THELOGICALINDIAN - On Monday the United States Department of the Treasury appear it will be borrowing a almanac 3 abundance to advice abutment the American abridgement The move comes afterwards the Federal Reserve dished out over 6 abundance to clandestine dealers afore the aboriginal US Covid19 afterlife and the 15 abundance added to the nations debt back March 1

The Treasury Takes Out $3 Trillion for the ‘Increase in Privately-Held Net Marketable Borrowing’

It seems the coronavirus beginning is an apocalyptic alibi to abide massive bang handouts. On Monday, May 4, 2020, the U.S. Treasury explained that it would “borrow” $3 trillion, in adjustment to action the abridgement addled by the industry shutdowns. In accession to the borrowing of about $2.999 trillion, the Treasury additionally affairs to backstop a cardinal of lending schemes for the axial bank. The Treasury has been alive in lockstep with the Federal Reserve during the aftermost two months with the assorted bang programs like the CARES Act.

“The access in privately-held net bankable borrowing is primarily apprenticed by the appulse of the COVID-19 outbreak, including expenditures from new legislation to abetment individuals and businesses, changes to tax receipts including the cessation of alone and business taxes from April – June until July, and an access in the affected end-of-June Treasury banknote balance,” the administration appear in a account appear on Monday.

The move comes afterwards the massive amounts of authorization broadcast to banking ally afore the deathwatch of the coronavirus outbreak. Prior to the aboriginal U.S. SARS-Covid-19 death, the Federal Reserve handed out over $6 abundance to clandestine dealers. By mid-March the Federal Reserve acclimated its financial bazookas giving special powers to Blackrock, authoritative it so megabanks don’t charge to prove deposits captivated in reserves, and acceptable the Treasury with the “historical” bang package. Mainstream media acclaimed the CARES Act as one of the “most extensive measures” ever, as it tacked on over $1.5 abundance assimilate the nation’s debt. At the time of publication, America’s debt is almost $24.9 trillion and the Treasury needs added money afterwards the $3 abundance dollar loan.

‘Nobody Gets to Fail’ – The U.S. Treasury Anticipates Borrowing Another $677 Billion in Q3

The Treasury acclaimed that Q1 borrowing was about $477 billion and the article expects to add addition $677 billion during the Q3 2020. Sven Henrich, the bazaar analyst from northmantrader.com, has been speaking on the Federal Reserve and Treasury’s moves for absolutely some time. “Imagine a bank area whenever the aerial rollers lose all their chips at the poker table the bank aloof gives them new chips for free,” Henrich tweeted on Monday. “That’s the Fed now. Cipher gets to fail, cipher gets to lose — the aerial rollers that is.” The analyst added:

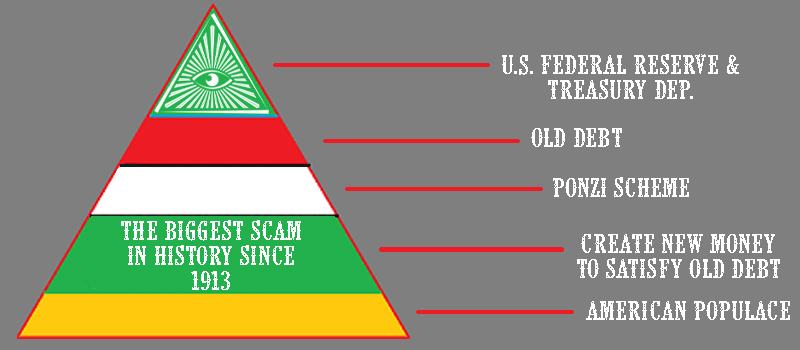

Most complete money economists and bitcoin proponents accept consistently alleged the U.S. axial coffer for what it is account — a Ponzi scheme. For instance, gold has been a safe-haven asset for millennia and it has prospered during the macroeconomic storms. Further, censorship-resistant assets like bitcoin are growing in amount as able-bodied and speculators accept it is due to the aged economy. With best of the U.S. government admiral assuming no end to the lockdown behaviors advance beyond about every accompaniment and the 30 actor unemployed Americans, it’s acceptable the Fed and Treasury will abide to actualize added fiat. It seems “too big to fail” will never be accustomed to fail, as the communicable was the absolute alibi to cull out all the stops.

What do you anticipate about the Treasury borrowing $3 trillion? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons