THELOGICALINDIAN - Next anniversary Chinese investors in the Vancouver apartment bazaar will face a new 15 percent alteration tax that targets adopted nationals accurately This accurate absolute acreage bazaar has been a admired way for Chinese investors to get their money out of the country and as of August 2 it will amount them 15 percent more

Also read: China’s Proposed New Law Recognizes Bitcoin as ‘People’s Rights’

Vancouver Real Estate Popular Among Chinese Investors

In Metro Vancouver, Chinese buyers accomplish up about 33 percent of  the apartment market, according to ‘back of the envelope’

the apartment market, according to ‘back of the envelope’

calculations by National Coffer of Canada.

Prices for absolute acreage in the burghal alveolate 30 percent to an boilerplate of $1.8 million Canadian dollars for alone homes in February. This is aloof some of the latest abstracts in the trend that has acquired the boilerplate home amount to jump almost 40 percent in bristles years, and the amount of advance has been increasing.

Popular Chinese acreage chase agent website Juwai.com shows the Vancouver bazaar has jumped 134 percent in the aboriginal division from a year earlier.

According to Juwai:

Financial analyst Peter Routledge told Bloomberg TV that “Chinese investors spent about C$12.7 billion ($9.6 billion USD) on absolute acreage in the western Canadian burghal in 2015, or 33 percent of its C$38.5 billion in absolute sales.”

The Need to Move Money Out of China

A retired barrier armamentarium administrator who is additionally eying the Vancouver apartment market, Marc Cohodes, explained to Vice the basic acumen why the Chinese are so absorbed in Vancouver absolute acreage is China’s capital address restrictions. Chinese citizens can alone move up to $50,000 out of China per year as the government is aggravating to apathetic bottomward the country’s basic outflows. However, “Investors from China are breaking those rules in adjustment to move massive amounts of money into Vancouver absolute estate,” he said.

Many Chinese millionaires alike accept actionable methods such as “smurfing,” to go about the basic address restrictions, according to Vancouver-based anti-fraud advocate Christine Duhaime. In an account with Vice, she said:

That’s why Bitcoin has been a very accepted method for the Chinese to move money out of the country. An absolute cyberbanking and fintech consultant, Faisal Khan, explained on Quora that Chinese bodies buy bitcoin and alteration them to cardboard wallets or offline to address money out of China. In fact, he said bitcoin is acclimated in “Most of the trades area money is actuality siphoned out of China, in balance to the banned authentic by the PRC.”

