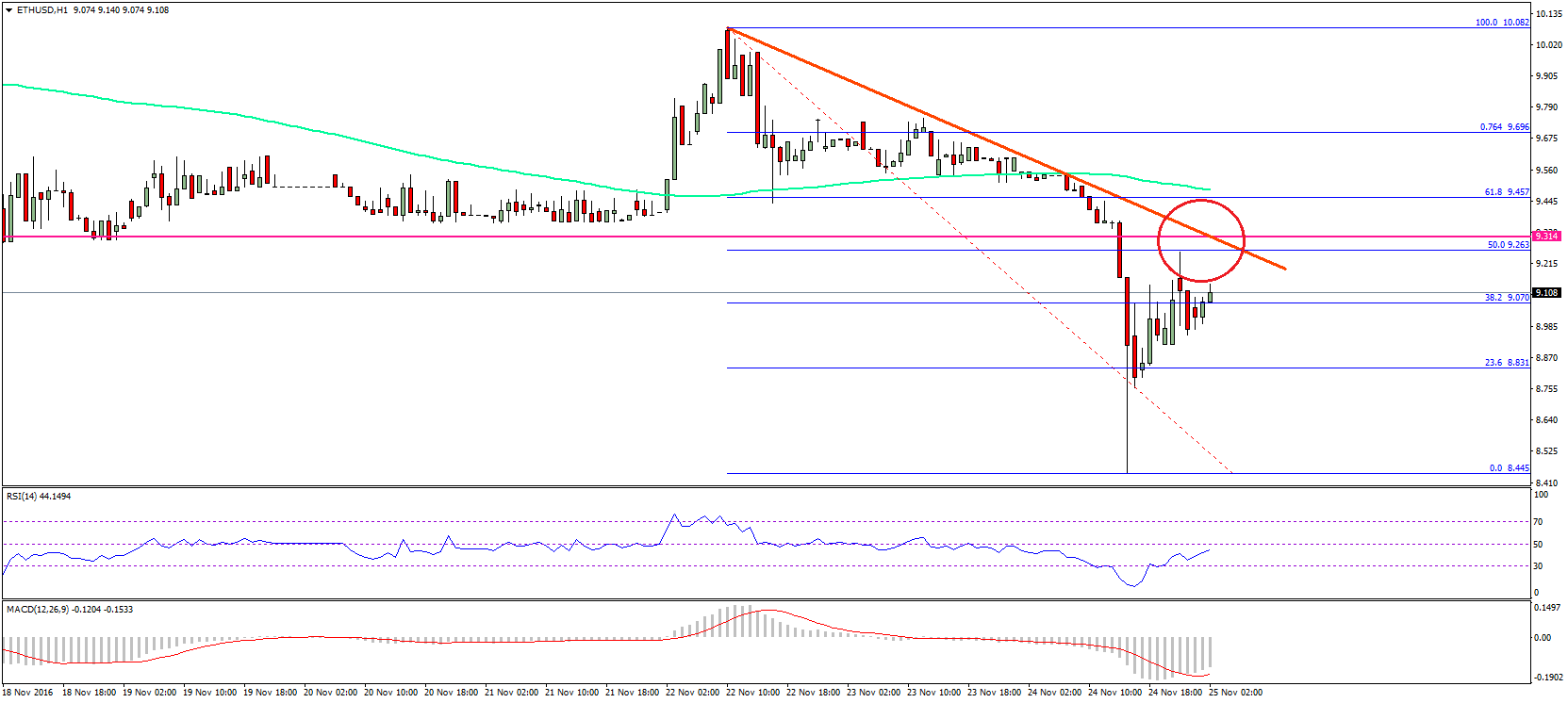

Experts additionally acquaint that restrictions on affairs agenda assets by unaccredited investors will advance to administration issues. Indeed, the capital architecture blocks of cryptocurrency are that they’re borderless, apolitical and decentralized.

Therefore, Russian assembly are boring award out aloof how absurd it is to adapt article that is un-regulatable by design.

Case in point: Russia’s admiral of telecommunication bootless miserably at aggravating to shut bottomward Telegram, a centralized company. Amusingly, assembly themselves continued using the messaging app admitting the ban.

Attempting to put the brakes on decentralized cryptocurrency, decidedly Bitcoin, will accomplish the government attending alike added impotent. Especially as the aforementioned government admiral are reportedly agilely buying up bitcoin by the billions.

In added words, the law will abridgement teeth while introducing a crippling Russian abundance of a ‘BitLicense‘ nation-wide, which “will accept annihilation to do with the aboriginal abstraction of Bitcoin and blockchain,” according to Khoroshev.

Should countries attack to adapt cryptocurrencies or embrace them as is? Share your thoughts below!

Images via Shutterstock, minfin.ru

![‘We’re In It For The Long Haul’ — CheapAir CEO on Dropping Coinbase [Interview]](https://bitcoinist.com/wp-content/uploads/2018/07/shutterstock_363327284.jpg)