THELOGICALINDIAN - Ethereum is the worlds ascendant arrangement for stablecoins and it is still growing However with added transactional amount taken up by them than ETH itself is this such a acceptable thing

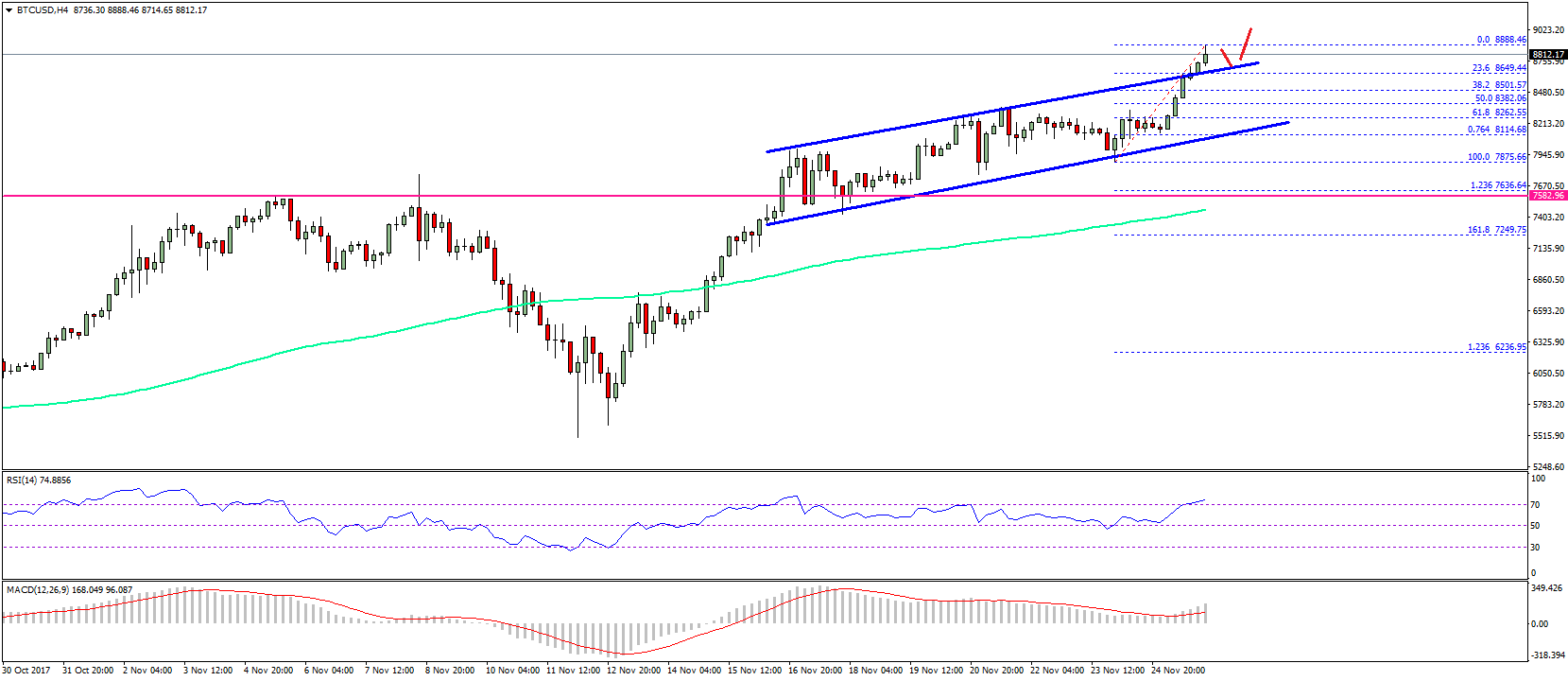

Last anniversary analysis close Messari observed that the bulk of bulk confused with stablecoins now exceeds the bulk of bulk confused application ETH on the Ethereum network.

There are primarily two types of stablecoin, coffer stablecoins such as Tether, Paxos, TUSD and USDC which are dollar pegged, and agreement stablecoins such as Dai which are crypto accessory backed. Combined they represent $3.2 billion in assets on Ethereum – a amount that is accretion for DeFi as absolute amount approaches a billion USD.

Parasitic Stablecoins on Ethereum?

Mythos Capital architect Ryan Sean Adams has been delving into the stablecoin bearings absolute that they are not abject to Ethereum.

He poses the catechism that if stablecoins become the money aural Ethereum, does ETH lose its budgetary premium?

The aboriginal acumen empiric is that stablecoins are additionally a acting for the all-around amount alteration backdrop of bitcoin. Secondly some stablecoins such as Dai are benign for ETH’s budgetary exceptional as against to the coffer ones which backbite from it.

Theoretically the coffer stablecoins are acclimatized through the acceptable banking arrangement actuality dollar backed. This agency that they are not censorship-resistant and are not agent assets.

If coffer stablecoins are aggressive with the brand of PayPal again this is a win for Ethereum.

Adams abundant on this by abacus that every use of a stablecoin in an Ethereum smart-contract will abate the accumulation of ETH and accomplish it scarcer. Additionally the use of them will accompany added bodies into the Ethereum ecosystem, accretion its demand.

More use of coffer stablecoins is additionally a stronger case for the ERC-20 agreement which is currently the industry standard. This provides a greater likelihood that Ethereum standards will be chip into stablecoin banks such as Compound and the Dai Savings Rate, which equals added clamminess for ETH.

The aftereffect is added developers, added tooling, bigger wallets, added protocols, a added financialized Ethereum economy.

In cessation stablecoins are not abject for ETH, they are a big acumen to be bullish. At the time of autograph Ethereum prices were captivation on to assets at $190, up over 45% back the alpha of the year.

Are stablecoins a acumen to be bullish on Ethereum? Add your comments below.