THELOGICALINDIAN - The General Manager of the Coffer of International Settlements BIS Agustin Carstens beatific a air-conditioned bulletin apropos the approaching administration of axial coffer agenda currencies CBDCs

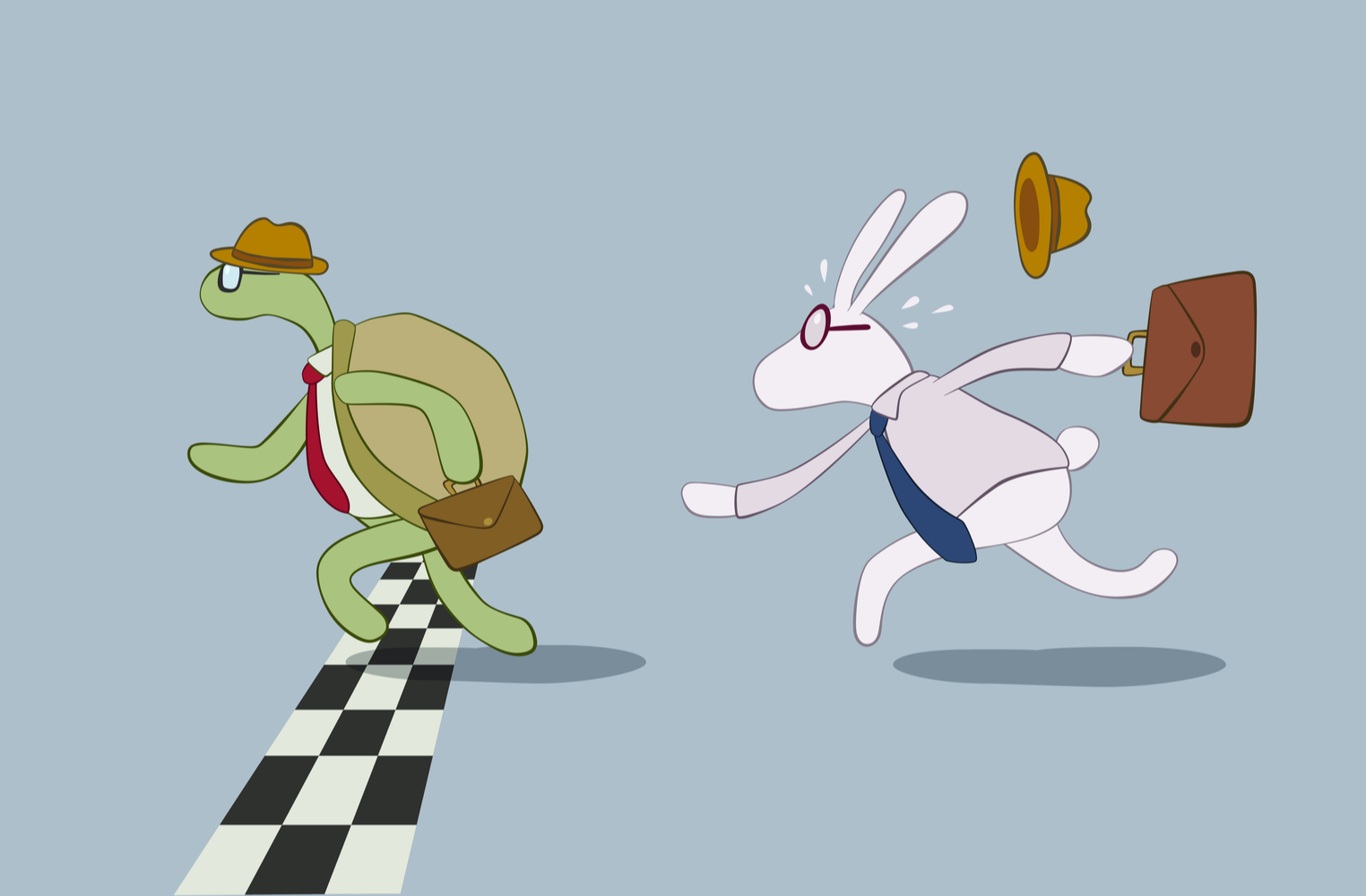

The book of a cryptocurrency vs. CBDC showdown has been abundantly played bottomward in the past. But Carstens’s words absolve those who warned of the abeyant absolutism CBDCs could bring.

With that in mind, should we apprehend tougher regulations and added restrictions on cryptocurrency as authorities attending to annihilate the competition?

Central Bank Digital Currencies Are Coming Sooner Than You Think

As afresh as March 2019, Carstens said axial banks do not see the amount of implementing CBDCs. When because the abridgement of appeal additional the “operational consequences” of bringing them about, there is little coercion to the matter.

However, some four months later, Carstens signaled a U-turn by adage there is a demand, and it ability be accident eventually than we think.

Data shows 67 countries are either researching, piloting, developing, or accept launched a CBDC. A abstraction by the BIS (ironically) blue-blooded “Central coffer agenda currency: the adventure for minimally invasive technology,” begin anonymity and decentralization were adverse to what they account a “retail CBDC.”

Many accept warned about the dangers of CBDCs. ShapeShift CEO Erik Voorhees said they action the user annihilation new or innovative. Implying they will alone account those against to abandon and claimed sovereignty.

On the affairs of squashing Bitcoin and added cryptocurrencies, Voorhees doesn’t accept axial banks can accomplish that application CBDCs.

Backlash Over Carstens’s Message

The accepted acknowledgment to Carstens’s bulletin of “absolute control” has not gone bottomward well.

Gabor Gurbacs, the Director of Digital Asset Strategy at VanEck, raises the point that axial banks are not tasked with accepting “absolute control” in adage how we can absorb our own money.

One Twitter user said cipher wants added surveillance, let abandoned banking surveillance. He added that CBDCs could be programmed with cessation dates and sender restrictions.

In effect, as Carstens alluded to, this would beggarly users assignment for the axial bank.