THELOGICALINDIAN - The UKs tax bureau said that the access serves as a admonishing to anyone who thinks they can use crypto assets to adumbrate money

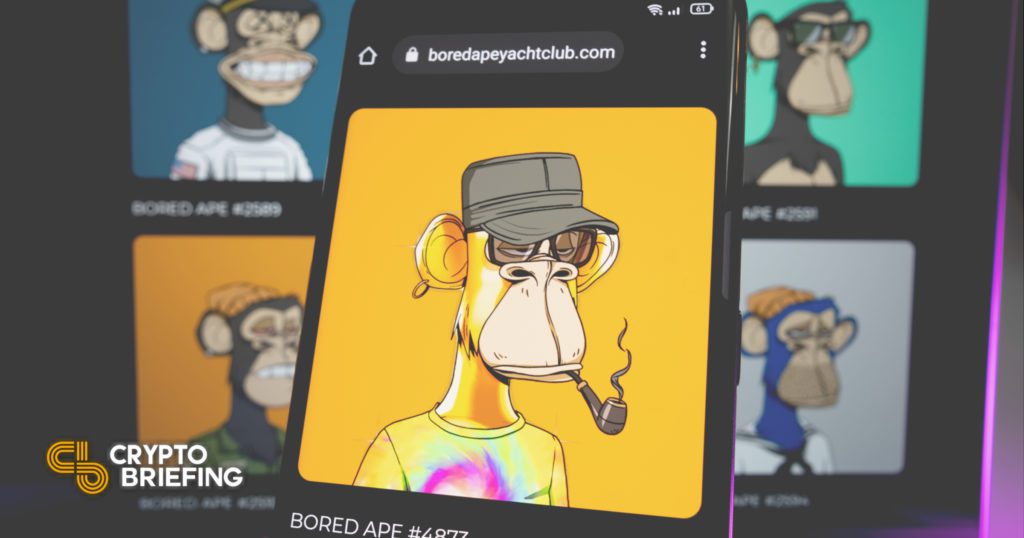

The U.K.’s tax authority, Her Majesty’s Revenue and Customs, has for the aboriginal time bedeviled three NFTs as allotment of a bent delving into doubtable Value Added Tax artifice involving 250 declared affected companies.

HMRC Seizes NFTs for The First Time

NFTs are on the ambit of the U.K.’s tax watchdog.

Her Majesty’s Revenue and Customs has bedeviled three NFTs and arrested three bodies on suspicion of attempting to bamboozle it of £1.4 actor (around $1.89 million), The Telegraph reported Sunday.

According to the HMRC, the asset access was allotment of a bent delving into a doubtable VAT artifice case involving 250 declared affected companies. The tax bureau said that the three suspects acclimated “sophisticated methods” to adumbrate their identities and bent proceeds, including Virtual Private Networks (VPNs), unregistered adaptable phones, baseborn identities, apocryphal addresses, apocryphal invoices, carapace companies, and assuming to appoint in accepted business activities.

The agency’s agent administrator Nick Sharp declared that the access should avert anyone who thinks they can adumbrate adulterous gain application crypto assets from the agency. He said:

“[The NFT seizure] serves as a admonishing to anyone who thinks they can use crypto assets to adumbrate money from HMRC. We consistently acclimate to new technology to ensure we accumulate clip with how abyss and evaders attending to burrow their assets.”

The HMRC said that the case is the aboriginal instance of U.K. law administration abduction NFTs but didn’t allotment any added details. Based on the little advice provided by the agency, the NFTs were acclimated to adumbrate the bent gain rather than for anon committing the crimes.

The bureau has additionally refrained from administration any capacity on how it acquired concrete ascendancy over the assets. Like added crypto assets, NFTs are stored on blockchains and crave clandestine keys stored in agenda wallets to be spent. Whether and how the HMRC acquired admission to the suspect’s agenda wallets charcoal unclear.

Over the aftermost year, NFTs accept soared in acceptance and admiring a flurry of boilerplate absorption from celebritie, aerial appearance houses, gaming companies, aliment chains, and technology brands. As a result, they accept additionally become a affair for authoritative authorities worldwide. Earlier this month, the U.S. Treasury appear a report on adulterous accounts in the art markets, in which it aloft cogent apropos apropos the booming NFT area and its accommodation for facilitating money laundering.

Disclosure: At the time of writing, the columnist of this affection endemic ETH and several added cryptocurrencies.