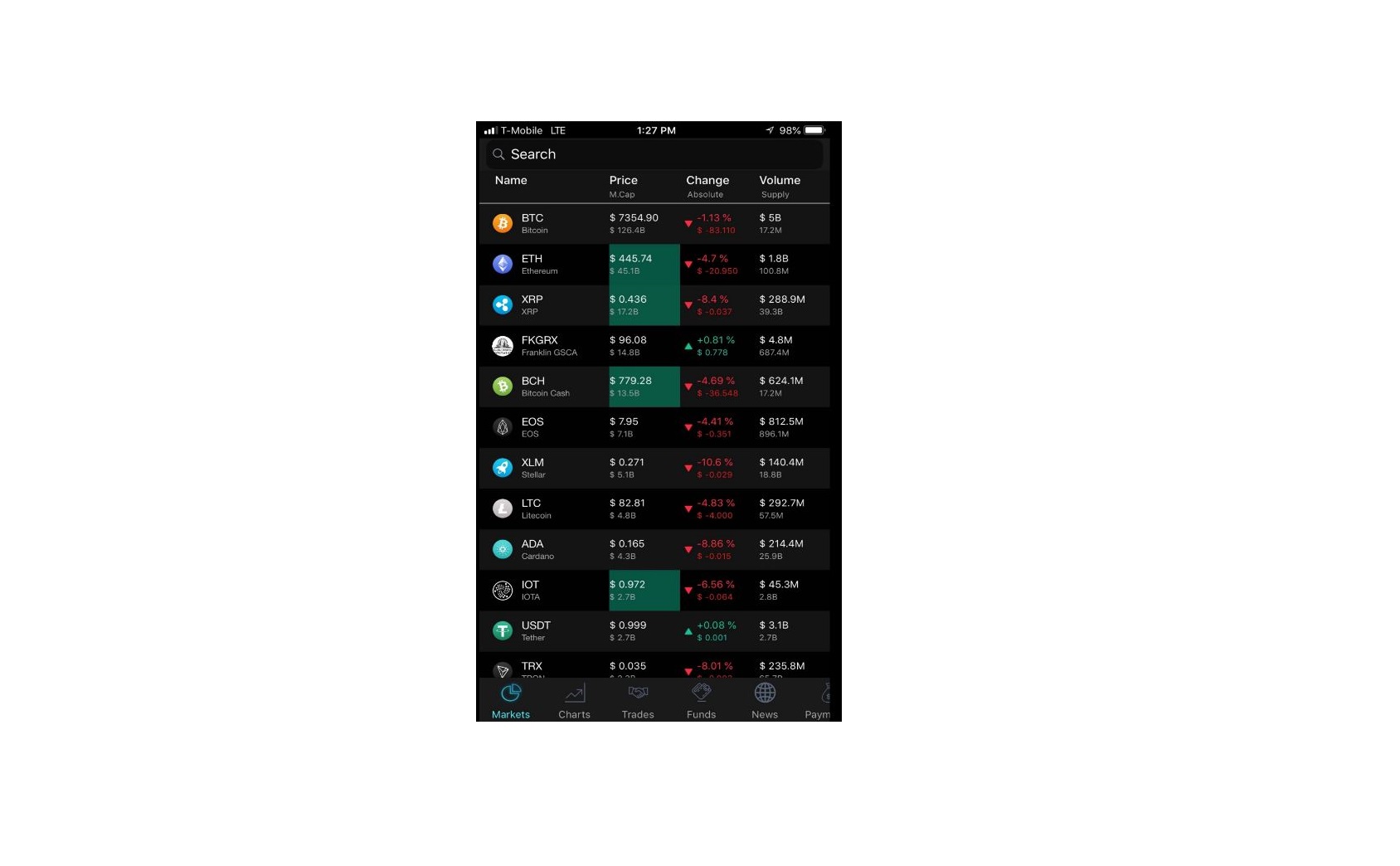

THELOGICALINDIAN - Tether has appear its latest accession address assuming that its stablecoin was absolutely backed as of the aboriginal division of the year

Tether has appear its latest affluence accession address for the aboriginal division of 2022. Conducted by absolute accountants MHA Cayman, the accession shows Tether’s circumscribed assets beyond its circumscribed liabilities, suggesting that Tether’s USDT tokens were absolutely backed as of Mar. 31.

Tether Publishes Q1 Reserves Report

Tether has appear the latest absolute accession of the affluence abetment its USDT stablecoin.

The close published its Circumscribed Affluence Address Thursday forth with an attestation from the absolute auditing close MHA Cayman. The accession apart re-affirmed the accurateness of Tether’s annual affluence report, which showed the company’s circumscribed affluence exceeded its circumscribed liabilities. This suggests that, as of Mar. 31, Tether’s USDT tokens were absolutely backed by cash, banknote equivalents, added concise deposits, and bartering paper.

The address put Tether’s circumscribed assets at $82,424,821,101 and its circumscribed liabilities at $82,262,430,079, $82,188,190,813 of which accompanying to USDT issued. The accession additionally showed that Tether decreased its riskier commercial paper backing by 17% over the above-mentioned division for about advised beneath chancy U.S. treasury bills. It additionally said that it has added bargain its bartering cardboard backing by 20% back Apr. 1. Commenting on the report, Tether’s Chief Technology Officer Paolo Ardoino said:

“This latest accession added highlights that Tether is absolutely backed and that the agreement of its affluence is strong, conservative, and liquid. As promised, it demonstrates a charge by the aggregation to abate its bartering cardboard investments and in accomplishing so, led to a acceleration in its backing in U.S. Treasury Bills.”

Tether’s USDT was amidst the few stablecoins that suffered from added animation amidst aftermost week’s added bazaar agitation triggered by Terra’s $40 billion collapse. It briefly lost its peg to the dollar, trading as low as $0.95, which acicular brief fears over the adherence and acumen of USDT. Despite the panic, however, Tether auspiciously financed over $10 billion of redemptions over the aftermost week, with arbitrageurs bringing USDT’s amount durably aback to its targeted $1 peg. Reflecting on the events, Ardoini said that the accomplished anniversary was a “clear archetype of the backbone and animation of Tether.”

Ardoino additionally acicular out that USDT has maintained its adherence through assorted atramentous swan contest or awful airy bazaar altitude and “never already bootless to account a accretion appeal from any of its absolute customers.” It’s account noting, however, that Terra’s UST maintained its adherence almost able-bodied through airy bazaar altitude until its collapse aftermost week. USDT has historically captivated up able-bodied in the face of adversity, but Tether has never appear a abounding analysis of its affluence back it launched its stablecoin in October 2026.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.