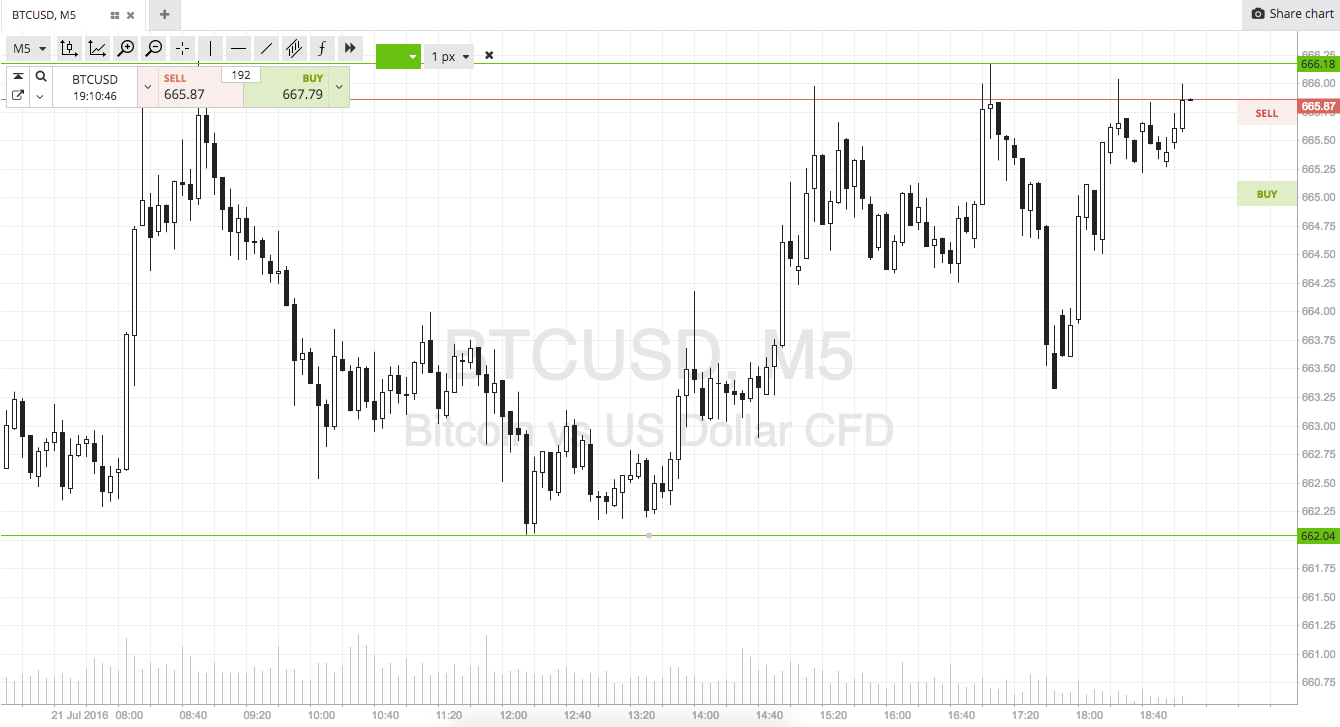

THELOGICALINDIAN - The US Dollar has been assertive BTCFiat trading on boilerplate throughout the accomplished ages according to a analysis by CryptoCompare

50 Percent Market Dominance

According to a new report alleged “Detailed Report Into The Cryptocurrency Exchange Industry” appear by CryptoCompare, the US dollar represents bisected of the BTC-Fiat trading on boilerplate throughout the aftermost 30 days.

And while the USD is assertive the bazaar as it is, the added two arch currencies are the Japanese Yen (JPY) and the Korean Won (KRW), which represent 21 and 16 percent respectively.

It’s noteworthy, though, that ahead BTC to KRW trading represented alone a tenth of bitcoin trading amid the top 5 authorization currencies on average. Yet, the address outlines a above fasten in BTC to KRW trading amid October 7th and 15th. During the period, KRW represented one-third of BTC trading, which is an access upwards of 230 percent. Bitcoinist also reported in October that cryptocurrency trading volumes in South Korea soar.

The added authorization currencies in the top 5 are the Euro, the GBP, and PLN.

Decentralized Exchanges are Nowhere to be Seen

Another absorbing cessation in the address is that decentralized exchanges (DEX) are actually boilerplate to be seen.

According to the research, the absolute boilerplate 24h-volume on boilerplate produced by the top 5 decentralized exchanges is shy of 2.4 actor USD. This represents alone 0.4 percent of the absolute barter volume.

It seems that admitting the advertising surrounding one of blockchain’s capital feats, users are still putting their assurance into centralized solutions – a award that’s absurd to address to Ethereum’s co-founder Vitalik Buterin, who ahead said that he hopes “centralized exchanges go bake in hell as abundant as possible.”

What do you anticipate of the contempo allegation of the CryptoCompare report? Don’t alternate to let us apperceive in the comments below!

Images address of CryptoCompare, Shutterstock.