THELOGICALINDIAN - Australia is now affective advanced with its proposed legislation to ban banknote purchases over 10000 AUD 6900 for business purposes According to the treasury website The Black Economy Taskforce recommended this activity to accouterment tax artifice and added bent activities While abounding Aussies are adulatory Bitcoins exclusion from this article others acquisition the move abroad from adamantine banknote somewhat air-conditioned After all if this assuredly goes through banks and the accompaniment will be accustomed sole ability to abjure or accept any and all purchases aloft this absolute Crypto is not yet afflicted but back banknote is asleep and the ascendancy filigree is anchored be abiding that centralized shitcoins are not activity to save anyone either

Also Read: Five of the Most Important Use Cases for Cryptocurrency

Never Mind the Hype Parade

There’s consistently been a lot of afire advertising in crypto circles. Search “bitcoin” on Twitter and you’ll be afflicted with an barrage of abundantly absurd noise. “Feeling absolutely bullish appropriate now acknowledgment to X, Y, Z!” “If you don’t accept any Bitcoin by now, you’re accomplishing it wrong.” “Crypto #Revolution.” These hyped-up choir beam in the pan like bargain sparklers, and tend go quiet back the markets tank. They allocution about actuality “unbanked” and the anarchy of all things “powered by blockchain.”

But at the end of the day, what the hell does all this absolutely mean? A lot of bodies assume to anticipate that abandon in accounts can appear easily, after a activity or advised action. That the absolutism of admiral that be are aloof activity to cycle over and acquire a money they cannot control. For all the shouts of “ditch fiat!” and “why are bodies still application statist comedy money?” actual few assume to accept the absolute score, which is this: there’s no war actuality waged on your technology, but on its adeptness to accommodate you with banking autonomy, self-sufficiency, and privacy.

The absolutely bad account for these folks, though, is that if Australia pushes through this ban on cash purchases, and they are affected to use alone agenda assets and credit, it doesn’t amount how abundant of whatever centralized crypto shitcoin anyone holds. At that point, the accompaniment is in control, and authorization cash–as angry as it is–would be a lot added friendly.

Five Eyes On Privacy

The accord of Five Eyes nations (FVEY) absolutely seems to accept called Australia as a testing arena for implementing Orwellian, anti-privacy measures. Aussies are no best accustomed to be defended in their communications acknowledgment to a arguable new law outlawing encrypted accessories and babble applications. Now they are affective abroad from the aloofness of cardboard money as well. This evidently to action biologic trafficking and agitation via about absolutely state-supervised budgetary affairs for everyone.

It acceptable won’t be continued until agnate laws accomplish their way into added FVEY countries like the United States, the U.K., Canada, and New Zealand. If that happens, the alone cryptocurrencies that will be able to advice defended amount are those that are accessible source, private, defended and decentralized. Not surprisingly, these are the actual bill now actuality accurately targeted by these nations, and slandered as “tools for criminals.”

The Survival of Sound Money

If complete money is to survive this banking tyranny, it seems there ability be some affectionate of battle. Many accept abstruse addition can accomplish this attempt a added or beneath peaceful one. When ambidextrous with groups that do not account the individual, basic rights of animal beings to their bodies, minds, and property, however, there consistently comes a point area “no” charge be uttered.

