THELOGICALINDIAN - Japanese bunch accumulation Sony has invested in Securitize through its adventure basic armamentarium SFVGB LP which is comanaged by Sony Financial Ventures SFV and Global Brain Securitize is a blockchainoriented close that helps businesses affair adjustable aegis tokens

Sony Joins Nomura, MUFG, and Santander to Invest in Securitize

The latest advance by SFV・GB an addendum of Securitize’s contempo funding round that aloft over $14 from VC firms, including Nomura Holdings, MUFG Innovation Partners, Santander InnoVentures, and Blockchain Capital.

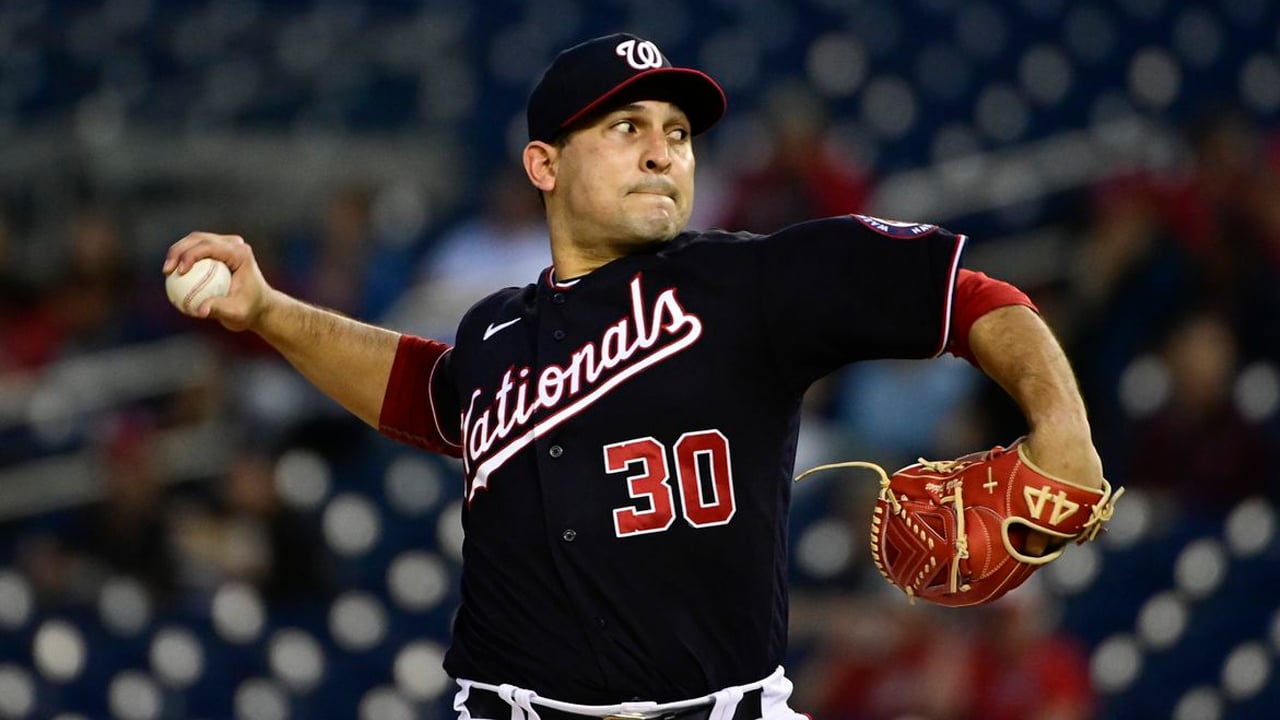

Securitize CEO and co-founder Carlos Domingo commented:

SFV is allotment of Sony Banking Group, a Tokyo-based banking casework accumulation that includes the captivation close Sony Banking Holdings and its subsidiaries, including Sony Life Insurance, Sony Assurance, Sony Bank, Sony Payment Services, and Sony Lifecare, amid others.

The VC close invests in startups and businesses beyond Asia, North America, and Europe. SFV has been absolutely alive at acknowledging confusing technologies, including bogus intelligence (AI), the Internet of Things, and robotics.

SFV administrator Junji Nakamura commented:

Parent Sony has been because blockchain for assorted use cases, including agenda rights administration (DRM). The aggregation ability use the technology for PlayStation 5.

What Are Security Tokens?

Security tokens were admired as the abutting big trend aftermost year, forth with stablecoins. They represent blockchain-based agenda units backed by real-world assets, such as aggregation shares, absolute estate, bonds, funds, and added disinterestedness products.

Securitize’s ambition is to improve basic markets by allowance companies affair agenda securities, which accept abundant advantages in agreement of liquidity, trading speed, and convenience.

Sony’s latest advance demonstrates that Japanese bazaar participants are added more absorbed in aegis tokens. In 2019, MUFG formed a analysis bunch calm with 21 added companies to analyze blockchain and aegis tokens for automated balance settlement.

Do you anticipate aegis tokens will accommodate acceptable markets? Share your thoughts in the comments section!

Image via Shutterstock