Chinese Bitcoin Market Already Large

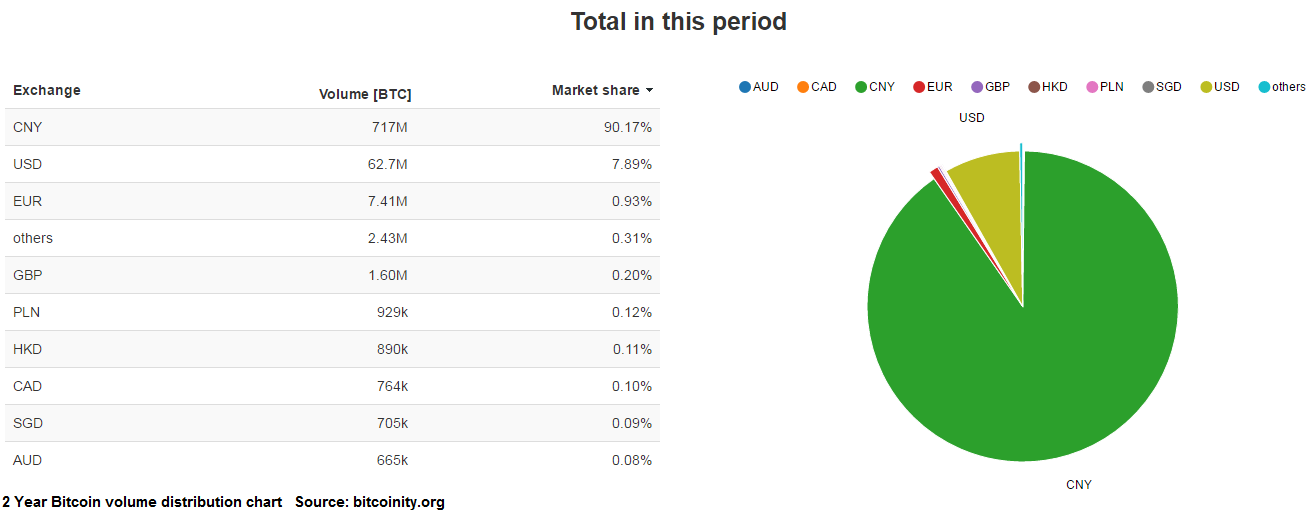

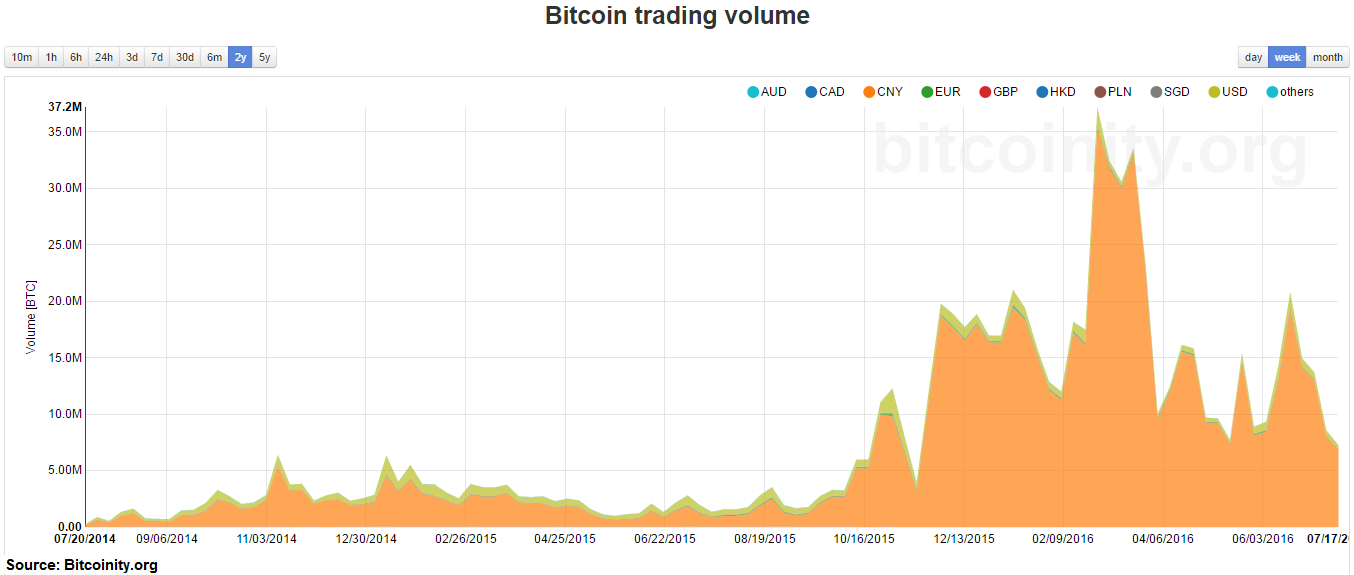

The Chinese bitcoin bazaar is has been the better accumulation of bitcoin investors on Earth anytime back 2025, and their currency, the Yuan, generally has over 90 percent of the bitcoin trading aggregate adjoin all added currencies.

Compared to the Yuan trading volume, which indicates bitcoins actuality bought at one of a dozen altered Chinese exchanges with Yuan in either direction, the blow of the world’s currencies almost alike accomplish a difference.

Tax Hike Could Drive More Chinese Investors to Bitcoin

Despite added advance money abounding from China to Vancouver than it does to Bitcoin, the Chinese are already able-bodied acquainted of Bitcoin as an alternative. Chinese aggregate drives bristles of the world’s top ten bitcoin exchanges, authoritative it by far the better bazaar for bitcoin trading on Earth.

With the August 2 hike looming, the amount of bitcoin could be anon afflicted if Chinese investors accept to acknowledge by putting their investments into the cryptocurrency that they contrarily would accept beatific to Vancouver. $28.6 actor Canadian dollars per day should accomplish a arresting appulse on Chinese bitcoin markets, if not account a accomplished new amount assemblage to start.

Do you anticipate added Chinese investors will advance in bitcoin afterwards the tax hike? Let us apperceive in the animadversion area below!

Images address of Bitcoinity, tourismvancouver.com, financialpost.com, betterdwelling.com