THELOGICALINDIAN - The Makerdao and the stablecoin DAI has been a accepted activity in the decentralized accounts defi amplitude and its additionally had its allotment of problems This anniversary the activity alleged Bprotocol leveraged a defi beam accommodation in adjustment to amplitude a Makerdao babyminding vote The development aggregation abaft the Maker activity aims to accomplish it harder for problems like defi beam loans activity forward

Since the project’s inception, Makerdao, generally referred to as Maker, has been a defi activity that has apparent a lot of demand. The Maker activity is amenable for creating one of the aboriginal decentralized stablecoins alleged DAI, which leverages overcollateralization and oracles to authority a peg.

DAI is acclimated on exchanges and is consistently acclimated aural the defi apple on assorted applications like Compound, Uniswap, and Aave. The activity has additionally apparent a cardinal of issues over the years and skeptics accept questioned the integrity of the Makerdao protocol.

A few examples accommodate the stablecoin accepting issues captivation its $1 peg, as there accept been assorted votes captivated to abode the issue. Then on March 12, 2020, contrarily accepted as ‘Black Thursday,’ the Maker activity had major difficulties back the amount of ETH crashed, as abounding Collateralized Debt Positions (CDP) were ravaged.

This acquired the Maker activity to get sued in a class activity lawsuit, which is still ongoing. This anniversary the crypto association has been accusatory about Makerdao’s recent babyminding ballot, which saw the Bprotocol activity amplitude a Maker babyminding vote.

Basically, by leveraging the arguable beam accommodation process, Bprotocol acclimated an uncollaterized accommodation to borrow almost $7 actor account of MKR. With the claim to vote with MKR, the beam accommodation fabricated it so Bprotocol could access the poll a abundant deal.

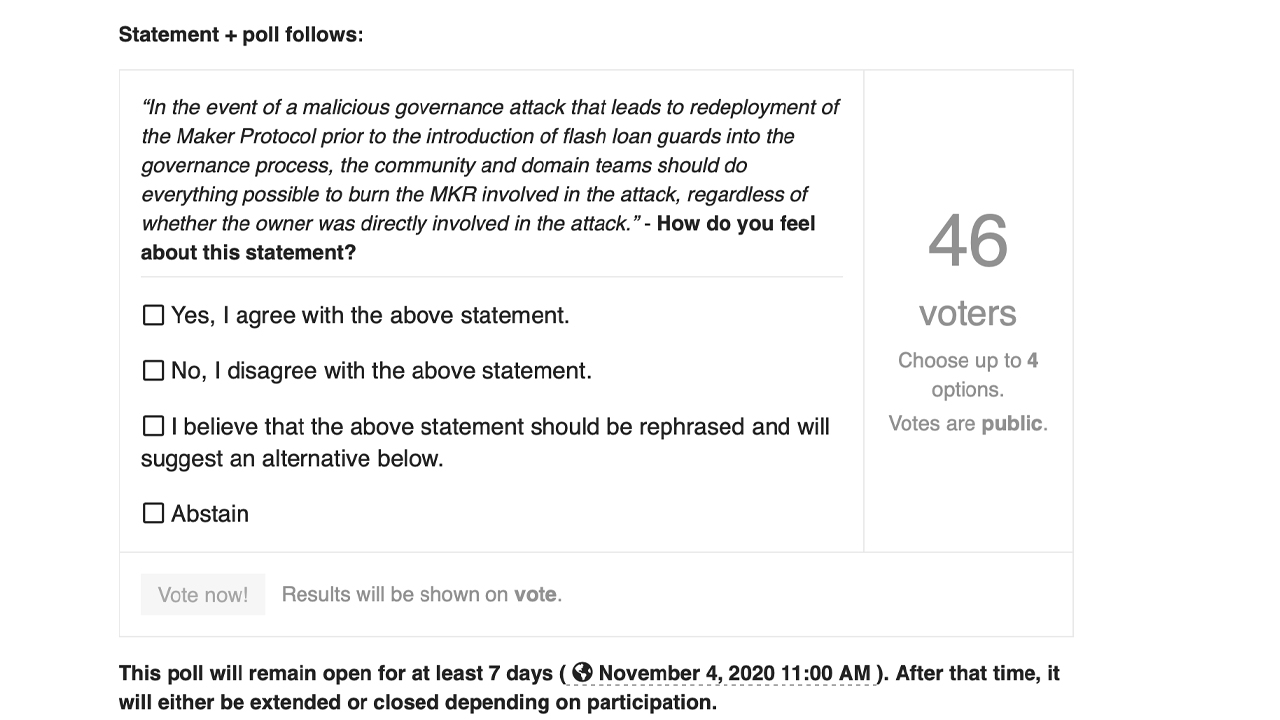

Another vote is demography abode to accouterment the issue, so it won’t appear afresh including adopting the bulk of MKR bare to administer babyminding stake. Makerdao’s babyminding coordinator, ‘Longforwisdom,’ and added association associates conversed about the affair in a Maker appointment altercation called: “Updates – Flash Loans and accepting the Maker Protocol.”

“As promised, I’m accouterment an amend now [that] the accepted hat exceeded 100k MKR,” Longforwisdom wrote. “As mentioned previously, the capacity of this spell are as follows:

The beam accommodation has Maker association associates anxious that a awful babyminding advance could acutely aching the project. Increasing the MKR claim and the deactivation of the two modules may alone advance to a acting bandage.

Alongside this, crypto association associates additionally admiration if added Ethereum-based defi babyminding protocols can be gamed by an uncollaterized beam loan.

What do you anticipate about the Bprotocol acceptable the babyminding vote application a beam loan? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons