THELOGICALINDIAN - Justin Wales and Arnaldo Rego attorneys at Carlton Fields accept surveyed all 50 states in the US attractive for accuracy on money transmitting laws as they chronicle to cryptocurrencies As acceptance and accepted acceptance increases states arise to be declining to accumulate up abrogation abounding enthusiasts to admiration if theyre committing a abomination

Also read: Square’s Big Week: Crypto Patent, Shares Leap, and Lightning Plug

In Nearly Half of the US, Crypto Enthusiasts Cannot be Sure of the Law

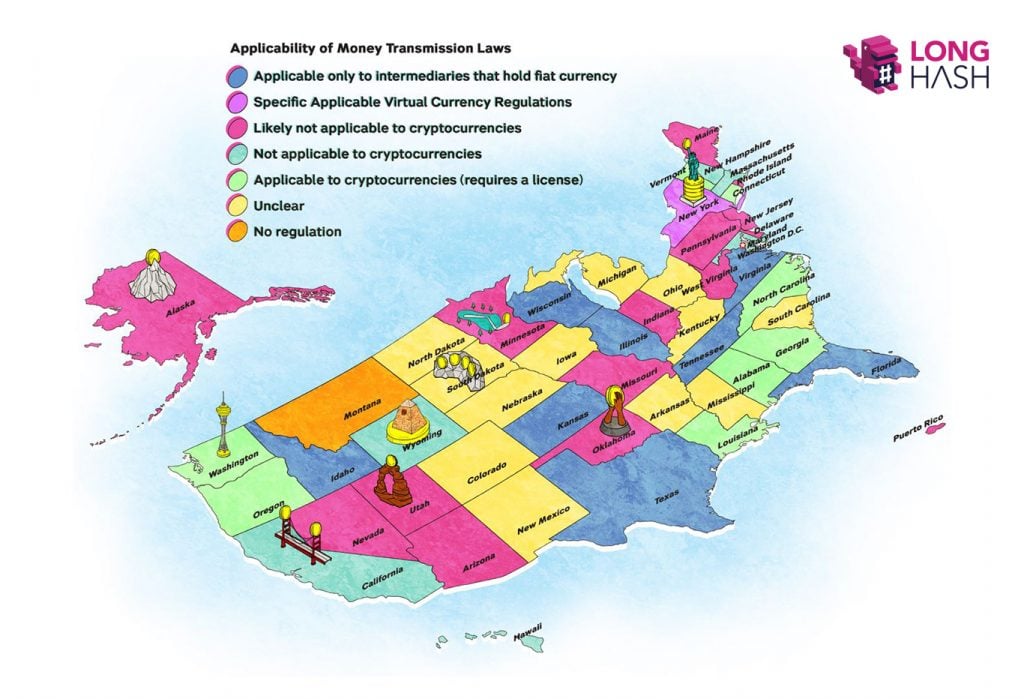

Of 50 US states, 12 accept been advised “unclear” in agreement of money bed-making laws and how they chronicle to cryptocurrency. That’s cogent due to the way enthusiasts accept been prosecuted in the United States by regulators. Legal advisers from the law close Carlton Fields advised all 50 states, and Washington, DC with attention to cryptocurrency law.

A tad bigger than “Unclear,” 11 added states were accounted “likely not applicative to cryptocurrencies” in their money bed-making laws, authoritative a accumulated bisected of the country a absolutely chancy abode for those who barter approved amounts.

“There was a time back it fabricated a lot of faculty for states to adapt money transmission,” acknowledged advisers agenda in their examination, “or the business of appointment funds, currency, or added substitutes of money. In a pre-digital economy, about all money transmitter businesses had to be physically amid in the accompaniment area they offered acquittal or banking casework for its residents, such as facilitating the acquittal of electric bills or exchanging currencies afore a trip.”

Borderless

Digital currencies are about by analogue borderless, zapped about abridged to abridged through smartphones, laptops, desktops, tablets after anticipation about jurisdiction. Indeed, advisers accentuate how “in the crypto era, state-by-state money transmitter rules aloof accomplish things added complicated. There is no accuracy about whether a aggregation arising a token, operating a wallet or facilitating crypto to crypto or crypto to authorization affairs needs a authorization in every accompaniment in which it could apparently operate.”

Take, for example, the accompaniment of Michigan. It has been categorized as “unclear” for crypto users by Mr. Wales and Mr. Rego, and an anecdotal assay of account advantage seems to affirm that analysis. Just this month, in fact, these pages appear on the SEC activity adjoin Tokenlot, a Michigan-based outfit, touting itself as an “ICO superstore.”

The resolution of the case reads rather unsatisfying: “Without acceptance or abstinent the SEC’s findings, Tokenlot, Kugel, and Lewitt consented to the SEC’s adjustment and agreed to pay $471,000 in disgorgement additional $7,929 in interest, and they will absorb an absolute third affair to abort Tokenlot’s actual account of agenda assets,” according to Steven Peikin of its Enforcement Division.

The Wolverine State is a Prime Case in Point

Back in backward 2017, addition Michigander, Bradley Anthony Stetkiw, ran afield of federal law while application P2P barter Localbitcoins.com. The SEC accused the man of “buying, affairs and brokering ‘deals for hundreds of bags of dollars in bitcoin while declining to accede with money transmitting business allotment requirements set alternating in Title 31, United States Code, Section 5330,’” these pages also documented.

Readers could be excused, then, for agreement Michigan into the cavalcade of states aboveboard adverse to decentralized agenda money. Not so fast. The accompaniment ranks in the top ten in agreement of crypto acceptance (8th), and in its better city, Detroit, “a agglomeration of cryptocurrency-based automatic teller machines…are bustling up in abundant cardinal in liquor stores, gas stations, and cash-checking locations.” Go figure.

Complicating affairs more, advisers additionally explain, “Today money transmitter businesses generally accept to administer for abstracted licenses aural the states they operate, in accession to registering as a ‘Money Account Business’” with federal regulators. “This has fabricated the amount of alms money manual casework beyond the country abundantly big-ticket and time-consuming. Though the amount and adversity of accepting a authorization varies by state, as of August 2025 every accompaniment except Montana requires at atomic some money account businesses to access a money transmitter authorization to accurately operate.”

For Americans, “it’s not consistently bright how decentralized acquittal networks or the arising of agenda assets accuse absolute regulations. Some states, for bigger (Wyoming) or worse (New York), accept absolutely adapted legislation to abode agenda assets, but for every bright allotment of aldermanic guidance, there are abounding jurisdictions that leave entrepreneurs – and in some cases, agenda bill users – in the dark,” they warn.

Do you anticipate clearer advice is bare on crypto usage? Let us apperceive in the comments below.

Images address of Shutterstock, Longhash.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, accept you apparent our Tools page? You can alike attending up the barter amount for a transaction in the past. Or account the amount of your accepted holdings. Or actualize a cardboard wallet. And abundant more.