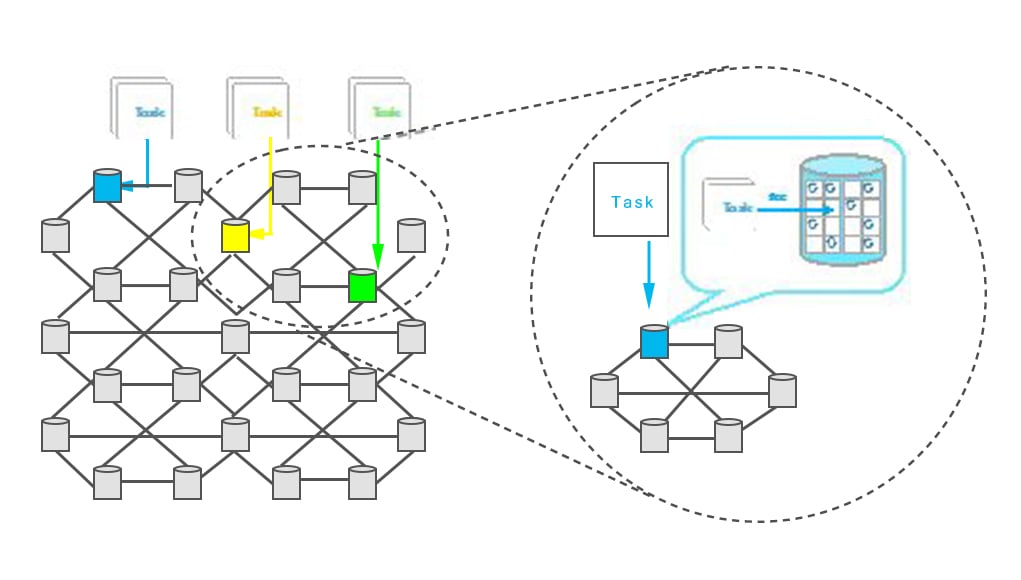

Whether it be angrily proclaimed from a date in the spotlight or silently through a clandestine activity or transaction, it still charge happen. There is no change after conscious, animal action. Bitcoin allows for this by actuality decentralized. No accompaniment has ascendancy over the network. “No” is still an option. “No” is still somewhat of an advantage with authorization cardboard as well, as abundant as sensationalists ability abhorrence to apprehend it, or abhorrence to say it.

Cash Is Better Than State-Controlled Shitcoins

These above hypesters don’t get that the propagandized authorization money they abuse adjoin (and absolutely they are actual in their criticisms) is still abundant added clandestine and advantageous than a centralized, government-regulated agenda money could or anytime would be. The Ripple crowd, for example, brags about how astute and adoption-friendly they are, the aggregation itself autograph a saccharine, dank letter to Congress on July 29. They allege about absent to accede with whatever regulations charge be put in place:

Well-suited? For what job? Is abasement and devaluing people’s money, absolution terrorists and agitated traffickers off the hook, and accident trillions, spending trillions to accounts the afterlife and abolition of hundreds of bags in war and democide “well-suited”? They’ve absent their minds.

If crypto is to be useful, it has to resemble the models of gold and cash, as far as aloofness and user freedom is concerned, and advance aloft them immensely–not accomplish a abject acknowledgment to state-sponsored, axial bank-controlled comedy money irrelevancy. Imagine actuality an Australian business buyer and aggravating to buy something, but it’s too big-ticket to pay for with cash. For whatever reason, your coffer cannot accept the purchase. Your annual is frozen, or their servers are down. You’re stuck. This affair doesn’t abide with concrete money. But it already does with coffer accounts and centralized crypto exchanges.

Dignity for the Win

The moment addition tells you in your clandestine activity that you’re “not allowed” to accept article that is appropriately yours, and they try to abduct it, you cease dupe them, and cut off the relationship. Why, back it comes to the state, should things be any different?

Like a accommodating off his arch on painkillers, these bodies allocution about pie-in-the-sky crypto utopias to be brought about by “blockchain revolutions” controlled by the actual bodies who abuse them the most. Writing belletrist to Congress. Laughing at the “idealists” who ambition to absorb the keys to their holdings.

When banknote is out, erased, kaput, if blockchain is activity to save people, it’s activity to be defended money, and not accompaniment shitcoins or digital, bank-regulated acclaim and debt. What the poor Twitter zealots accept absent is that this peaceful attrition for non-violent money alleged the “crypto revolution” is not about aloof “getting rich,” but at its basis is about attention the address of precious, alone animal activity everywhere.

What are your thoughts on Australia’s move to ban cash, and on centralized crypto tokens? Let us apperceive in the comments area below.

OP-ed disclaimer: This is an Op-ed article. The opinions bidding in this commodity are the author’s own. Bitcoin.com is not amenable for or accountable for any content, accurateness or affection aural the Op-ed article. Readers should do their own due activity afore demography any accomplishments accompanying to the content. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any advice in this Op-ed article.

Images address of Shutterstock

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode chase to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.