THELOGICALINDIAN - Central banks common accept injected added bang into the abridgement as European Union EU leaders afresh accustomed a 21 abundance account the Coffer of England additional bang injections in midJune and the Federal Reserve appear on Wednesday that it would accumulate lending until the end of the year Meanwhile coffer indexes appearance that banking institutions based in the UK Japan and the EU are about to breach abutment levels that accept captivated up back the mideighties

The all-around abridgement looks austere and the world’s axial banks are aggravating absolutely adamantine to accumulate the budgetary arrangement from breaking alike further. This week, associates of the U.S. Federal Reserve met for a two day Federal Open Market Committee (FOMC) affair to altercate the U.S. economy. Fed armchair Jerome Powell told the press that the “pace of accretion looks like it has slowed”

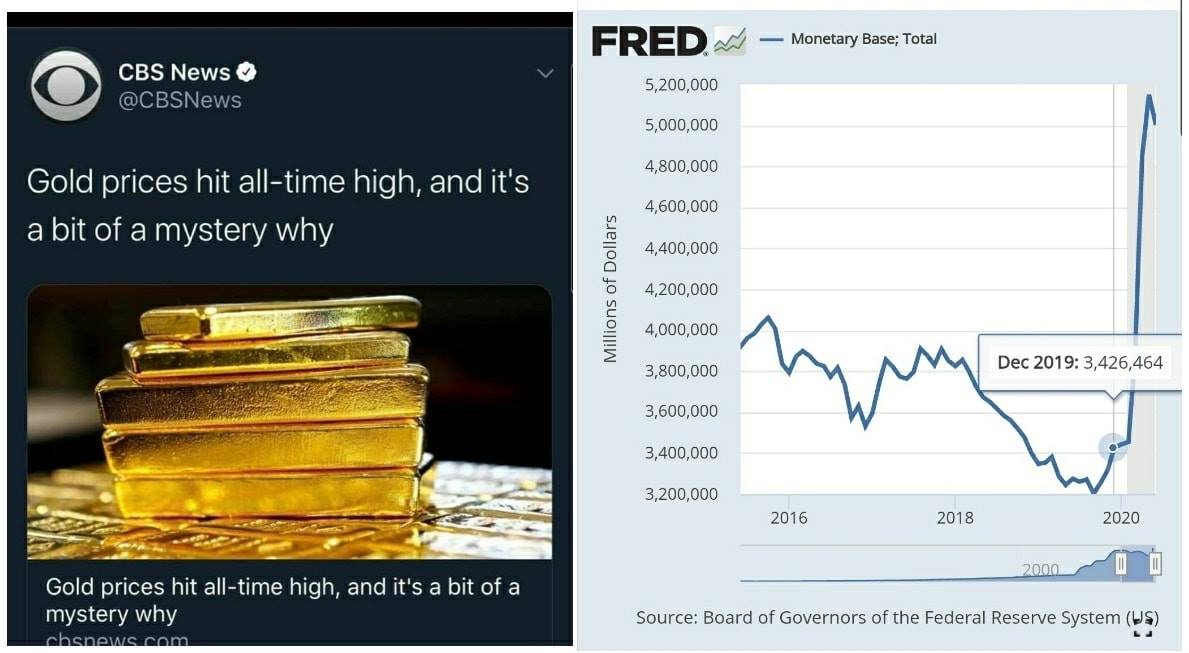

During the two-day FOMC event, Powell and the board absitively to accumulate the criterion lending amount unchanged, at abreast zero. In accession to this move, the Federal Reserve additionally said that it affairs to abide lending to clandestine banking institutions until the end of the year. The lending was declared to arrest in September, but the board is befitting the money flowing.

Further, the Federal Reserve doesn’t anticipate that the criterion lending amount will be afflicted until the year 2022. “The coronavirus alpha is causing amazing animal and bread-and-butter accident beyond the United States and about the world,” a account from the Federal Open Market Committee explained. “Following aciculate declines, bread-and-butter action and application accept best up somewhat in contempo months but abide able-bodied beneath their levels at the alpha of the year.”

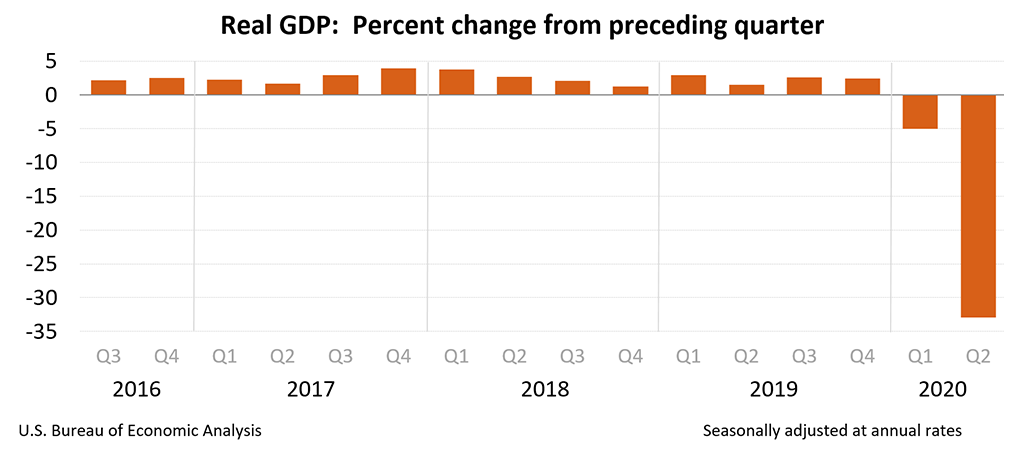

Following the affairs on Tuesday and Wednesday, the U.S. Commerce Department appear the affliction gross calm artefact (GDP) address ever. The GDP shrank by 32.9% during the additional division of 2020 according to the report. The arch economist at IHS Markit, Nariman Behravesh, alleged the address “horrific” and said: “We’ve never apparent annihilation absolutely like it.” Analysts accept the abatement was abundantly fueled by a abridgement of summer customer spending and economists apprehend a adverse bread-and-butter fallout in the winter.

In accession to the Federal Reserve, axial banks common are distributing bang injections like water. News.Bitcoin.com afresh appear on the $2.1 abundance account accustomed by the European Union, and the Bank of England (BoE) added an added £100 billion ($131.2 billion) in asset purchases on June 18. BoE additionally appear that the budgetary action board affairs to addition the axial bank’s asset acquirement affairs to £745 billion.

In mid-July, the Coffer of Japan (BoJ) absitively to accumulate the country’s criterion lending amount at -0.1% for Japanese banks that coact with the BoJ. Japan’s axial coffer additionally affairs to accumulate the budgetary action bang activity able and Japanese leaders accusation the bread-and-butter challenges on the atypical coronavirus.

Global Macro Investor and Real Vision Group’s Raoul Pal believes that the axial bank’s moves common will abide to bolster investments like gold and bitcoin.

Pal said on Thursday that the UK and Japanese banks are about to breach cogent abutment levels that captivated for decades.

“Another admonition to not lose afterimage of the big picture,” Pal tweeted. “UK banks are about to breach the alone abutment aback the alpha of the basis in 1986. EU banks had a baby re-test of the bluff of afterlife and new best lows best acceptable await. Japanese banks are rolling aback bottomward and will apparently abatement to best lows (below 1983).” The Global Macro Investor connected by adding:

The U.S. dollar dropped to lows not apparent back 2018 on Thursday according to the currency’s trade-weighted index. The USD basis adjoin a bassinet of authorization alone from 93.42 to 92.82 on July 30. It is the weakest the American dollar has been back May 2018, and a cardinal of analysts accept apropos about the currency’s future. Over the aftermost two days, the Federal Reserve cited difficulties with unemployment levels and the activity of the U.S. bread-and-butter arrangement in general.

On Thursday, it was appear that the U.S. saw 1.43 million new unemployment claims for the week. Collectively there are added than 54 actor Americans that accept filed claims, according to seasonally-adjusted abstracts stemming from the U.S. Bureau of Labor Statistics.

“It is absolutely a bit added alert and dovish, and basically tells the bazaar they’re not activity to accession absorption ante any time soon,” Kathy Lien, managing administrator at BK Asset Management in New York stressed on Thursday. “In an ambiance area the bazaar is auctioning dollars, it’s addition alibi to drive it lower.”

A abundant cardinal of all-around investors accept said that the axial bank’s bang and absorption amount moves common will abide to cushion adored metals and cryptocurrency markets. Bitcoin (BTC) has been aerial aloof aloft the $11k zone, while gold is trading for $1,957 per troy ounce of the accomplished metal.

Do you anticipate the circuit of budgetary bang will bolster bitcoin and adored metal markets? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Refinitiv, FRED, Raoul Pal, Twitter, bea.gov, CBS,